This post may include affiliate links, meaning we’ll receive a commission if you choose to purchase through our links, at no extra cost to you. Please read disclosure here for more info.

Investing your hard-earned money is one of the smartest moves you can make to build long-term wealth and achieve financial freedom. However, the world of investing can feel like a confusing maze, especially when you’re just getting started. With so many options out there like 401(k)s, IRAs, stocks, bonds, and more, it’s tough to know the ideal path to take.

Maybe you’ve wondered – should I pay off debt first or invest? What account types should I prioritize? How much do I really need in an emergency fund? When is the right time to start investing, and what strategy works best?

If you’ve felt overwhelmed by these questions, don’t worry – you’re definitely not alone. The good news is, there is an optimal order and set of guidelines that can help simplify your investing journey while maximizing your money’s growth potential.

In this comprehensive guide, we’ll walk through the steps of exactly where and how to invest your money from square one. We’ll cover everything from building an emergency fund and taking advantage of accounts with amazing tax benefits, all the way to developing an investment strategy focused on long-term compounding. Stay tuned as we lay out the ideal roadmap to put your finances on the path to prosperity.

Table of Contents

9 Steps Order For Investing Your Money

I. Building an Emergency Fund

No matter how carefully you budget and plan, there’s always a chance something unexpected could happen that costs a bunch of money. Your car could get into an accident and need thousands of dollars in repairs. You could lose your job without warning. Or you could get seriously sick or injured and get slapped with crazy medical bills. Any of these emergencies could Create a huge money crisis if you don’t have a stash of cash set aside to cover it. That’s why having an emergency fund is so essential – it acts like a protective shield to keep you from going into debt or worse when life throws you a curveball.

I’ll never forget about 8 years ago when I got into a fender bender and the mechanic said fixing the bumper would cost $5,000! I was freaking out trying to figure out how I’d pay for that. But then I remembered my emergency fund and was able to easily cover the cost without going into debt or having to make difficult sacrifices. It was such a relief.

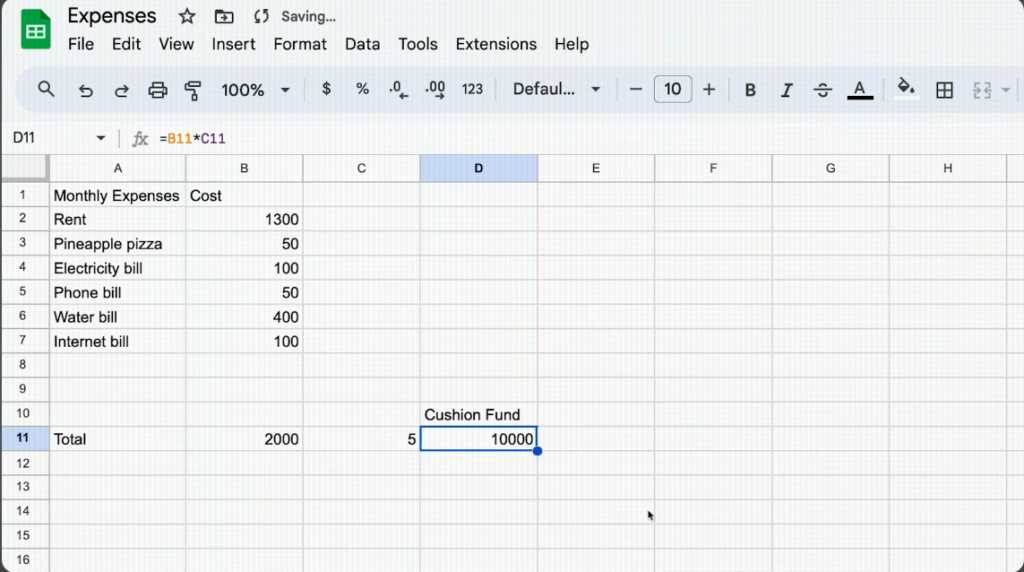

A. Determining the amount

But how much cash should you actually keep in an emergency fund? The standard advice is to save enough to cover 3-6 months’ worth of your basic living expenses. That includes things like your rent/mortgage payment, utilities, food, transportation and minimum loan payments. So let’s say your essential monthly bills add up to $3,000. For an emergency fund, you’d want to set aside between $9,000 on the lower end for 3 months’ coverage, or up to $18,000 for a 6 month cushion.

Having that kind of cash buffer means that even if your income took a major hit due to job loss or other emergency, you’d be able to pay your important bills for several months while getting back on your feet. It prevents you from being a single emergency away from financial disaster.

