Money troubles? You’re not alone. According to the latest survey done by Forbes 76% of Americans live paycheck to paycheck,

This alarming statistic tells us the urgent need for better financial literacy and management. And it’s something every other human in our neighborhood is worried about,

But here’s the good news: taking control of your finances isn’t as Hard or complex as it might seem. With the right strategies, you can break free from financial stress and build a secure future.

This guide breaks down money management into a 6-Steps payday Routine:

- Figure out your basic expenses

- Save for emergencies

- Understanding credit scores and tackling high-interest debt

- Start investing, beginning with your 401(k)

- Maximizing investments through Roth IRAs and brokerage accounts

- How to Put your finances on autopilot

Without any more words let’s just get into it,

Step 1: Find Your Financial Baseline (Necessity)

The first and most important step is finding your financial baseline. Many people struggle with money because they don’t track their expenses properly. This mistake is called “mental accounting” – when you mentally categorize money instead of writing it down.

For example, if you get a tax refund, you might think of it as “extra” money and spend it on wants like a new TV. But that refund is just your own money being returned to you. It should be treated the same as your regular income.

The solution is simple – make a spreadsheet listing all your monthly expenses like rent, groceries, utilities, etc. This will show you the minimum amount needed for your current lifestyle. Then, remove any non-essential expenses like streaming services or subscriptions.

What remains are your core expenses:

- Housing (rent/mortgage) – Aim for under 30% of your income

- Groceries – About 10% of your income

- Insurance and utilities – Another 10% of your income

The total of these core expenses is your “financial baseline” – the absolute minimum to cover necessities each month.

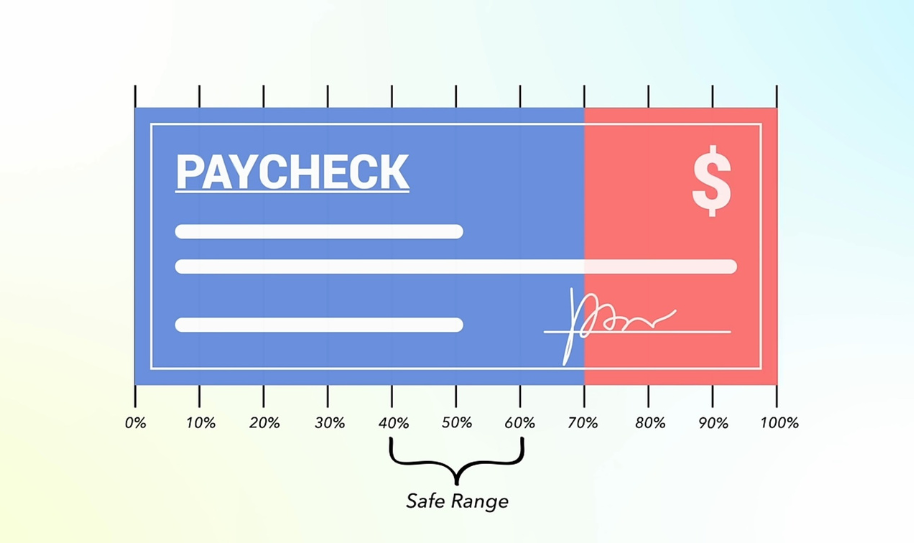

Experts recommend keeping this baseline under 50% of your total income, though it can vary. In high-cost-of-living areas, necessities may require 60% of your income. In lower-cost areas, it could be 40% or less.

To give you a safe number including various factors just make sure 40% to 70% of your paycheck should cover your baseline expenses. If it’s higher, look for cheaper alternatives on non-essentials.

But don’t just go by the rules of thumb – do the math for your specific situation. Calculate the percentage of your necessities consumed to understand your personal financial baseline This number builds the foundation for the next steps of budgeting and money management.

