Did you know according to a recent survey of Marketwatch 65% of Americans Say Finances Are Their Biggest Source of Stress, this survey was done on a group of 2000 Americans, They also stated that people are afraid to even look at their checking accounts,

this serious statistic is concerning When you Give it thought on Why people are losing grip on their money? the answer is management people don’t know how to perform the division of their income that fuels emergency, expenses as well as future growth

So today, Let’s talk about managing money like the 1%. You know, those folks who seem to have it all figured out financially? Well, they’ve got this secret weapon – the 75/10/15 rule. It’s a simple but powerful way to divide your income that can work wonders for your wallet.

It’s a solid strategy for budgeting, saving, and investing that can help anyone build wealth over time. I’m about to break down exactly how this rule works and how you can start using it today to transform your money allocations.

Starting with,

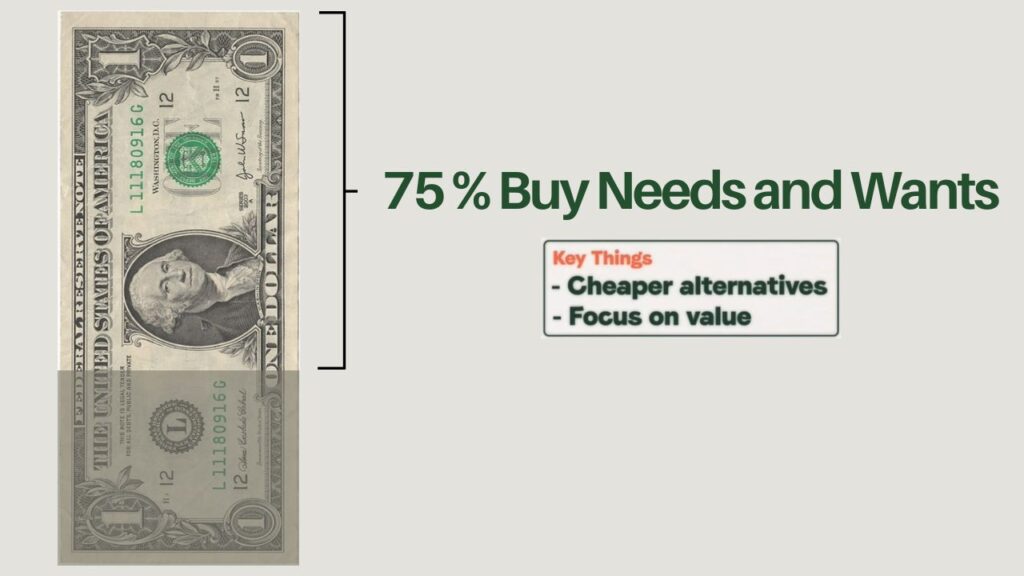

The 75% Rule:

The first step On how to manage your money like the 1% is following the 75% rule for every dollar you earn. A maximum of 75 cents out of each dollar can go towards your lifestyle expenses – housing, groceries, transportation, entertainment, etc.

and for me, my 75 also includes my debt. Not all of it but high-interest debt which I have explained below:

This 75% limit serves two important purposes:

- It forces you to seek out value and make cost-conscious choices. Instead of premium gas, buy regularly. Maybe giving that McDonald’s meals a break. Opt for happy hour deals when dining out. I know many if you might not seek this as good advice but keep this in mind no matter what just keep your expenses under 75% of your earnings which should be the maximum.

- It makes you evaluate purchases based on true value and happiness, It makes you think hard about what’s really worth spending money on. Don’t waste money on stuff that doesn’t make you truly happy long-term. (your favorite car, and that expensive phone, etc) you need to give those a pause for until you complete your cushion money what that? I will explain below in 10% rule, But it’s okay to spend on small joys that you really care about and that improve your daily life.