B. Recommended accounts

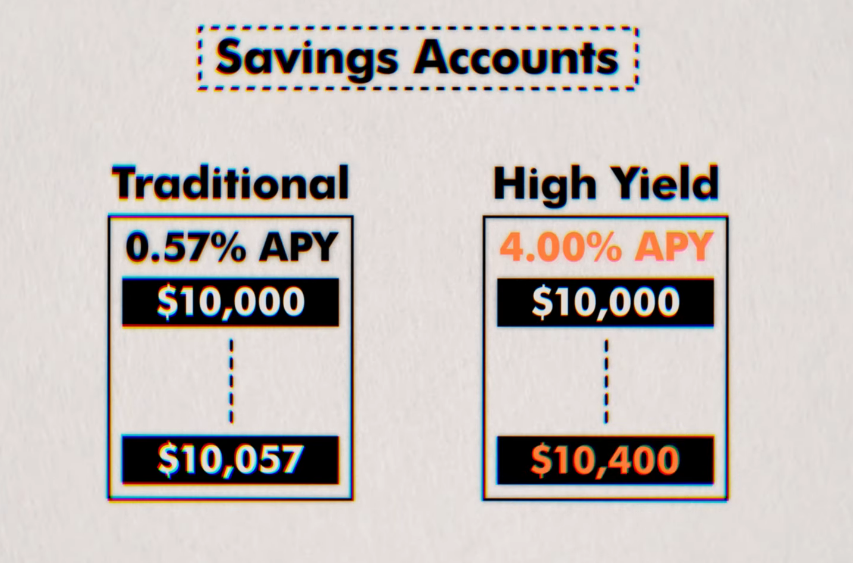

Once you’ve calculated your target emergency fund amount, you need to pick the right place to keep that money accessible, but also earn you a decent return while it’s parked there. The ideal spot is a high-yield online savings account. These specialized accounts pay WAY more interest than you’d get from a regular brick-and-mortar bank’s savings account.

While those old-school savings accounts might pay an interest rate of just 0.01% or basically nothing, you can find high-yield online savings accounts paying 3-4% or more in annual interest on your cash balance. That’s huge compared to earning almost no interest at your typical bank. A few of the best high-yield savings options to look into are Ally Bank’s online savings, Marcus by Goldman Sachs’ high-yield accounts, and the high-yield savings from American Express.

By keeping your emergency fund in one of those high-yield savings vehicles, your cash cushion can be growing a bit while still being there when you need it for an emergency expense. That growth from interest is a nice added bonus while your funds are parked there ready for the unexpected.

The key takeaway is that an emergency fund acts as your plan B – your security net to fall back on when unnecessary, urgent expenses pop up that could otherwise wreck your finances. With that cash set aside, you don’t have to go into panic mode and make desperate decisions like taking on high-interest debt or raiding other savings. You’ve got the emergency handled.

II. Taking Advantage of Employer 401(k) Match

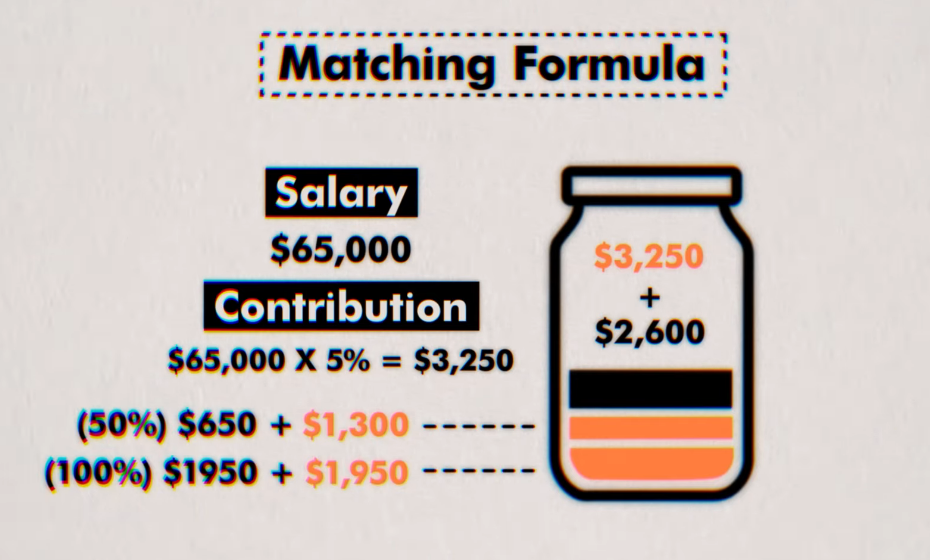

If you’re lucky enough to have an employer that offers a 401(k) retirement plan, you’ll definitely want to take advantage, especially the employer match part. See, lots of companies will actually match the money you contribute to your 401(k) account, up to a certain percentage of your salary. It’s basically free money from your job just for saving for retirement!

A. Maximizing contributions to receive the full match

The way it typically works is your employer will match whatever you put in, up to a certain amount. So if the match is 100% of your contributions up to 3% of your pay, it means if you make $50,000 per year and contribute $1,500 (which is 3% of $50,000), your employer will also put in $1,500. Just like that, your original $1,500 contribution gets doubled to $3,000 for that year!

