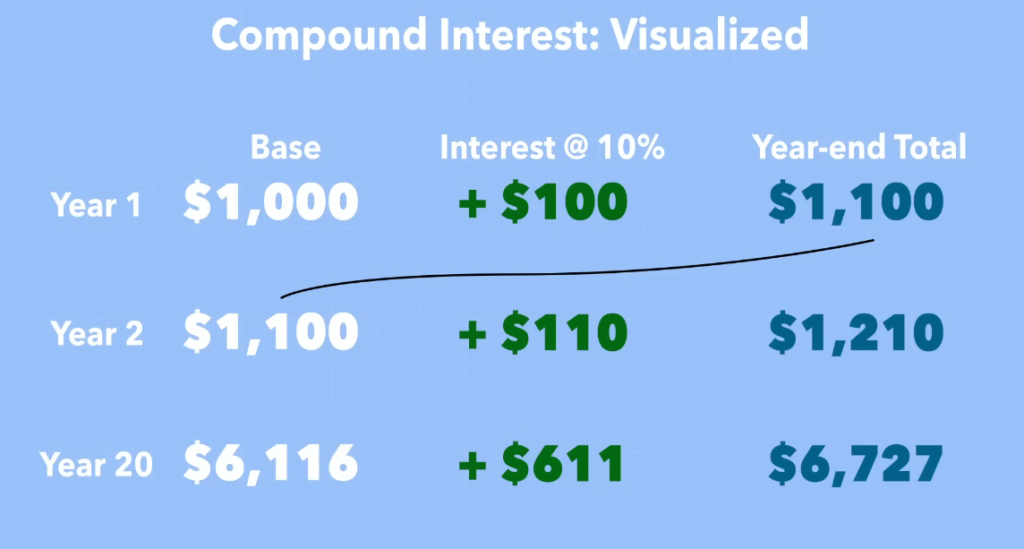

As this is a beginner’s guide, let me quickly address why you need to invest. There are two key reasons:

- Compound interest: Let your money work for you.

- Inflation protection: Ensure your money doesn’t lose its principal value.

Investing in the stock market might seem scary if you’re new to it. You’ve probably heard fancy negative words about how it’s risky and you could lose money. Well, it’s not as complex as people make it out to be! I’ll explain what investing really is (and isn’t) in simple terms.

Throughout this guide on how to invest in stocks for beginners, we’ll cover everything from the basics of stocks to more advanced strategies like creating a diversified portfolio.

By the end of this guide, you’ll understand:

- Why investing is crucial for long-term financial growth

- The fundamentals of how the stock market works

- Different types of investments, with a focus on index funds

- Practical strategies like dollar-cost averaging

- The importance of a long-term perspective in investing

So, let’s set aside the intimidating stereotypes of Wall Street and With this guide Principles dive into the Actual maths of investing.

Investing: What It Is and Isn’t

Investing in the stock market seems scary if you’re new to it. You might have heard fancy negative words that it’s risky and you could lose money. Well, it’s not as complex as people tell you it is!, I’ll explain what investing really is and isn’t.

So, Investing is NOT a way to get rich quickly. It’s a safe and smart method to grow your money over time, not an overnight path to millions. Stories of people making a fortune from investing can be misleading.

Investing helps prevent losing your money’s value due to inflation. Just as I told you in the introduction itself. Inflation decreases what your money can buy each year.

Investing in stocks is one of the best ways to outpace inflation and protect your money’s value over the long run. While there are no guarantees like return on F.D., stocks have historically provided returns above inflation rates, and I’m sure they will keep doing that when held for long periods. Now it doesn’t mean you can invest in anything and holding for a longer period means more gains NO.

The next step is to know the market. You need to understand how it works to determine which company you can invest your money in that will grow it and not decrease its value over a period of time.

In simple words determining which company stock will continue to grow and which one will fall?

What is a Stock and Shares?

Let’s go through This example which I learned earlier: The Lemonade Stand, by the end of this ex, you will get all the nuances cleared!

The easiest way to understand how the stock market actually works is with lemons. Let’s say you own a lemonade stand in your neighborhood called “Super Lemon Drink.” It’s doing really well because your secret recipe is using limes instead of lemons just saying. You’re confident that you can grow your Super Lemon Drink business, but you just need more money to expand.