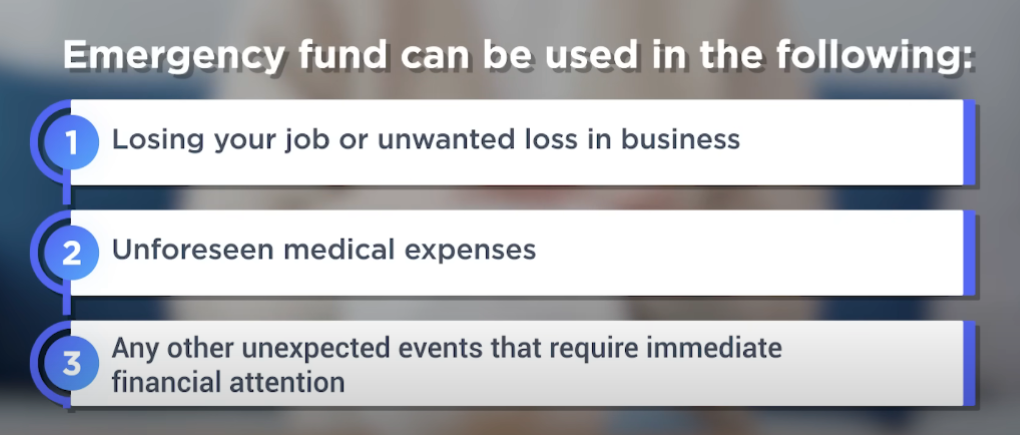

Step 2: Build an Emergency Fund

According to Foxbusiness report Around 56% of Americans can’t afford a sudden $1,000 expense. They said they would borrow it somehow to pay for it.

So, The next step is establishing or Increasing your emergency fund. You’ve likely heard this before, but aim to save 6 months’ worth of living expenses. This money should be kept in an easily accessible, high-yield savings account.

Let’s take an example: Suppose your monthly necessities expenses from Step 1 that you calculated come at 2500$ then your emergency fund should have 15000$ in it saved, (2500×6).

This Should be the end goal of your emergency fund. Stop after you have reached that number. Even if you can add more to it. there are better places to put your money, we have discussed that in Step 4 below,

PRO TIP: Now It’s crucial this money is liquid, meaning you can access it immediately in an emergency. Don’t put it in something like a Certificate of Deposit (CD), which is locked away for months.

Why Don’t use a regular savings account?

In a normal savings account, the interest rate is around 0.5%. At that rate, a $15,000 balance would only earn $75 after one year.

Instead, open a high-yield savings account (HYSA) which earns 4% or more in interest. A $15,000 balance would grow to $15,600 in one year! providing 600 in interest in comparison to just 75$

Some top HYSA options include:

- Laurel Road offering 5.15%.

- American Express offering 4.25%.

- Sofi Bank offering 4.60%.

No affiliates I personally use American Express as of now.

With a solid emergency fund established, you’ll be prepared for the unexpected and can move on to the next financial step with peace of mind.