The numbers can be different, but the key is to contribute enough of your salary to get the maximum amount of that free money from your employer match. A common match might be 50% of your contributions up to 6% of your pay. So you’d want to contribute at least 6% to get that full possible match.

B. Vesting and job transitions

One important thing to know about the 401(k) match – oftentimes you don’t get to keep the employer contributions right away. Many companies use a vesting schedule where you earn rights to that matched money over time. So if the vesting period is 5 years for example, you may only get to keep 20% of the employer match after 1 year, 40% after 2 years, and so on until you’re 100% vested after 5 years on the job.

This vesting schedule is something to pay attention to if you’re considering changing jobs. Because if you leave before being fully vested, you’ll miss out on some of that free money your employer contributed. You may only get the vested portion while the rest goes back to the company. So before changing jobs, check how much you’d be leaving behind by not being fully vested yet.

The bottom line is – if your job offers a 401(k) match, contributing enough to max out that free money should be a top priority! It’s a guaranteed 100% return on those matched dollars, with that extra money helping you build up a much bigger retirement fund over time. Just be mindful of vesting rules when switching jobs down the road.

III. Paying Off High-Interest Debt

Before we can invest and grow our money, we need to take care of any high-interest debt weighing us down first. I’m talking about things like credit cards, which typically charge interest rates of 15-25% or more. Those types of soul-crushing interest rates will sabotage any effort to get ahead financially.

To tackle this, make a list of all your debts – credit cards, personal loans, etc. Then categorize them by interest rate from highest to lowest. Consider anything with an interest rate above 5-7% to be the “high-interest” priority debts to focus on first.

A. The opportunity cost

Here’s why high-interest debt is such a money drain: the higher that interest rate, the more you’re getting charged just to borrow that money. It’s like flushing money down the toilet every month in interest fees. Even if you invested instead, you’d likely make less from investment returns than what you’re paying in interest to that debt.

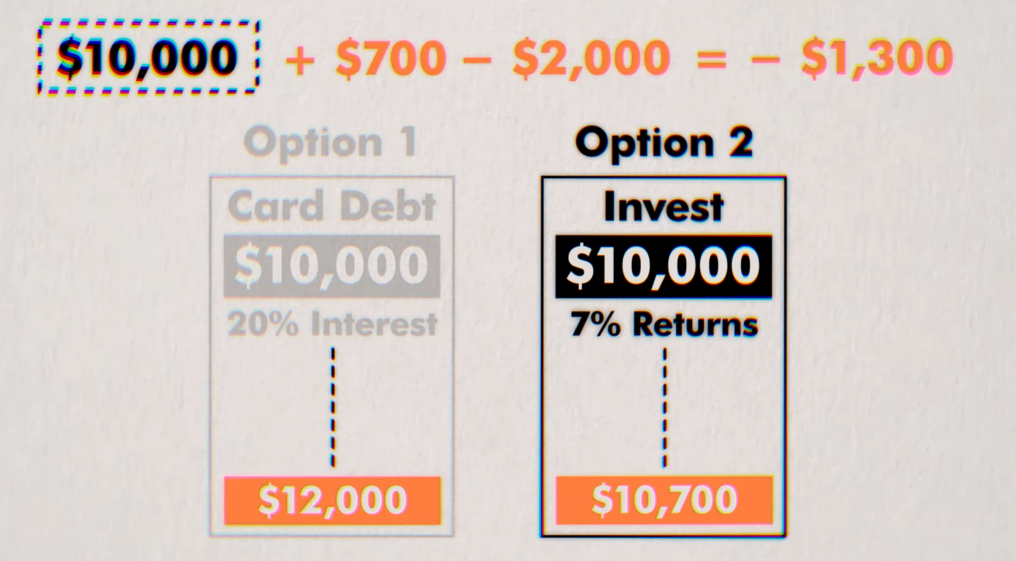

Let’s say you have $10,000 in credit card debt at 18% interest, but also $10,000 in cash you could invest. If you invest that $10,000, you’d likely make something like a 7% return annually, which is $700 gained for the year. But that 18% interest on your debt means you’re paying $1,800 in interest over that same year! So you’re actually $1,100 in the hole overall after subtracting that interest cost.

B. Repayment strategies

So once you’ve identified the high-interest debt culprits, you need an execution plan to get rid of them efficiently. Two of the best strategies are the debt snowball and debt avalanche methods.

The debt snowball approach is where you pay minimums on everything except the smallest debt. Then you blast that smallest debt with all extra money until it’s paid off. Once that’s done, you take that payment amount and “snowball” it onto the next smallest debt, and so on until they’re all gone.

The debt avalanche is similar, but you prioritize paying off the debt with the highest interest rate first while paying minimums on the rest. Then you avalanche down to the next highest interest debt once the first is paid off.

Whichever strategy you use, the key is deploying all extra cash flow toward eliminating those high-interest drains so you can start making forward progress!

