Books are really someone’s lifetime experience that you can carry in your hand. Reading books is simply a shortcut to learning, Not many of us are fond of reading.

But surely many of us look for the shortest way to learn things I do it, and Books my friend are the fastest way to consume knowledge.

So for that reason, I have prepared a list of my favorite Personal Finance Books, this list also includes my next read books – it’s a curated journey through the books that transformed my understanding of money and wealth. And I’m sure it will definitely help you as well.

But here’s the thing: I’m not asking you to read all of them (although you certainly can!). Instead, I want you to find the one that speaks to your current situation. Whether you’re a young professional just starting out, or someone looking to optimize their investments.

Let’s get into it-

Book 1: “The Almanack of Naval Ravikant”

“The Almanack of Naval Ravikant” by Eric Jorgensen is a super amazing book that shows how to optimize our lives for wealth rather than just money. Naval Ravikant, makes a clear distinction between the two concepts.

The Traditional Office Worker: Naval uses the example of a traditional office worker to illustrate the difference between making money and generating wealth. Workers can make money by renting out their time, but their earning potential is linear because their inputs are closely tied to their outputs. For example, eight hours of work equals eight hours of earnings.(time = money)

Generating Wealth Through Leverage: To generate wealth, Naval suggests applying leverage, which is a force multiplier that creates a disconnect between inputs and outputs, by disconnecting the output. means you provide more value than the time you put it. eight hours of work equals 48 hours of earnings. (money> time) that is the power of leveraging.

He discusses three ways to apply leverage:

- Capital Leverage: Having access to money, whether it be from an investor, generational wealth, or a magic lamp.

- Labor Leverage: Having people work for you to achieve your objectives.

- Building a Product with No Marginal Cost of Replication: Creating something that can be produced once, and its impact can compound over time with zero additional cost to make it again. For Example code and media, such as a software product or a YouTube video, or a blog you are reading right now.

Taking the First Step: The author in this book also emphasizes that taking the first step is the only thing needed to get started. Although many of us are confused about what that should be. The answer to that in one word is by offering value to people who can pay for it.

Self-promotion: Keeping this “VALUE concept” in mind. I have collected and written this blog on side hustles…. which took me more than 2 weeks to write it covers various business models that Offer great value to people over time.

All in all “The Almanack of Naval Ravikant” teaches valuable lessons about generating wealth through leverage. By taking small steps and building momentum, one can transform their life and optimize it for wealth and happiness.

Book 2: “The Millionaire Next Door”

“The Millionaire Next Door” by Dr. Thomas Stanley is a highly recommended personal finance book that is based on a survey of thousands of actual millionaires in America. So it’s not actually written on thoughts but on actual reality. The book aims to uncover the true profile of millionaires, which often differs from the stereotypes portrayed in media and social media.

When I read it, this is the 1Key Lesson I learned:

Valuing Financial Independence Over High Status One of the most significant lessons from the book is how real millionaires prioritize financial independence over the appearance of high status.

The millionaires that were surveyed for Dr. Stanley’s book prioritize being financially independent rather than merely looking rich. They achieve this by living below their means and Properly planning their financial future. As a result, they enjoy the freedom that comes with financial independence, even if their income drops or their business experiences a bad year.

Lesson no.2- The Illusion of Wealth: With easy access to credit, anyone can create the illusion of wealth by purchasing expensive clothes, leasing the latest sports car, or getting a huge mortgage on a mansion they can’t afford. However, this lifestyle leaves them just one step away from financial catastrophe, without the peace of mind that comes with true financial independence.

living below one’s means to achieve genuine financial independence is the key lesson of this book. Not cutting down convenience is alright, But By avoiding the trap of hyper-consumption that many people struggle with, these millionaires journal their expenses (books no. 6 mentioned below help with that) and every cost to secure their financial future and enjoy the peace of mind that comes with it.

And there are many more lessons that talk about their habits as well in the book, all I can tell it’s a must-read.

Book 3: The Index Card: Why Personal Finance Doesn’t Have to Be Complicated

The Index Card by Helaine Olen and Harold Pollack is a book whose main aim is to tell people that finance is not something you overcomplicate like your maths paper.