Step 3: Importance of Credit Score and Pay Off High-Interest Debt

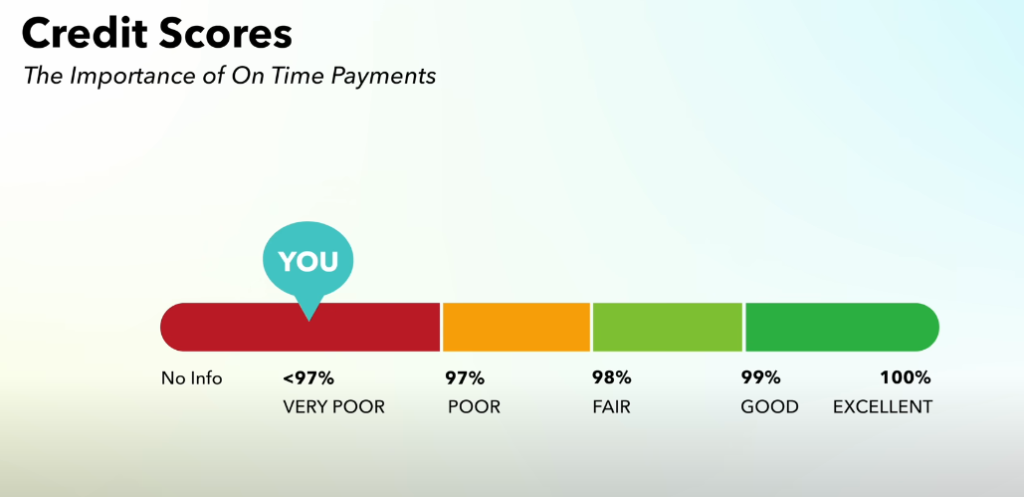

The next step is to Maintain a Good Credit Score. In America is very important for many financial decisions. The key is making your debt payments on time.

We are programmed from our school life that above 90% is considered excellent but in real life especially in the case of finance there is no room for mistakes well it’s about money so how could you!! right?

Here’s how your on-time payment percentage affects your credit score:

99-100% On-Time Payments = Excellent Credit

97-98% On-Time Payments = Good Credit

Below 97% On-Time Payments = Very Poor Credit

Missing even one payment out of 20 can severely damage your score. This may seem odd since a 95% is usually considered a good grade. But for credit, lenders want a perfect payment history. So when it comes to debt step 1 is simply ensuring you make all minimum debt payments on time to protect your credit score.

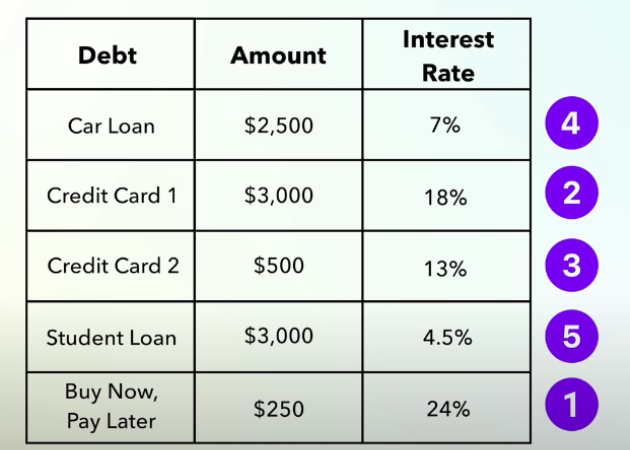

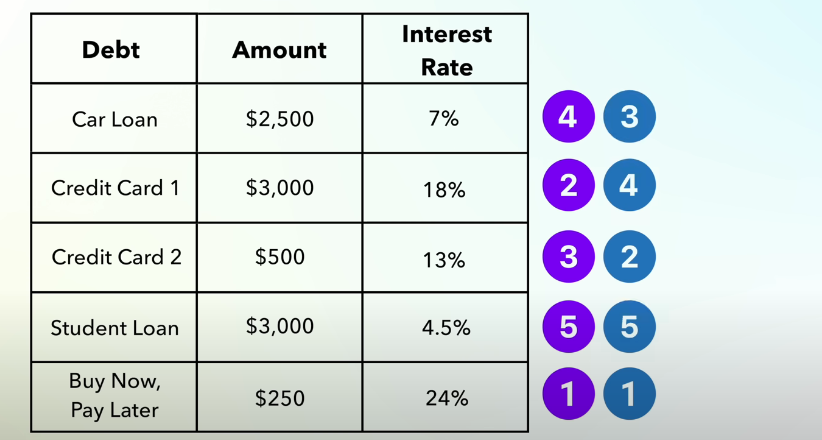

The next thing is now we look at the actual debt we have and how we should clear it off the right way-

Paying Off High-Interest Debt First

Debt strangles your income by requiring huge monthly payments to credit cards, loans, etc.

Once your credit score is in good shape, it’s time to tackle your highest-interest debt. The average American debt (per U.S. adult) is $66,772, and 77% of American households have at least some type of debt.3,4,5 whether from luxury spending, keeping up with unaffordable lifestyles, or necessary purchases like furniture.