Having high-interest debt is like carrying a huge weight holding you back financially. But by making it an upfront priority to aggressively pay it off using one of these proven methods, you’ll free yourself up to really start accelerating your wealth.

IV. Maximizing Tax-Advantaged Accounts

The next step after taking advantage of your employer’s 401(k) match and paying of High Interest Debt is to maximize your contributions to tax-advantaged accounts like the Roth IRA and Health Savings Account (HSA). These allow your money to grow much faster than taxable accounts.

A. Roth IRA

1. Contribution limits and income eligibility

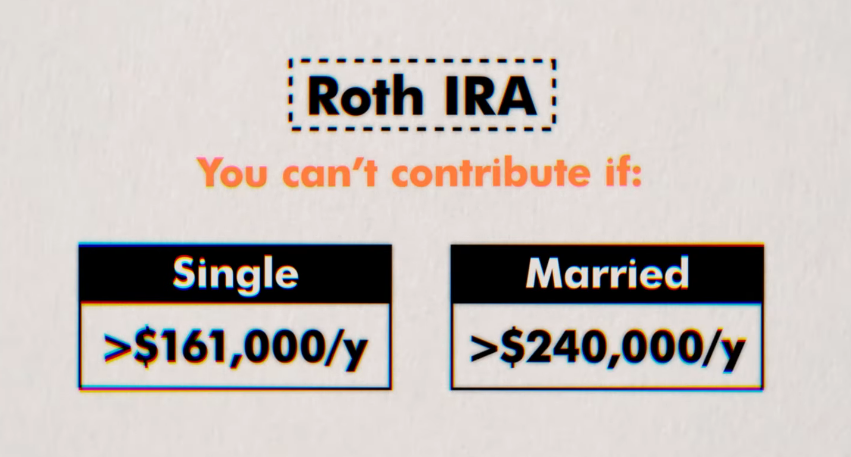

The Roth IRA has annual contribution limits based on your age. For 2024, if you’re under age 50, you can contribute up to $7,000 into a Roth IRA. However, if you’re over age 50, the limit increases to $8,000 to allow for catch-up contributions. It’s important to note there are also income limits for contributing to a Roth IRA. Single individuals with an income exceeding $161,000 or married couples with a combined income over $240,000 in 2024 are not eligible to contribute directly to a Roth IRA.

2. Tax benefits of a Roth IRA

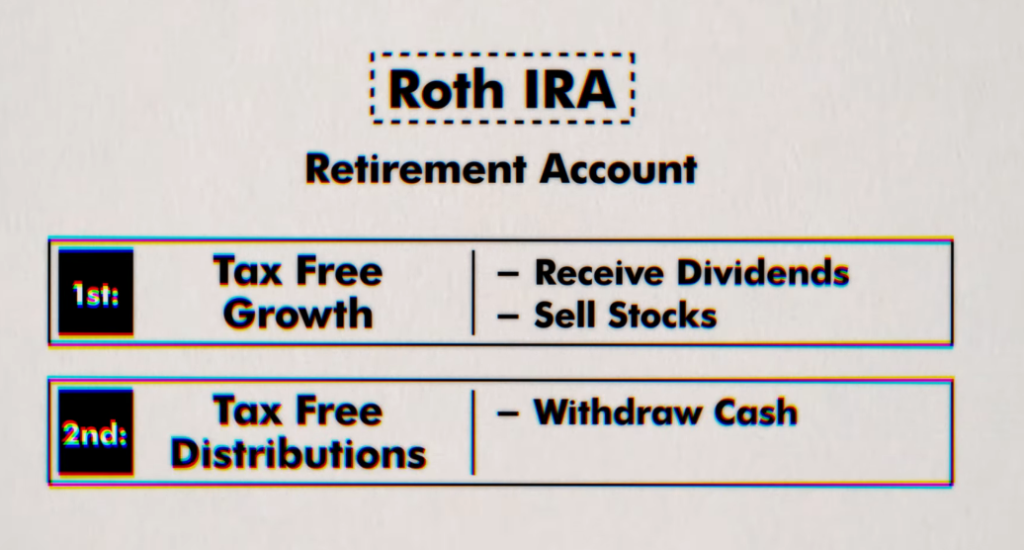

The main benefit of a Roth IRA is its tax treatment. Contributions are made with after-tax dollars, but all future growth and earnings on your investments are allowed to compound completely tax-free within the account. Even more appealing, when you eventually withdraw funds from the Roth IRA in retirement, those withdrawals are also tax-free if certain criteria are met. This allows your money to grow much faster than in taxable accounts.