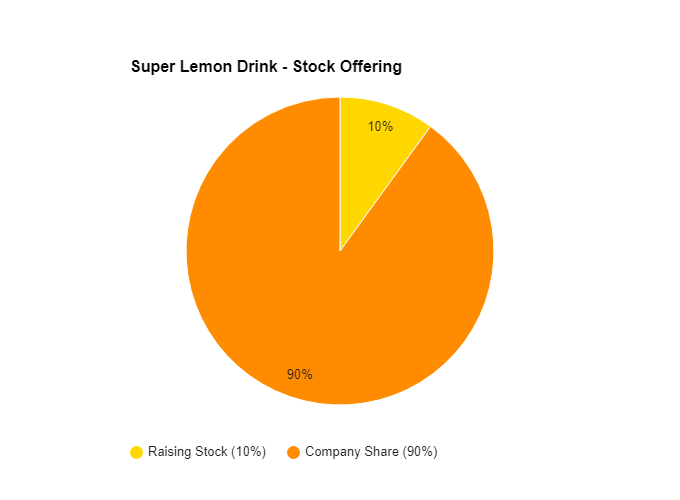

So you decided to raise money by selling Stocks of your company ie, The Ownership of super lemon drink. Now let’s look at how Selling Stocks work.

Process of Selling Stocks to Investors If Lemon Drink wants to raise from the stock market

Super Lemon drink company wanted to raise money so it decided to give 10% ownership of this company to investors in exchange for money

In this case. A company has to legally go through a lot of regulatory work to get approval from the government and stock regulations.

When approved a company gets listed in the stock exchange market ie, they get permission To raise money by issuing stock. Stock is a more general financial term, used to refer to the financial instruments a company issues that represent a certain percentage of the total ownership of the company which is further divided into shares.

shares are portions of a stock offered by the company. In the case of the super lemon drink Company, Whatever amount of shares issued under that stock is = 10% of the super lemon drink company.

And those shares in the stock are what you actually buy which means you buy Shares of Super Lemon Drink companies “Stock”.

You could buy all the shares in the stock or 1 it is being offered to the market to decide Whether to put their money in or not!

A glamor question: What if people don’t buy out all the shares of the offered stock by the company?

Generally, the listed companies are Reputed Enough to have obvious businesses and are allowed to raise money through public offering they had all the requirements met when they applied for listing.

but it happens that all of the issued shares are not sold. In those cases to save the share price from falling often the company bought these back from the market and these shares are called treasury stock. and the ones that are already bought by people in the market are called outstanding stock.

Although explained above is all you want to learn as of now if you need more about the differences I recommend you read this article on stocks vs shares.

(you don’t need to go this in-depth as of now, but Still, I guess we have to answer the glamor as well)

How the Market works!

So, now you are aware of how companies offer their shares to various investors in exchange for money through stock market listing. Once they are listed what happens next?

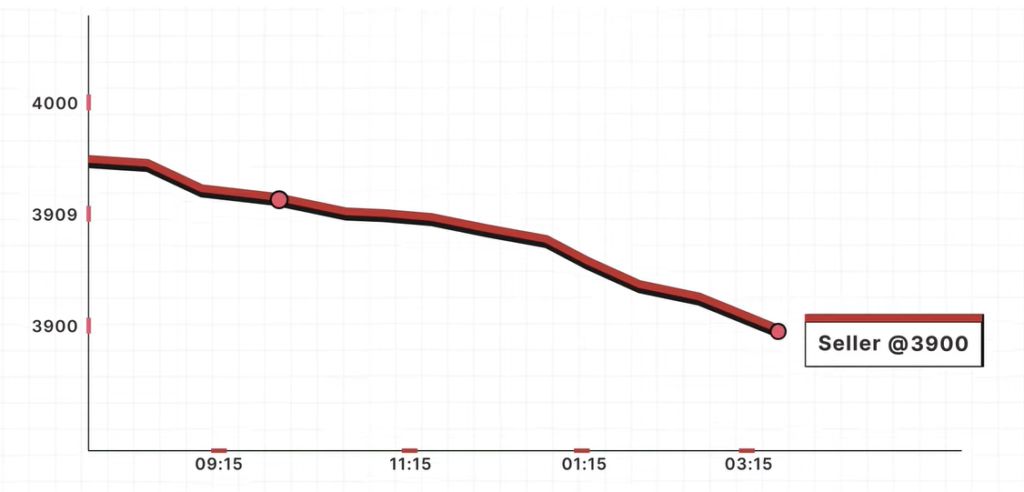

Whether the stock price will go up or it will go down. What makes the prices fluctuate? we will look into each case. Let’s start with,