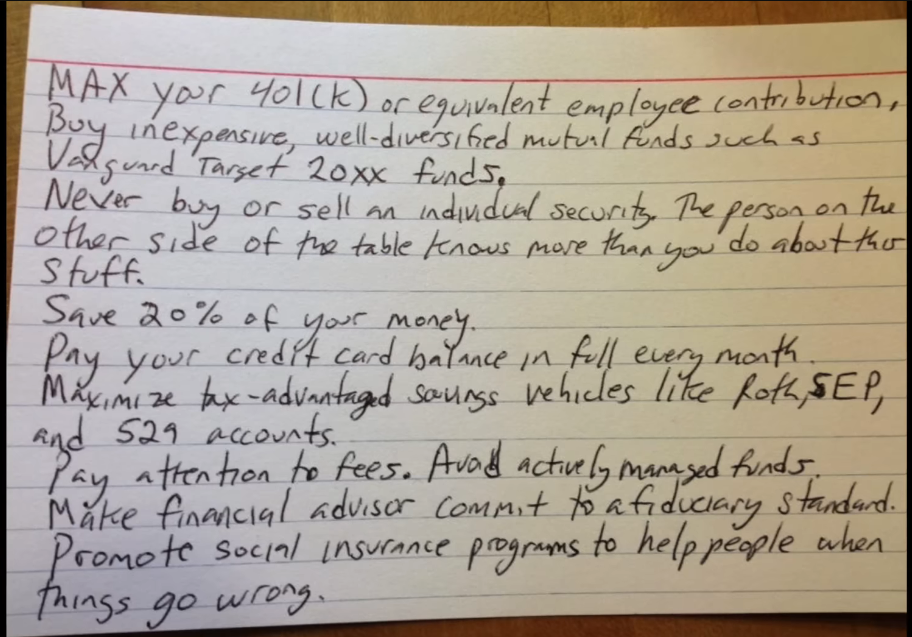

Key Idea of the book: Despite the financial industry’s efforts to convince people that personal finance is extremely complicated, the authors argue that managing money can be simple. They claim that the essential rules of personal finance can fit on a single 4×6 index card.

Background: During an interview, Harold Pollack, a University of Chicago professor, suggested to Helaine Olen, a financial journalist and author of “Pound Foolish,” that everything one needs to know about managing money could fit on an index card. To demonstrate this, Pollack wrote down a list of rules on a card and shared it online.

The Book’s Purpose: In “The Index Card,” Olen and Pollack explain why the 10 simple rules on the index card can outperform the complex financial strategies promoted by the financial industry. They emphasize that simplicity often requires work and insight to achieve.

Personal Takeaway: “The Index Card” helps readers cut through the noise and understand the most important money lessons. The rest of them are add-ons. I highly Recommend This For someone who feels finance is complicated or those who are in jobs pls read this concise and easy-to-read book.

Book 4: So Good They Can’t Ignore You

The main Argument by Mr. Cal Newport is that he challenges the popular advice of “following your passion” in his book “So Good They Can’t Ignore You.” Instead, he suggests that people should focus on developing valuable skills and learning to love what they do, instead of doing what they love!

The Problem with “Follow Your Passion” Advice: Many get-rich-quick videos and articles encourage people to follow their passion, But passion is not good if it doesn’t make you money it’s a hobby and the only way to make money is by proving value. And then loving the process of creating value is the core principle of this book. he calls it,

The Craftsman Mindset: Mr. Newport advocates for adopting the “Craftsman mindset” as an alternative to following one’s passion. This mindset emphasizes focusing on the value you can offer to the world rather than what the world can offer you.

When individuals focus only on what they can gain from the world, they are likely to face more setbacks and miss out on valuable opportunities. There is so much explanation of this context in the book.

Now before you pour your time into a valuable skill. I highly recommend this book to develop a mindset of giving, anyone can benefit from the thought of this book, but young ones watch out it’s especially for you.

Book 5: The Psychology of Money

Yes the world famous and when you read it you get to know the “out-of-the-box” concept the author has shared

Key Idea: Success with money is not just about knowledge; it’s more about behavior. Even intelligent people can struggle with managing their finances because behavior is difficult to teach.

Book’s Content: “The Psychology of Money” explores the psychological factors behind financial decisions and offers insights on how to better manage emotions related to money. The book contains 19 short stories that delve into the unusual ways people think about money and guide them in making better sense of life’s most important financial topics.

The misconception it clears: Personal finance and investing are often taught as analytical, math-based subjects. People believe that with the right data and formulas, they can unlock the secrets to wealth. “But if you think closely market reacts More to the hype of an event (negative or positive) than that of the actual event day. Think about it.”

I highly recommend this Short-read book to everyone at every stage you will get a fresh perspective on financial decisions and how your emotions affect them.