Why high interest first? Look at the example below

With a $6,500 credit card balance at 19.5% interest, you choose to pay the minimum price the $130. that minimum payment would take 8 years to pay off with an additional cost of $6,000 in interest!

Is it really wise to strangle for 8 years and pay off almost the same interest as the principal amount or just rid of the debt and save yourself at least 5,000$ that you would have paid in interest?

There are two popular strategies for paying Debt: (I prefer the 1st one)-

- The Avalanche Method Pay the highest interest rate debt first (credit cards, payday loans, etc. over 7-10% interest). This mathematically costs the least over time.

- The Snowball Method: Pay the smallest balance first, regardless of interest rate. This motivates you to clear debts quickly.

As you can see above the payment preferences have changed While less efficient in the long run the Snowball Method provides Psychological motivation as you see debts disappearing from your sheet and the money that you were giving to the small debt that amount can now be contributed to remaining debt in the sheet,

NOTE: I recommend you stick to avalanches it’s like giving effort and not getting instant results but is the long run it’s the more beneficial one just like the concept of “delayed gratification”.

Step 4: Invest for the Future Starting with 401k

Investing may seem complicated with flashing stock screens and day traders. But the basics are simple, and investing can help you make millions over your lifetime.

Einstein called compound interest the “eighth wonder of the world.” Over time, the stock market returns around 10% per year on average. This means your money doubles every 10 years without you doing anything!

For example, if you invest $6,000 per year from age 25 to 65 at a 10% return, you’ll end up with over $2.7 million. But if you just kept that money under your mattress, you’d only have $240,000. That difference can easily change your life.

The key is starting investing as early as possible, but from where should you start?

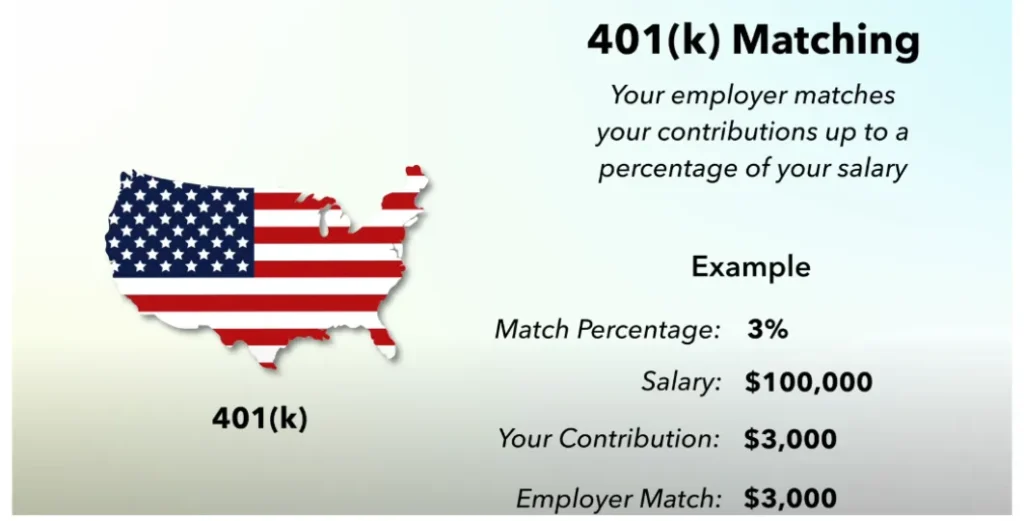

You should start with tax-advantaged retirement accounts like a 401(k). Most employers offer a 401(k) plan and will match a percentage of your contributions – that’s free money! The 2024 limit is $23,000 if you’re under 50, or $30,500 if you’re 50 or older.

Let’s look at an example: let’s name it Brian

- Brian makes $100,000 per year

- His employer offers a 100% match up to 3% of Brian’s annual income. 401(k) match

- So if Brian contributes 3% ($3,000), his employer will also put in $3,000.

- Making Brian at the end of each year a 100% return on his contribution. Making it 6000$

- Taking advantage of this match is a no-brainer.