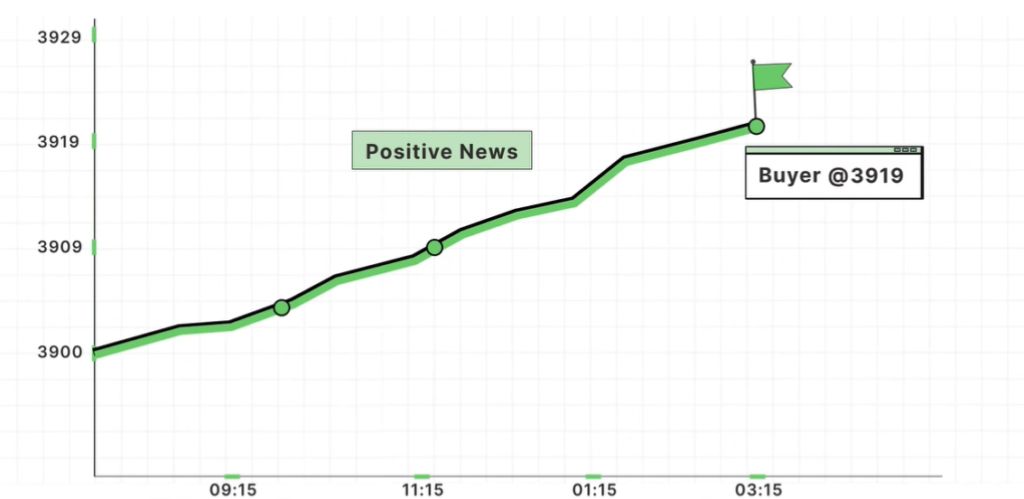

How Stock Prices Increase

So moving away from Listing, Next is how does a stock’s price increase? Let’s say your lemonade business is doing really well. People are hyped about it, and strangers want to buy its stock because they believe it’s a great business opportunity,

So the strangers will go up to your shareholders (who already own shares of your business), and the strangers will offer to buy their shares from them. A share price increase comes down to demand, and demand comes from good business models, or booming sectors like technology and chipsets in our current era.

Since now there’s a high demand for Super Lemon Drink shares, your previous investors can ask strangers for more money than what they originally paid for the shares. So although the previous ones bought each share at $10, these strangers said that they were willing to pay $25 for a share. And now Mr. Johnny(previous investor) has the option to sell each share for $25. Which is 15$ profit for him…… but

Realized vs. Unrealized Gains

Realized gain: If he does sell, his $15 gain becomes realized or real because he gets cash in exchange for his shares – a $150 gain, not bad!

Unrealized gain: If he doesn’t sell, he has $15 in unrealized gains, meaning he hypothetically gained $15 in wealth because someone is willing to buy the shares at $25. But the $15 gain is not considered real yet until the transaction actually happens.

But why wouldn’t he sell? Well, you need to know there is one benefit of not selling the share-

Dividends

Let’s say Super Lemon Drink is making a ton of profits, and you (the main owner) want to reward your friends (the shareholders) for believing in the company.

So you take some of the profits that you made, and you give them to your shareholders in proportion to how many shares they own. You get paid more dividends if you hold more shares, And this money gift is called a dividend. The more the company earns so you will too! Depending on the amount of share you hold of course!

How Stock Prices Decrease

Now, let’s flip the script. Imagine your Super Lemon Drink business hits a rough patch. Maybe a health inspector found out about your secret lime recipe, or perhaps a global lemon shortage is making headlines. Suddenly, your business doesn’t look as sweet to investors.

In the real world, stock prices can fall for various reasons:

- Company-specific issues: Like our lemonade stand’s recipe problem, a company might face scandals, poor financial results, or leadership changes.

- Economic factors: Just as a lemon shortage would affect our business, broader economic issues like inflation or recession fears can drive stock prices down.

- Global events: Think of these as the “lemon apocalypse” scenarios. Wars, pandemics (remember the COVID-19 crash of 2020?), or major political shifts can cause widespread market panic.

- Industry trends: If a new health study claimed lemonade was bad for you, all lemonade stocks might suffer. Similarly, changing technologies or regulations can impact entire industries.

When these things happen, New investors might say, “I’m not willing to pay $25 for a share anymore. How about $15?” If most people think this way, shareholders who want to sell might have to lower their asking price, sometimes even below what they originally paid.