Book 6: I Will Teach You to Be Rich

Author: Ramit Sethi

Target Audience: The book is aimed at young professionals, the audience for this book is people with medium to high incomes, who want to learn the fundamentals of personal finance.

Although I have not read it as of now, But hey I have ordered it and as soon as it reaches me I will give it a read. hearing a lot of good things in reviews I couldn’t stop myself from recommending this one.

Key Topics:

- Banking

- Saving

- Budgeting

- Investing

Unique Perspective of the book that I’m aware as of now: Sethi’s philosophy differs from many other personal finance gurus. He advocates for controversial behaviors, such as allowing yourself to buy as many lattes as you want, while still providing sound advice on growing your net worth.

Strategies Covered:

- Eliminating student loans and debt

- Creating a spending plan

- Preparing for major purchases like a wedding or a house

It’s a complete beginner guide kind of book that young ones should definitely read it’s like a roadmap! the one book that you can give to a complete beginner, alongside the psychology of money.

Investing Advice in the book that people love: Sethi dedicates an entire chapter to what he calls the “pyramid of investing.” This approach allows readers to choose their level of involvement in investing based on their preferences. He reviews the basics of various investment options, including:

- Target date funds

- Index funds

- Mutual funds

- Single stocks

I’m excited to read this one you should consider this one if you are new to finance.

Book 7: The Simple Path to Wealth

This book by JL Collins is a summary of a man’s life who wants to share the financial knowledge he has gained throughout his adult life. From his learnings, he believed that money is the most powerful tool for easy navigation in this complex world.

The man himself is the author Mr. JL Collins. it’s one of the most beautiful books on money, i had a great time reading it because of the fact it came from the direct experience of a person’s “lifetime”. like we seek advice from our elders who we believe are wiser and have more life experience than us.

This book is a collection of experiences by JL Collins. He emphasizes that Having fewer choices to choose from in Finance is the easiest and the Safest way to actually make money.

Choosing less is more (and how to choose that “less”) is the one sentence that defines this book and the author came to this through a beautiful incident

When Collins tried to discuss money with his daughter, she expressed

This reluctance to spend her life thinking about it constantly. prompted him to simplify the money lessons as much as possible, resulting in the creation of this book.

Thankful to this book I have shortened my portfolio of investments from multiple mutual funds to a few of them and earnings are great because of the fundamental thought of long term and relying on the strong fundamentals of the companies. and it feels good to be more organized with finance.

The basic concept covered in the book

Minimize debt: Reduce or avoid debt to free up resources for savings and investments. Low debt levels contribute to a healthier financial life.

Adopt a long-term perspective: Focus on the long-term power of compounding. Consistent investments over decades can significantly grow your wealth.

Invest in low-cost index funds: Build a diversified portfolio with low-cost index funds to achieve strong long-term returns and mitigate market fluctuations.

For sure these are concepts that you might feel overlap with books like I Will Teach You How to Be Rich or The Index Card or even some with the psychology of money.

but there is a unique angle to the financial world each Book gives you. I’m not saying you should buy everyone mentioned in this blog. Read the above-given overview of the book decide which one aligns with your life the most. Choose that one, read and then Move forward to other books!

I mean that’s what I did and now I have given you a list of books that I believe are the best for financial knowledge gains.

Now before I go here is an extra one for you— my favorite one that teaches you about the market like no other,

Book + 1: A Random Walk Down Wall Street: The Time-Tested Strategy for Successful Investing

Author: Burton G. Malkiel

“A Random Walk Down Wall Street” was first published in 1973, and updated editions have been released every few years since then.

So a quick overview on author Burton Malkiel.

he is a renowned Princeton economist, best known for his work on the efficient market hypothesis. This theory suggests that a company’s share price reflects its current worth, and the price will change when new information alters the business’s value.

It’s a One-Stop Advance knowledge Resource “A Random Walk Down Wall Street” serves as a comprehensive complete resource for understanding the stock market, Wall Street, and the business of investing. It offers a wealth of knowledge for those seeking to gain a better grasp of these topics. Although I would recommend other books over this one for beginners.

Comprehensive Coverage:

The book provides an in-depth exploration of all major investment vehicles, including:

– Stocks

– Bonds

– Real estate investments

– Tangible assets

Historical Context Coverage is also the part of this book,

The book provides valuable historical context for the stock market and explains how the financial industry has evolved to its current state.

I want to also mention that:

While highly informative, the book is not an easy read. It is thick and dense, diving deep into the subject matter. However, for those serious about gaining a thorough understanding of the stock market and investing, this book is a must-have. More on the advance side of the financial know-how!