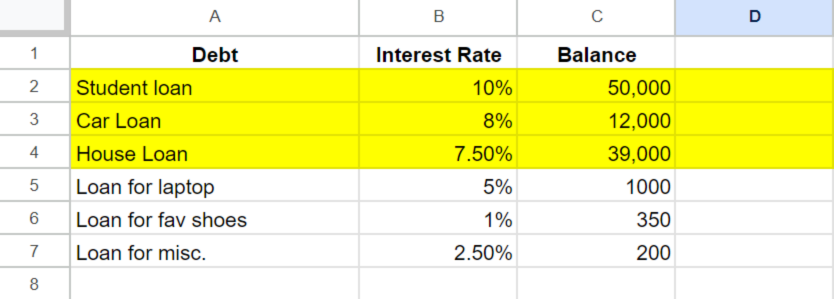

Tackling High-Interest Debt First

The next focus should be eliminating any high-interest debt you’re carrying – categorized as 7% APR or higher. Why? Because High-interest debt like credit cards acts as a monthly financial drain, Draining away income that could be invested elsewhere.

Make a list of all your debt accounts – cards, loans, etc. Include each interest rate and outstanding balance. Then highlight any debts with a 7%+ APR as your highest priority.

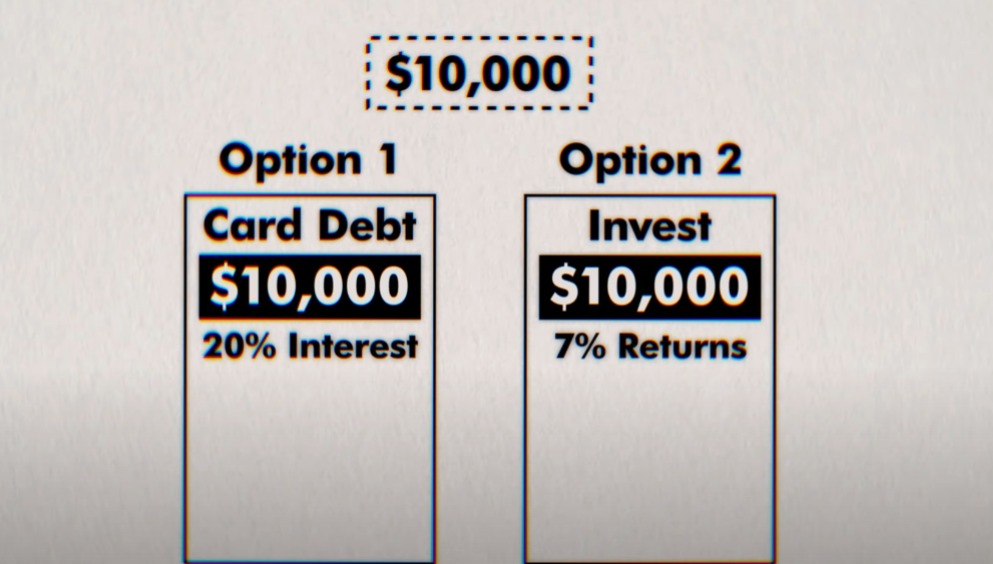

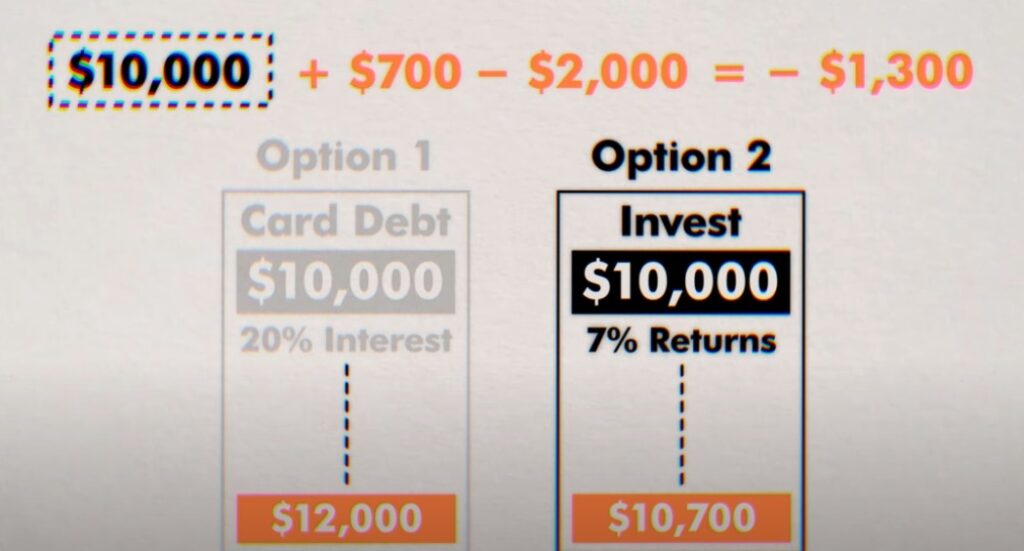

Here’s why high-interest debt is so Deceptive: It comes with immense opportunity costs by handcuffing your money. Just look at this example, if you have $10,000 in cash, you could either:

- Pay off a $10,000 credit card debt at 20% interest

- Invest that $10,000 (which historically averages 7% annual returns)

Choosing option 2 would make your $10,000 debt balloon to $12,000 after a year due to interest charges. Even though you’d earn $700 from investing, the $2,000 interest cost puts you $1,300 in the hole compared to just paying it off.

(Does this mean investing is bad hell no, guys it comes down to opportunity cost. When it comes to financing I always advise people to look for long-term growth. when you look for the long term you find not only growth opportunities but also limitations the things that stop your money from growing Just like the above example.