If Johnny sells his shares at $8 each, he’ll have a realized loss of $2 per share. Ouch! But if he holds on, Believing in Super Lemon Drinks strong business fundamentals that the price will recover, In this case, he has an unrealized loss – the value is down on paper, but he hasn’t actually lost cash yet.

Remember, stock prices can drop just as fast as they rise, often based on how Investors perceive the company’s future or react to world events. That’s the reason investment should be done wisely and within your risk tolerance!

Two Types of Stock Investments and Which one to buy

1. Individual Stocks:

An individual stock represents ownership in a single company. It’s owning stock of a single company for ex-Apple Inc.

Although Buying just one stock is very risky. Let’s say you invest $1,000 into Company A’s stock. If that stock drops 25% from $1,000 to $750, your whole $1,000 investment just lost $250!

To reduce risk, you Should diversify by buying smaller amounts of multiple stocks. Instead of one $1,000 stock, you could buy 10 stocks at $100 each. Now if one stock drops 25%, you only lose 2.5% overall. And let’s say 2 more also lose, at least it’s not going to drop 25% like before. market investment is all about managing risk

The downside to this process is researching and investing in 10 different company stocks. (that will continue to grow your money) it’s a lot of work for a beginner.

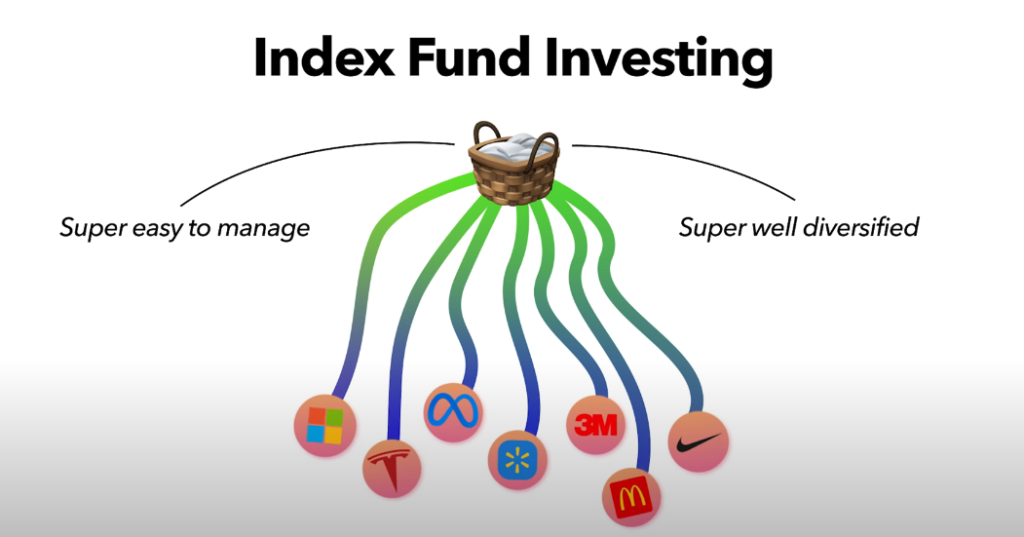

So, What we are left with is to invest in already distributed investments called funds.

2. Investment Funds:

Investment funds are a great option, especially for beginners. A fund is like a jar of assorted M&Ms. Each candy represents a single stock, but the jar contains many different stocks. so a fund is a portfolio of different valuable stocks.

By buying one fund, you automatically get exposure to all those different company stocks inside. This provides instant diversification in one easy purchase.

Rather than risking it all on one company, funds reduce your risk by spreading your money across many companies at once. This makes funds much less volatile.

But Not every fund out there is the best choice, there are plenty of options available and I’m going to tell you what exactly you need to invest in just keep reading……to our next point fund investment types,

3 Types of Fund Investments

There are three main kinds of investment funds you can buy and why you need the 3rd one let’s look at it in more detail:

- Mutual Funds A mutual fund has an actual person called a fund manager who actively picks which stocks and investments to include in the fund. Since it’s being actively managed, mutual funds charge higher fees. Many mutual funds also have minimum investment amounts you need to meet before buying in. Mutual funds only trade once per day after the market closes at 4pm ET.

- Exchange-Traded Funds (ETFs) ETFs are mostly passively managed, meaning there’s no fund manager actively picking the investments. Instead of active management, ETF fees are generally lower. They also tend to have lower minimum investments required. Unlike mutual funds that only trade once per day, ETFs can be bought and sold whenever the market is open.