3. Backdoor Roth IRA strategy

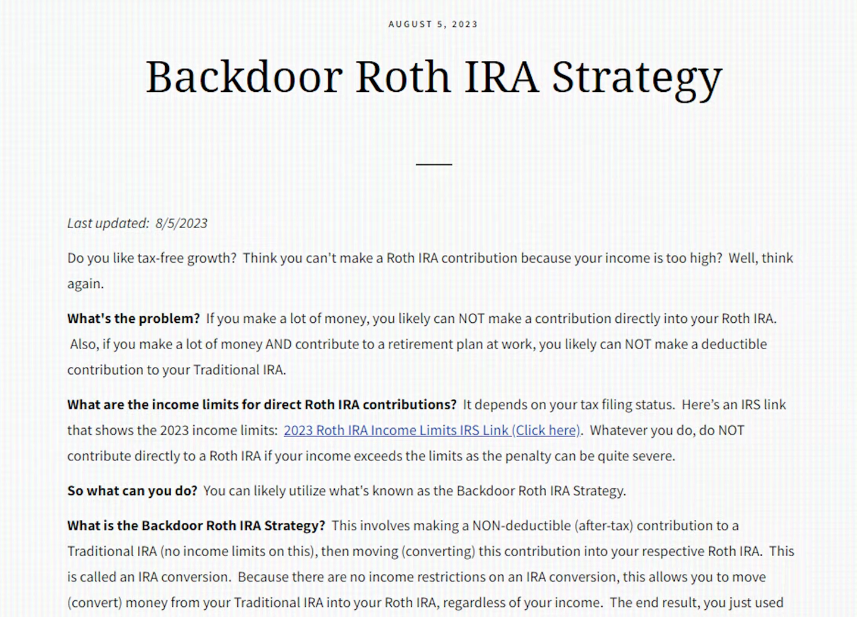

If your income exceeds the limits for directly contributing to a Roth IRA, there is a strategy called the “backdoor” Roth IRA that allows you to fund it indirectly. This involves first making non-deductible contributions to a traditional IRA, then converting those funds into a Roth IRA. While there are specific steps to follow, the backdoor Roth allows you to take advantage of the Roth’s tax benefits regardless of your income level.

B. Health Savings Account (HSA)

1. Triple tax advantages of an HSA

A Health Savings Account (HSA) provides triple tax advantages that make it an incredibly powerful account for saving and investing. First, contributions to an HSA are tax-deductible when made. Second, any growth and earnings on your HSA investments are tax-deferred while in the account. Finally, withdrawals from an HSA are completely tax-free when used for qualified medical expenses, now or in retirement.

2. Contribution limits and eligibility requirements

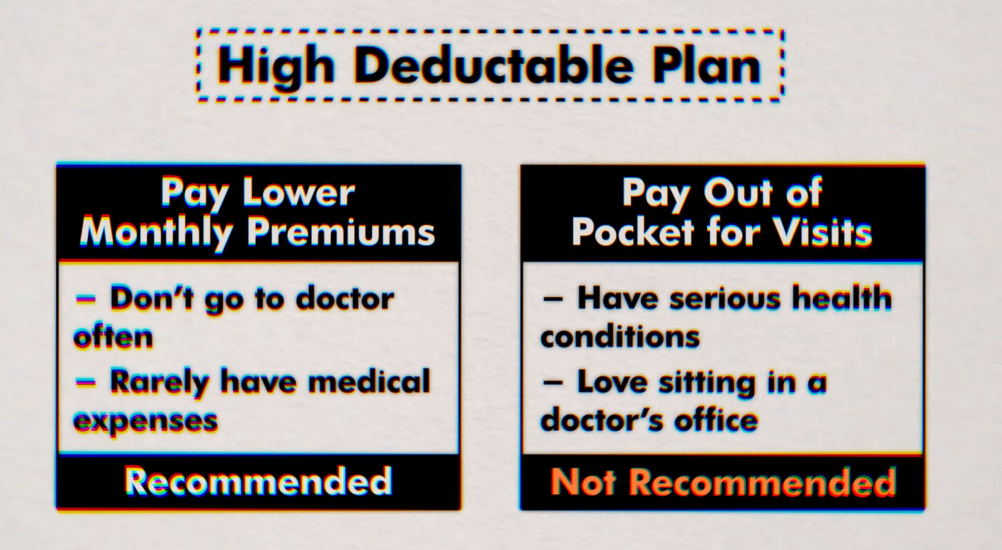

For 2024, individuals can contribute up to $4,150 into an HSA, while families can contribute up to $8,300. However, you can only contribute to an HSA if you have a qualified high-deductible health insurance plan (HDHP). This means the plan has a higher annual deductible than traditional health insurance before coverage begins. So while HDHPs require more out-of-pocket health costs, they make you eligible for the valuable HSA.

3. Using an HSA as an investment vehicle

One of the most advantageous aspects of an HSA is that you can invest the money similar to a retirement account. By maxing out your HSA contributions and investing those funds, you essentially create a pool of tax-free money available to use for healthcare expenses later in life. This makes the HSA an excellent way to build up funds for medical costs in retirement when those expenses are typically highest.

So in summary, after capturing that 401(k) match, prioritize maxing out Roth IRAs and HSAs if eligible. The tax advantages will turbocharge your savings compared to taxable accounts. Just be mindful of the annual contribution limits and income limits for Roth IRAs.