So start knocking out those high-interest “Debt loads” first before moving on to growing your wealth. Debt freedom allows you to use your income productively.

Suppose you can spend less than the 75% limit, even better! Allocate any leftover difference to the 15% investing portion of the rule. (mentioned after the 10% rule).

The 10% Rule: The Cushion Fund

The next 10 cents out of the dollar you earn should go into your cushion fund. This is a separate savings account specifically for emergencies.

Seems logical right, but if not here is something you should look at

According to Foxbusiness report Around 56% of Americans can’t afford a sudden $1,000 expense. Your cushion fund protects you when real-life emergencies hit – not splurges like vacations or cravings, but true emergencies like:

– Your house getting flooded

– Getting stranded somewhere with no money

– A major car repair

– Or a hospital bill

I remember once my friend got in a bad accident that ruined his car. The mechanic said repairs would cost $5,000+! The only option he was left with was to take out an expensive loan. So you better be ready with some cushion funds as we all know insurance doesn’t always cover everything in life.

So how do you calculate your Cushion Goal

1. Add up all your monthly expenses (rent, bills, etc.)

2. Multiply that number by 5

This is how much you need in your cushion fund – enough to cover 5 months’ worth of costs.

For example, if your expenses are $2,000 per month, then your goal is $10,000 (5 x $2,000).