- The only drawback is the liquidity. If you need the money in between the period you will be charged some amount as a penalty as 401k matching is a retirement plan account.

NOTE: what that 3% implies is an employer will give up to a 3% MAX match on your annual salary which means if you do 2% he will do the same. if you do 3% he will do the same but if you do more than 3%. your employer will only give max 3% of your annual salary match. So it is recommended to at least invest up to 100% employer match percentage to get the full benefit of this 401k account.

What should you invest in (inside 401k)?

The easiest way to invest in a 401(k) is through low-cost index funds or ETFs. These allow you to own a big chunk of the entire stock market in one fund. For example, an S&P 500 index fund gives you a piece of ownership in 500 of America’s biggest companies.

History shows index funds can average around 8% annual growth over long periods. That’s not bad

But if you think investment in stock is a better idea hold that thought because you can do that with your Roth IRA and the normal brokerage account that we are going to discuss next.

Beyond the match amount, experts recommend contributing around 10% of your paycheck to retirement accounts like a 401(k). (because in Roth IRA you can invest less than 401k) in 401k your money compounds tax-free until retirement age. The benefit of this is: that today you save tax annually!!!

Let’s take Brian’s example again: suppose Brian contributed 10% of his income which means 10k so now he is left with only 90k which means instead of paying tax on 100k he will have to pay it on 90k only!!

Resources: There are more types of employer matching offered as well you can read them here before investing. And also read all the basics about 401k accounts here.

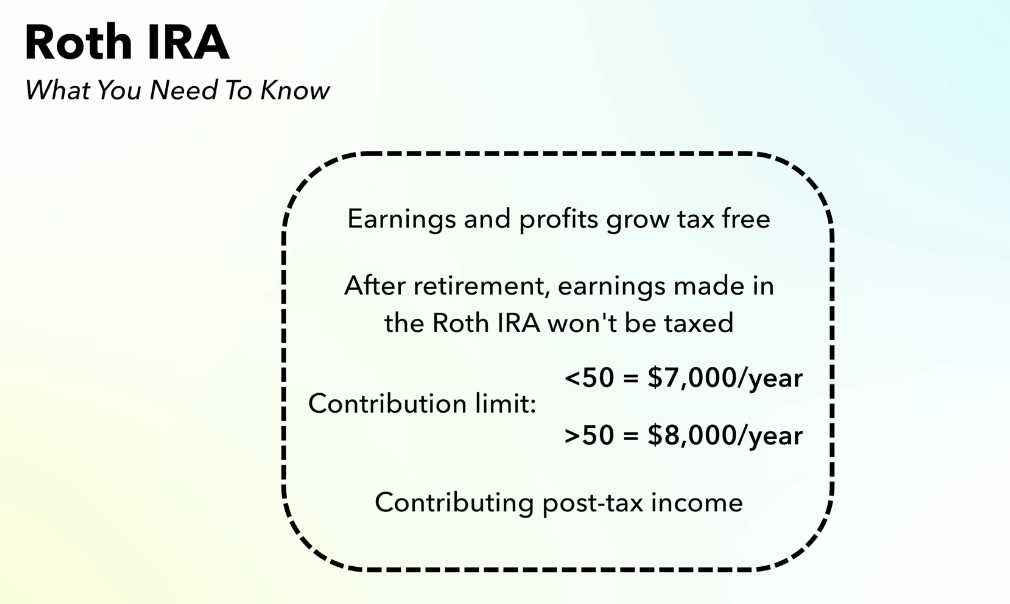

Step 5: Maximize Investment Contributions With Roth IRA and taxable brokerage account mix

After contributing to your 401(k), the next step is investing the additional money in a Roth IRA. This is a special retirement account where your money grows completely tax-free.

With a Roth IRA, you contribute money that has already been taxed. But when you retire and withdraw the money, including all the investment earnings, it will be totally tax-free income!