V. Maximizing 401(k) Contributions

Once you’ve taken full advantage of any 401(k) employer match available, you’ll want to consider maxing out your annual contributions to this retirement account. Putting in as much as you can into a 401(k) offers two huge benefits:

First, it allows you to save a ton on taxes for that year. That’s because the money you contribute to a 401(k) gets deducted from your taxable income. So if you make $60,000 annually and max out your 401(k) by contributing $20,500, you’ll only be taxed like you made $39,500 for the year. This can mean thousands in tax savings!

The second big perk is that all that money, and any growth it achieves through investment earnings, gets to compound and grow tax-deferred until retirement age. You don’t have to pay any taxes on it as it grows for decades. This allows your savings to snowball much faster than money sitting in a regular taxable account.

Contribution limits

Each year, the IRS sets new limits for how much you’re allowed to contribute to a 401(k) plan. For 2023, anyone under age 50 can contribute up to $22,500 into a 401(k). Those 50 or older get a catch-up provision allowing them to contribute up to $30,000.

While maxing out annually may seem like a lot of money to save, even contributing a portion of those limits can make a huge difference over time. Let’s say you’re able to put in $15,000 a year starting at age 30. Assuming 7% annual growth, you could potentially have over $2 million in that 401(k) by age 65!

The key is taking advantage of your 401(k)’s tax-deferred compounding as much as possible within the annual limits. Every extra dollar you can afford to squirrel away will continue growing for decades until you need it in retirement. It’s one of the most powerful wealth-building tools available.

VI. Investing in a Taxable Brokerage Account

After you’ve maxed out all the tax-advantaged retirement accounts available to you, it’s time to look at opening a regular taxable brokerage account to keep investing. These types of accounts have a couple key benefits:

First, the money is easier to access since it’s not locked away for retirement. So if you need funds for a large purchase like a home down payment or kid’s college tuition in the next few years, you can withdraw from this account.

The second benefit is that you still get some tax advantages when it comes to paying capital gains taxes on any profits you make from selling investments. More on this in a bit.

A. Recommended Platforms

When it comes to opening a taxable brokerage account, I personally recommend checking out the platform M1 Finance. The great thing about M1 is that they pay a premium interest rate of 1.7% on any cash sitting in your account uninvested. Most brokers pay little to no interest on idle cash.

M1 also makes it really easy to invest in bundled portfolios of stocks and ETFs rather than picking individual companies. This helps you stay diversified. They have pre-built options like a Responsible Investing portfolio or you can build your own.

B. Tax Considerations

While you don’t get the full tax-free treatment as you do with retirement accounts, taxable brokerage accounts do offer some tax benefits when it comes to capital gains – the profits you make when selling an investment.

If you hold an investment for over a year before selling, you qualify for long-term capital gains tax rates, which can be 0%, 15% or 20% depending on your income. These rates are much lower than ordinary income tax rates you’d pay on short-term holdings sold within a year.

So while you will owe taxes annually on interest, dividends or realized capital gains within a taxable account, strategies like tax-loss harvesting and holding for long-term rates can help reduce the tax bite.

The key is to let as much as possible compound for decades by avoiding withdrawals. That allows your money to really grow over the ultra-long-term in a taxable brokerage account.

VII. Paying Off Low-Interest Debt

After knocking out those high-interest debt buckets like credit cards, you’ll want to turn your attention to any lower-interest debts you have. We’re talking about things with interest rates below 4-5% or so. This includes debt like some student loans, auto loans, and potentially low-interest mortgages.

Make another list separating out just these low-APR debts from the high-interest ones you’ve (hopefully) already paid off. Categorize them from highest interest rate to lowest so you have a clear picture.

A. Prioritizing repayment vs investing

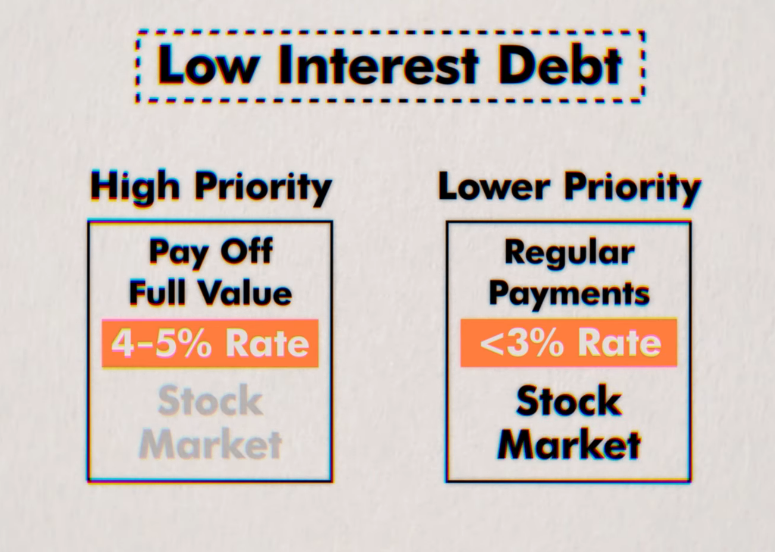

With lower-interest debt, you have a bit more flexibility in your repayment strategy compared to the urgency of eliminating high-interest debt. Evaluate if it makes more sense to just pay the minimum required amounts while prioritizing investing for potentially higher returns.