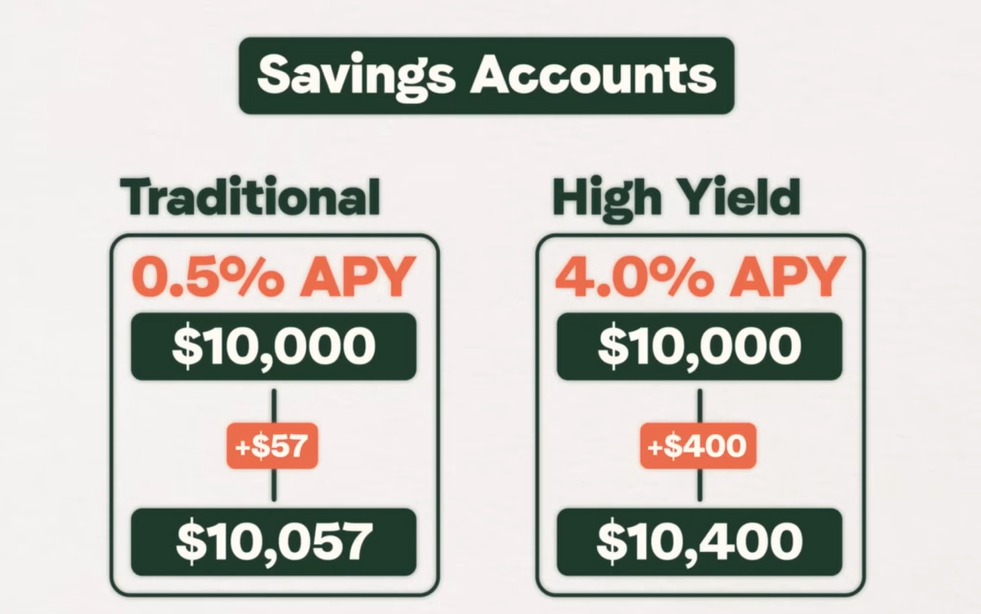

PRO TIP: Save Up Quickly Using a High-Yield Savings Account

Don’t use a regular savings account where the interest rate is around 0.5%. At that rate, a $10,000 balance would only earn $50 after one year.

Instead, open a high-yield savings account (HYSA) which earns 4% or more in interest. A $10,000 balance would grow to $10,400 in one year!

Some top HYSA options include: (list a few examples)

- Laurel Road offering 5.15%.

- American Express offering 4.25%.

- Sofi bank offering 4.60%.

No affiliates I personally use American Express as of now.

Once Your Cushion Is Funded, Stop.

The key is to save up a 5-month cushion quickly, but then stop adding to it. And now Just hold that 10% of your income for the next step and that is…..

The 15% Rule: Investing for the Future

The wealthy don’t just earn money from working – a key part of their wealth comes from owning assets that generate income. That’s why the 15% portion of the 75/10/15 rule is so important. This chunk gets invested to help you build your own portfolio of wealth-generating assets.

The two key investment accounts to start with:

Roth IRA – This allows your money to grow completely tax-free! You contribute the after-tax dollars, but all future growth and withdrawals in retirement are 100% tax-free

In 2024, you can put in up to $7,000 per year if you’re under 50 years old. If you’re 50 or older, you can contribute up to $8,000.

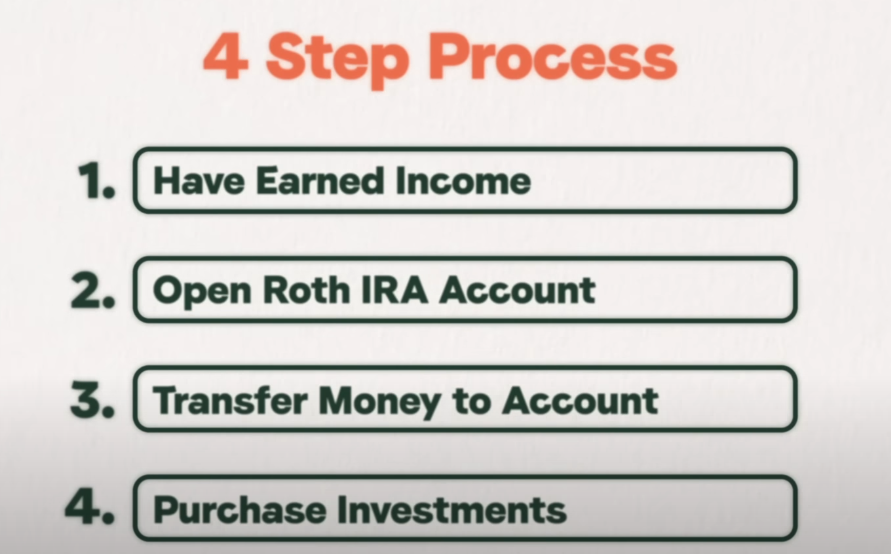

To open a Roth IRA,

you need to have earned income from a job, your own business, or self-employment. Then go to a broker’s website like Fidelity or Vanguard and open a Roth account. Transfer money from your bank into the new Roth account. Lastly, make sure to actually invest that money into funds or stocks within the account.

I Suggest Reading more about Roth IRAs.

A 401(k) account: it is a retirement account offered by some employers. Your contributions come directly out of your paycheck before taxes. This lowers the taxes you pay now, but you’ll pay taxes later when you take the money out in retirement.

The 2024 limit is $23,000 if you’re under 50, or $30,500 if you’re 50 or older. A big perk is that many employers will match a portion of what you contribute – that’s free money!

For example, if you make $65,000 and contribute 5% ($3,250) The most common match that employers give is 100% of the first 3% you put in, plus 50% of the next 2%.