Now moving to the best one,

- Index Funds Index funds are my personal favorite and they should be your too. They are passively managed funds that simply invest in whatever basket of stocks an associated index tracks. For example, the NASDAQ-100 index tracks the performance of the 100 largest technology companies.

And as I said earlier we need to diversify our investment there isn’t a better way than investing in the top 100 companies of the technology sector. Or the S&P 500 which includes the United States top 500 companies.

Compared to higher-cost mutual funds, index funds provide an easy, low-cost way to get diversified through passively owning a whole basket of stocks in one fund purchase.

REMINDER: After a quick overview I hope you got the answer to What to Invest in?, the next question Should be How to Invest in an index fund? Things like how much money to invest, when to invest, and when to withdraw. I e, investment strategy for beginners. So Next we will be learning A to Z of index funds with investment strategy. I want you to learn everything about index funds, and just after that, we will discuss the Best investment strategy (for individual stocks) if you just don’t just want to invest in index funds!!

A Complete Class You Need on Index Fund

Index funds are so important and even Mr. Warren Buffet recommends it.

so I have decided to pack all the details in this section relating to what it is, why it should be the starting point, and the best strategy of investment for index funds

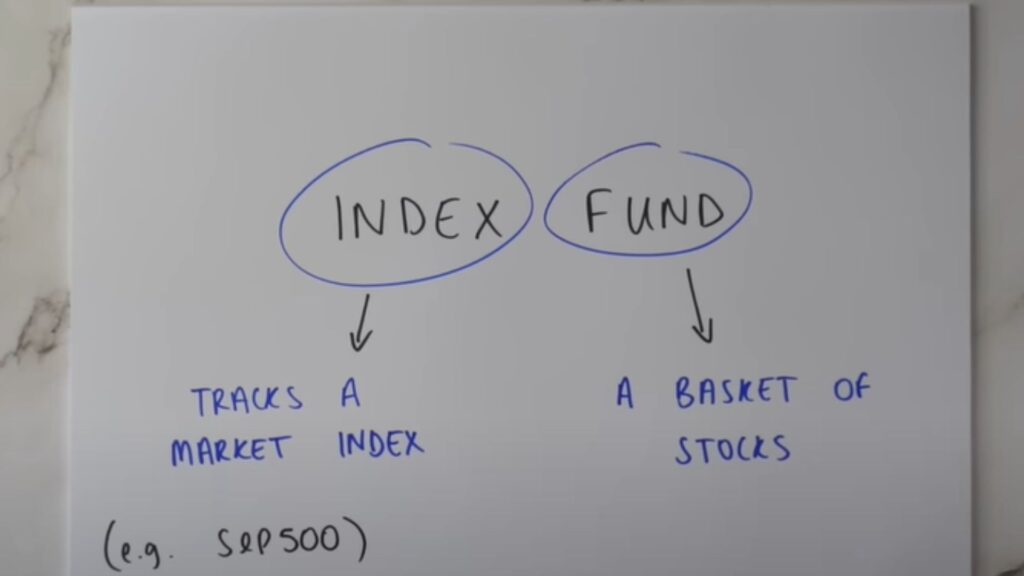

How Index Funds Work

An index fund is a financial holding that gives you access to everything it invests in, like a basket of stocks. A typical fund contains hundreds or thousands of stocks and aims to track an entire market index like the S&P 500 (top 500 U.S. companies) or NASDAQ.

Think of it like old video game cartridges that had 100 games – by buying the cartridge (index fund), you get access to all the games (stocks) for one price.

For example, the S&P 500 index fund holds companies like Apple (6.27% weighting at the time I took this screenshot), Microsoft, Amazon, Nvidia, And many more up to 500 top companies in the United States so, Your money is split proportionally across all 500 stocks based on their market weightings.

The Simplicity of Index Investing

Rather than researching individual stocks, you get automatic diversification across an entire index by purchasing shares of a single index fund. No need to pick stocks – the fund handles that by following the index composition. Or you can see the portfolio% in the above image.

This hassle-free approach at a low cost, definitely makes them the best choice for beginners to advanced… IMO.