For example, if you have a student loan with a 3% interest rate, you may be better off investing extra cash in the stock market instead, which historically has returned around 7% annually after inflation. The market gains could outpace that low 3% interest you’re paying.

B. Managing strategies

However, don’t completely disregard paying off low-interest debt either. A good compromise strategy is to split your extra funds between:

1) Aggressively paying off debts with interest rates in that 4-5% range, since that interest is still fairly high.

2) Investing the rest in retirement and taxable accounts.

3) Just making minimum payments for now on any lingering debt under 3% interest.

The goal is prioritizing high returns while also maintaining momentum in debt elimination. You want to eventually become completely debt-free so you can plow all your money into wealth-building if possible.

For added simplicity, you can draw a line at a certain low interest rate, say 3%, and pay off anything above that rate as a priority while just maintaining payments on anything below it.

The flexibility with low-interest debt rates is deciding if it’s cheaper to pay it off slowly while still investing, or knocking it out quickly then going all-in on investing after. There’s no perfect answer, but having a plan for these “lower” interest debts is key.

VIII. Investment Strategies

A. Passive investing with index funds

The best way to invest for most people is using a passive strategy of buying index funds. Index funds simply track a broad market index like the S&P 500, rather than trying to pick individual stocks. I invest the majority of my money in passive index funds like VTSAX or VOO that follow the total U.S. stock market. This is an easy, hands-off approach that avoids the headaches and underperformance of actively picking stocks. Index funds give you instant diversification at a very low cost.