This is a big advantage over traditional IRAs and 401(k)s, where you’ll have to pay taxes when you make withdrawals in retirement. But you can contribute less here,

In 2024, you can contribute up to $6,500 per year to a Roth IRA if you’re under age 50 (or $7,500 if over 50) as long as your income qualifies. Now if you have more money available to invest after 401k (10%) and Roth ira, consider buying the same stocks in a regular taxable brokerage account alongside index funds.

Since the Roth provides tax-free growth, it’s great for investing in stocks of large companies you expect to keep growing for decades, like Apple, Google, or Nvidia. The long time horizon allows you to aim for higher potential gains without taxes reducing your profits.

And if you think stocks are too risky do an index fund here as well just like you did with 401k as suggested above.

However, if you want to invest in stocks here is the golden rule to follow:

don’t try to “time the market” Here are two big problems with this strategy:

- It’s impossible to accurately predict market tops and bottoms. Even experts are usually wrong about when markets will rise or fall.

- You have to be right twice – knowing exactly when to sell before a decline, and when to buy back in after the decline. Missing either point means locking in losses.

The better solution is dollar-cost averaging. This means investing the same fixed dollar amount at regular intervals, regardless of whether markets are up or down.

For example, if you invest $200 into Apple stock every month for 5 years, you’ll automatically get more shares when the price is lower and fewer shares when it’s higher. Over time, this lowers your average cost per share without needing to forecast anything.

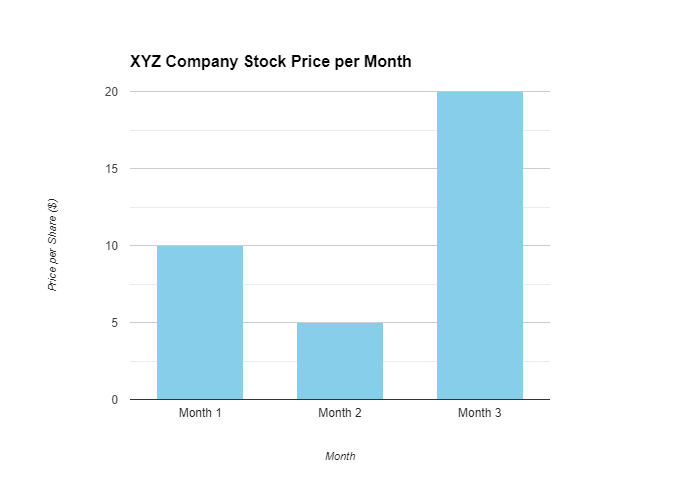

Let’s take another example of volatility

Let’s say you have $300 to invest in XYZ Company stock which is volatile you see potential in it after fundamental assessments and you decide to make to investment for over 3 months: (100$ every month)

- Month 1: Stock is $10, you get 10 shares for 100$.

- Month 2: Stock is $5, you get 20 shares for 100$.

- Month 3: Stock is $20, you get 5 shares for 100$.

So if you just do regular investment and don’t time the market at the end of 3rd month You will have 35 shares for $300, averaging $8.57 per share. Not the cheapest $5 price, but also not the highest $20 price.

And now if you apply the same approach to stocks that actually hold value in the market like Nvidia, Meta, apple, and Amazon you know your money will compound like crazy. Choose the appropriate one. Invest in a monthly basis.

By consistently investing the same amount, you remove the impossible guesswork of predicting highs and lows. Dollar-cost averaging helps reduce risk while keeping you invested through all market conditions.

Now let’s talk about Normal Brokerage account

Investing in stocks is something that we should do in a Roth IRA. although if we have more money available to invest it’s better to put it in a normal brokerage acc. than your savings account.

In a brokerage account, there are no exceptional tax benefits like the Roth and the 401k matching. but there is a way we can actually save our taxes and that is by paying long-term capital gain instead of short-term capital gain.

Let me explain,

When you invest in stocks or bonds through a regular taxable brokerage account, any gains you make will be subject to taxes. The amount of tax depends on how long you hold the investment.