For example, if you make $65,000 and contribute 5% ($3,250), your employer would add 3% of 65000$ (1950$ 100% match). plus the remaining 2% of 65k with a 50% match which means 50% of 1300$ equals to (650$) making a grand total of 2600$ That’s an instant 80% return on your $3,250!👑

- There are more types of employer matching offered as well you can read them here before investing.

- And also read all the basics about 401k accounts here.

All I can suggest is taking advantage of your employer’s 401(k) match is a no-brainer way to get free money for retirement.

(NOTE: these two accounts are not like your traditional account after opening it you need to invest this money into assets alright like mutual funds, stocks, etc) so what will be the right way to invest? That question is scary good and the answer to it is easier than you think).

Simple Investing Strategy

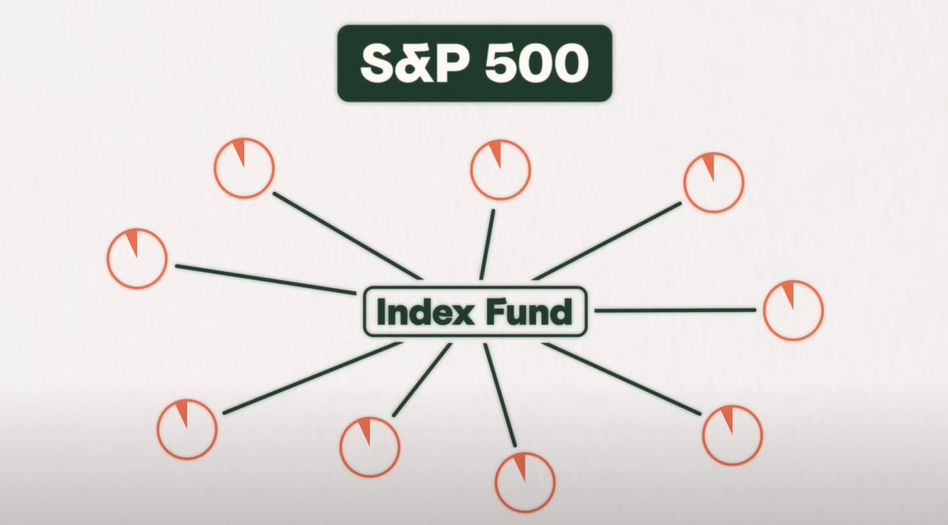

The easiest way to invest inside a Roth IRA or 401(k) is through low-cost index funds or ETFs. These allow you to own a big chunk of the entire stock market in one fund. For example, an S&P 500 index fund gives you a piece of ownership in 500 of America’s biggest companies. This instantly diversifies your portfolio instead of betting on just a few stocks.

History shows index funds can average around 8% annual growth over long periods. That’s not bad

But if you think investment in individual stocks is a better idea you need this approach:

Since the Roth provides tax-free growth, it’s great for investing in stocks of large companies as well which you think will perform better than 8% like Apple, Google, or Nvidia. The long time horizon allows you to aim for higher potential gains without taxes reducing your profits.

However, don’t try to “time the market” Here are two big problems with this strategy:

- It’s impossible to accurately predict market tops and bottoms. Even experts are usually wrong about when markets will rise or fall.

- You have to be right twice – knowing exactly when to sell before a decline, and when to buy back in after the decline. Missing either point means locking in losses.

The better solution is dollar-cost averaging. This means investing the same fixed dollar amount at regular intervals, regardless of whether markets are up or down.

For example, if you invest $200 into Apple stock every month for 5 years, you’ll automatically get more shares when the price is lower and fewer shares when it’s higher. Over time, this lowers your average cost per share without needing to forecast anything.