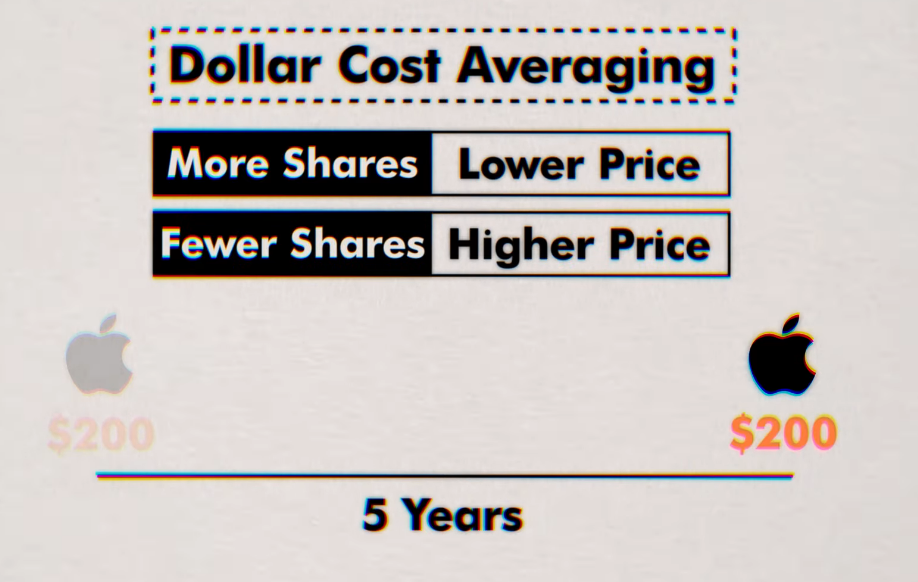

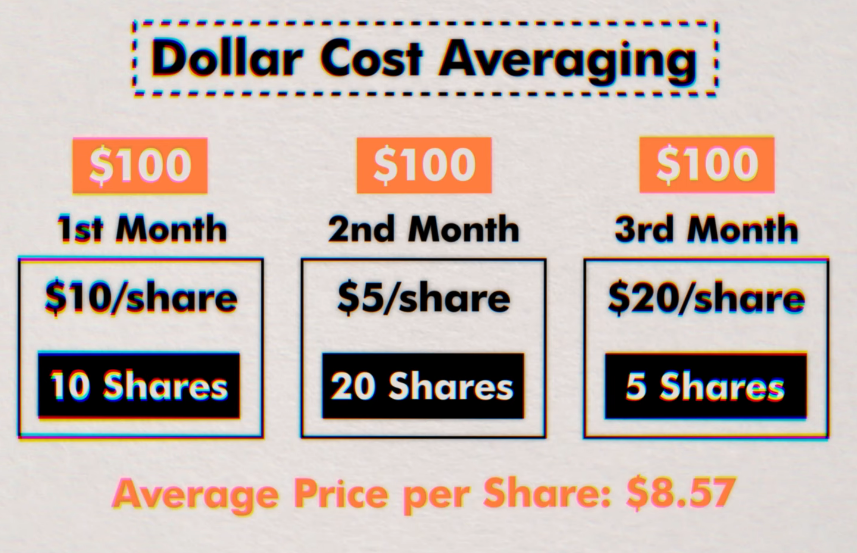

B. Dollar-cost averaging strategy

When investing in index funds, I use a strategy called dollar-cost averaging. This means investing a fixed dollar amount at regular intervals, like $500 per month. By automating your investments, you avoid the pitfalls of trying to time the market. Some months the share price will be up, other months it will be down. But by investing the same amount consistently over years and decades, you smooth out the pricing peaks and valleys. Dollar-cost averaging helps take the emotion out of investing.

C. Importance of a long-term mindset and consistency

The most critical things for successful investing are maintaining a long-term mindset and consistently contributing over time. It’s understandable to feel anxious about market volatility in the short-term. But historically, stocks have positive returns when held for 15+ year periods. The real wealth is built through compounding growth over decades.

That’s why the biggest mistake is letting your emotions cause you to stop investing, or even worse, sell out of the market when it dips. The investors who remain patient and keep contributing regularly through the ups and downs are the ones who see the biggest gains over the long run. Develop a plan, automate your investments as much as possible, and stick with it consistently for years. That’s the simple formula for investing success.

IX. Bonus Tips and Strategies

A. Leveraging tax-advantaged accounts for wealth acceleration

One of the biggest boosters for building wealth faster is taking full advantage of tax-advantaged investment accounts. Accounts like 401(k)s, IRAs, and HSAs provide tax benefits that supercharge your money’s growth compared to taxable brokerage accounts.

In a regular brokerage account, you get hit with taxes annually on any dividends, interest, or capital gains. But in a Roth IRA or HSA, that money can compound entirely tax-free for decades! That allows much more of your money to stay invested and grow over time. Maxing out these tax-sheltered accounts should be a top priority before investing in taxable accounts.

B. The power of compound interest and time in the market

They say the biggest rewards go to those who wait, and that’s definitely true with investing. The earlier you start, the more powerful compounding becomes in growing your wealth. For example, if you invested $6,000 per year starting at age 25, you could have over $2 million by age 65, assuming 7% annual returns!

However, if you waited until age 35 to start investing, contributing that same $6,000 annually would leave you with less than $900,000 at retirement age. Those 10 years can literally cost you over $1 million! Time is your biggest wealth-building asset when you allow compounding to work its magic.

C. Mindset shifts for building wealth

As important as strategy is, having the right mindset is equally crucial for long-term investing success. It’s normal to feel worried during inevitable market downturns. But implanting a few mindset shifts can keep you disciplined:

1) Expand your time horizon – Plan for decades, not years. Viewing investing through a very long lens smooths out the volatility.

2) Embrace failure – Even brilliant investors have bad years. What matters is being comfortable with short-term declines.

3) Cultivate control – You can’t control markets, but you can control your actions. Stick to your process and tune out the noise.

The greatest wealth is created by those who stay patient, brush off failures, and obsess over controlling their own behaviors. Develop this unshakable mindset, and the rest will follow.

This outline covers all the key points and strategies discussed in both transcripts, including building an emergency fund, taking advantage of tax-advantaged accounts, managing debt, investing in taxable accounts, and implementing effective investment strategies like index funds and dollar-cost averaging. Additionally, it incorporates relevant tips, mindset shifts, and considerations from the transcripts, such as the power of compound interest, embracing failure, and cultivating a sense of control over one’s financial future.

Conclusion on Order of Investing Your Money

There you have it – the optimal order and strategies for investing your money and building wealth over the long haul. We covered a lot of ground, from the importance of an emergency fund and capturing free money from your employer, all the way to maxing out powerful tax-advantaged accounts like 401(k)s, IRAs, and HSAs.

We looked at eliminating high-interest debt drains upfront while maintaining a balanced approach with low-interest debt. And we explored investing in taxable brokerage accounts while following strategies like passive indexing, dollar-cost averaging, and maintaining an unshakable long-term mindset.

The key is developing a personalized plan that follows these general guidelines while making sense for your specific income, goals, and circumstances. It’s also important to remain flexible and adjust as your life situation changes over time.

The wealthiest individuals understand that building long-term wealth through investing is a marathon, not a sprint. It requires patience, consistency, and controlling what you can control – your savings rate, tax optimization, and investing behaviors.

If you can put these principles into practice starting today, I’m confident you’ll be well on your way toward achieving financial freedom and turning your investment dreams into reality. The road may get bumpy at times, but staying disciplined to the process will pay off immensely over decades.

So what are you waiting for? Review these steps once more, make your investment plan, and take that first step toward securing your financial future. An incredible journey of wealth creation awaits!