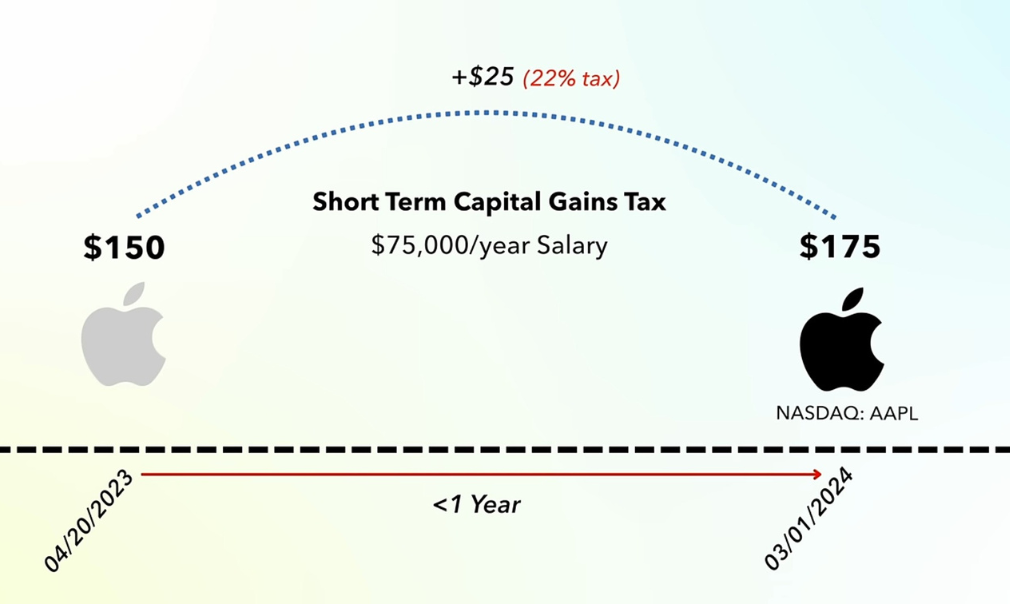

For example, let’s say you bought one share of Apple stock on April 20th, 2023 for $150. If you sell that share before April 21st, 2024 (before 1 year) for $175 (making a $25 gain), Now that 25$ qualifies for short-term capital gains taxes.

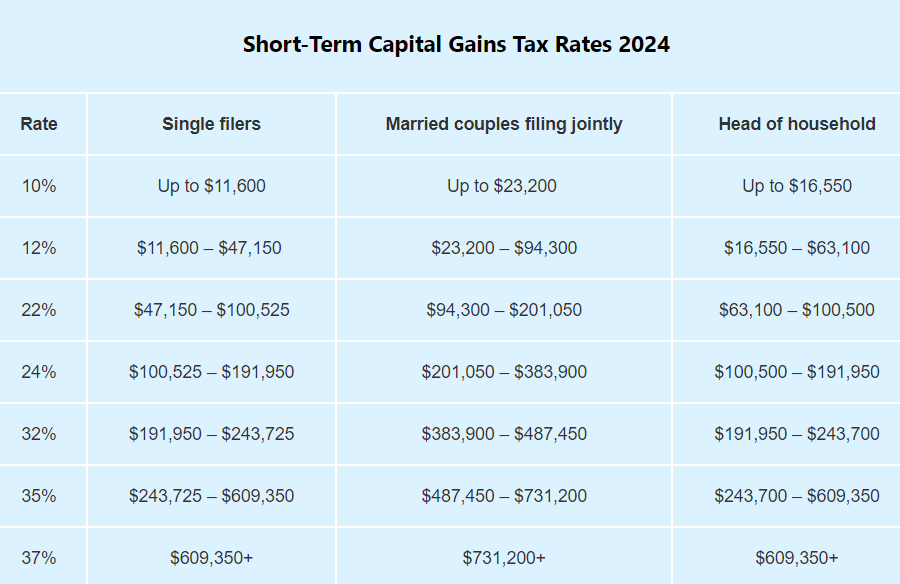

Short-term gains are taxed like regular income. So for example, if you make $75,000 per year, and you invest in Apple stock and hold it for less than a year, you’d pay 22% tax on that $25 gain since your “overall income along with that gain” falls in the 22% income tax bracket. (see tax rate below) and you pay taxes on your GAINS.