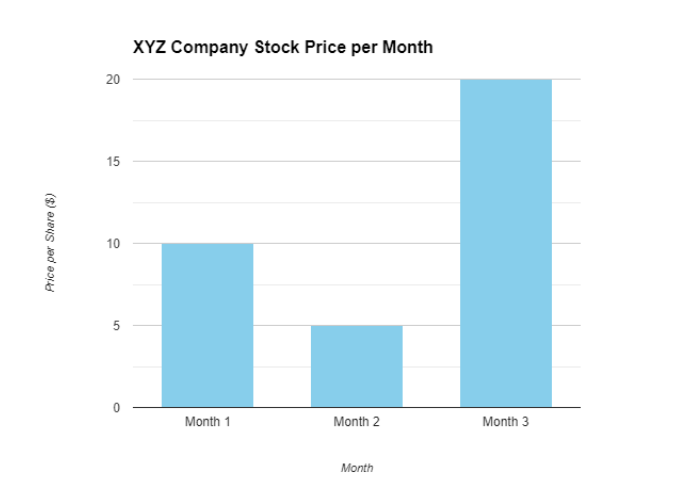

Let’s say you have $300 to invest in XYZ Company stock which is volatile and you decide to invest in it, for 3 months: (100$ every month)

- Month 1: Stock is $10, you get 10 shares for 100$.

- Month 2: Stock is $5, you get 20 shares for 100$.

- Month 3: Stock is $20, you get 5 shares for 100$.

So if you just do regular investment and don’t time the market at the end of 3rd month You will have 35 shares for $300, averaging $8.57 per share. Not the cheapest $5 price, but also not the highest $20 price.

And now if you apply the same approach to stocks that actually hold value and are not that volatile in the market like Nvidia, Meta, apple, and Amazon you know your money will compound like crazy.

By consistently investing the same amount, you remove the impossible guesswork of predicting highs and lows. Dollar-cost averaging helps reduce risk while keeping you invested through all market conditions

So, By maxing out accounts like 401(k)s and Roth IRAs consistently, your 15% investment money can snowball into a serious wealth-building machine thanks to compound growth.

The key is getting that 15% invested, not just saved sitting in the bank. Use these tax-advantaged accounts to put your money to work in income-producing assets. That’s how you transition from just earning from labor to building real wealth!

Note: If you are interested in learning more about the stock market we have a complete stock market guide for beginners. it comes with a free index fund guide that covers everything in detail do check it out!

Wealth-Building Mindset

The 75/10/15 rule helps you go beyond just earning a paycheck to actually building long-term wealth. But it takes more than just following the steps – it requires adopting a wealth mindset. boy’s and girl’s mindset is everything!!

Stop Thinking Like an Employee

Most of us are taught from an early age to get good grades, get a good job, and live off our paychecks. This is the employee mindset of trading time for money. The wealthy think differently – they make their money work for them through owning assets that generate income.

Rich people don’t just have bigger paychecks. They understand that the path to real wealth comes from owning productive assets like businesses, real estate, stocks, or other investments that provide cash flow month after month, year after year – even if they’re not actively working.

Keep Learning

The wealthy never stop learning and expanding their knowledge, especially about money and investing. Reading books on personal finance, studying how money works, and keeping an open mind to new wealth strategies separate them from the average employee.

Think about it – if nobody ever taught you about wealth-building accounts like 401(k)s and Roth IRAs, how would you learn to make your money grow? The wealthy seek out this crucial knowledge.

Believe You Can Be Wealthy

Perhaps the biggest difference is their fundamental belief in abundance rather than scarcity. The employee mindset thinks: “There’s only so much money to go around. Getting wealthy is extremely difficult or impossible for someone like me.”

The wealth mindset believes: “There is an endless supply of wealth in the universe available to anyone willing to embrace it. I am destined for greatness.” This abundance mentality allows the wealthy to try new ideas, take calculated risks, and persevere through failures.

Building real wealth goes beyond just budgeting and saving – it requires expanding your mindset. Follow the 75/10/15 plan, keep learning, and start believing you too can create income-generating assets. That’s how to achieve true financial freedom.

Final Thoughts

the 75/10/15 rule. It’s not rocket science, but it’s how the big dogs play the money game. Remember: 75% max for living it up (and squashing high-interest debt), 10% for your “oh crap” fund, and 15% to grow your wealth like a boss.

Now, don’t just nod along and forget about this tomorrow. Take action! Stick with it, even when it gets tough. Rome wasn’t built in a day, and neither is a fat bank account. and I will see you in the next one….