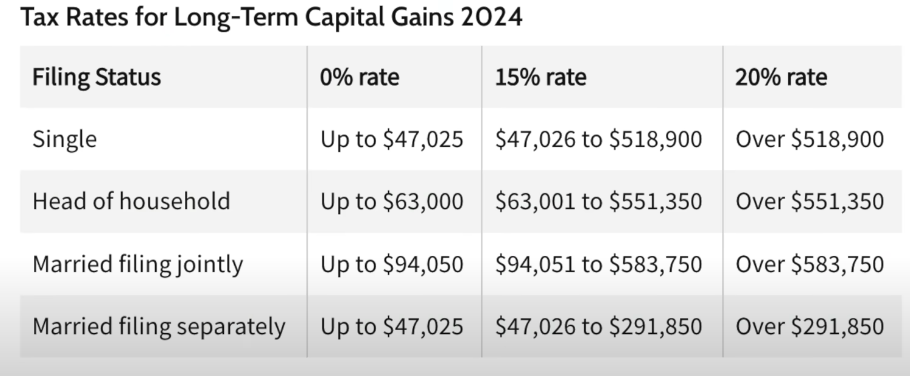

In another case, if you held the Apple stock for over a year before selling, it would instead get taxed as the long-term capital gains rates. At the same income of 75000$, it’s 15% of 25$ instead of 22%.

- For most people making overall under $47,500, the long-term gains are taxed at 0%.

- For overall income between $47,500 – $525,800, long-term gains are taxed at 15%.

So by holding investments over a year before selling, you can significantly reduce taxes on your profits.

It’s important to understand these tax implications when buying and selling stocks in a normal brokerage account. Minimizing taxes by holding long-term can make a big difference in your overall investment returns at the end of each year.

Happy tax saving😎😎

Step 6: Automate Your Finances

Automating your money can save you time and stress. It helps avoid “decision fatigue” – when the quality of your choices gets worse after making too many in a row.

In the past, managing money meant manually paying bills, transferring funds to savings, and investing. But now, you can set up your accounts to handle these tasks automatically.

Here’s how:

- Have your paycheck directly deposited into your main checking account.

- Set up automatic transfers to move money from checking into two other accounts – one for spending and one for saving.

- Your spending account covers monthly bills and essential costs like groceries and gas. Set a budget for extras like dining out.

- At month’s end, Set a reminder and do a wire transfer of any extra money from spending to savings.

- Use your savings account for important goals like building an emergency fund, investing, or saving for big purchases.

- You can even set up transfers from savings to specific goal accounts, like moving $500/month to your emergency fund until you have made 6month of your income saved in it

So if you’re working on Step 3 of building a 3-6 month emergency fund, you’d have your paycheck deposited to checking, then some automatically sent to savings, then $500 from savings to a separate high-yield account reserved for emergencies.

Over time, your emergency fund will fill up automatically, without you having to think about it.

The same idea works for investing – set a percentage of your pay to transfer to a brokerage account or a Roth ira account each month.

Your 401k gets contributed through salary deferral, which means your payroll department sends money to your account. And your plan administrator will ensure you get contributed as per you asked for. (my suggestion at least invest up to 100% employer match percentage to get the full benefit of this 401k account.)

Managing your money doesn’t have to be a constant chore. By setting up a system to automate your cash flow, you can focus your time and energy on other priorities, while making steady progress toward your financial goals.

Final Thoughts

There you have it – your roadmap to managing that paycheck. From tracking expenses to automating your investments, each step builds on the last. Remember, it’s not about perfection, but progress. Start with your financial baseline, then tackle each step at your own pace.

Still feeling overwhelmed? Just pick one thing – maybe setting up that emergency fund or bumping up your 401(k) contribution. Small actions add up over time, just like compound interest. So take that first step today, and i will see you in the next one…!