The Key Advantages of Index Funds With example-

One of the main advantages is you get diversification. This is the third time I mentioned it I know but this time I want to give you an example of this-

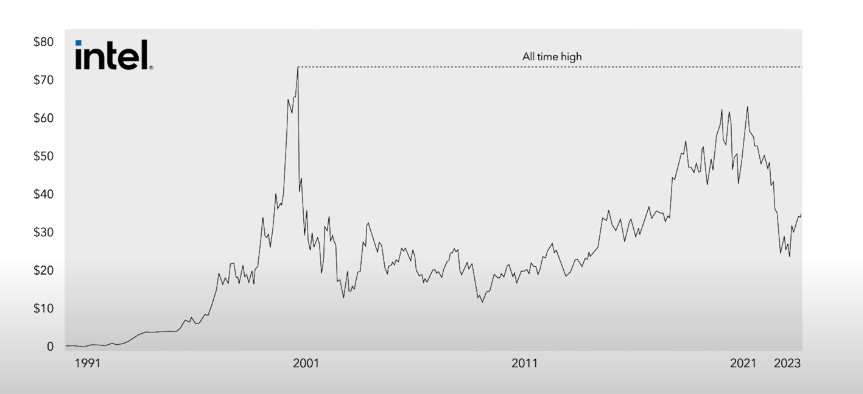

Consider the tech company Intel – they were once an amazing stock back in the .com days, but if you had chosen this stock back then, you can see by the chart that to this day you would still not have broken through its all-time highs back in 2000.

Compare that to the overall performance of the stock market since 2000, which has at least 4xed since then.

This is the danger of picking individual names when you know nothing about individual stocks. Sure, there is more reward involved, but there is also a ton of risk, and that’s a strategy that we don’t want to do as a beginner.

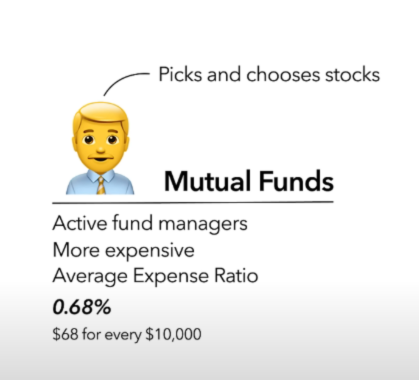

2. Index fund is a passive investing strategy that usually outperforms active managers over time. The key distinction here of index funds versus mutual funds is that index funds are passively managed and mutual funds have something called an active fund manager. The fund manager within that fund is trying to pick and choose individual stocks to try to outperform the market.

But as a result, because the mutual funds have this type of manager, it’s going to be a lot more expensive to own. So what typically happens is that you start to pay higher fees to try to actively beat the market with a mutual fund manager. But oftentimes that doesn’t actually happen.

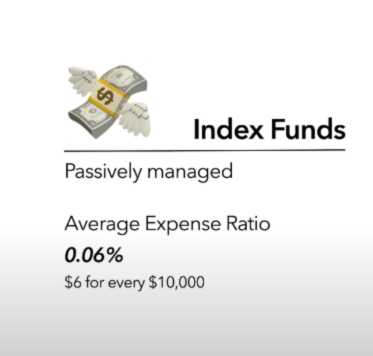

3. They have super low management fees. The average expense ratio, or yearly fee, of an index fund is around 0.06% on average. So that means six dollars of a fee for every 10,000 dollars you have invested – that’s a pretty negligible fee that won’t eat into your returns.

Now compare that to the average mutual fund expense ratio and it’s actually 0.68% or around 11 times higher than that of an index fund. These particular fees will eat into your return over time, and that’s why as a beginner investor you want to just pick a simple investing strategy with the lowest fees possible.

According to Vanguard, “a 50 basis point or 0.5% difference in fees may not greatly affect performance over the course of a single year. However, the same fee differential compounded over longer periods can make a significant difference in the two funds.”

Now I hope you get the complete picture of why it’s the best fund out there let’s see how to invest in an index fund or simply say, which one to choose?

Examples of Index Funds and the Best Picks

Let me share my top 10 recommended index funds

You’ll notice there are quite a variety of options here. In the image, the underlined ones are the S&P 500 index tends to be a favorite among investors investing communities. The reason is simple – you get well-rounded diversification by owning pieces of the 500 largest U.S. companies.

What could be a better diversification strategy than that, right?

Continuing with the example Every index fund has a unique ticker symbol – think of it as a code name, much like airport codes (JFK for JFK airport). One of the most popular is VFIAX, the Vanguard S&P 500 Index Fund.

When building an index portfolio, some prefer holding just one fund, while others combine two or three funds.

So for beginners, it is recommended to invest in 3 funds but not just any three funds there is a whole strategy you will need to follow to maximize your benefits and we are discussing it right away,

But Above all just remember the most crucial factor is having a plan that allows you to invest consistently over many years. That’s how you’ll build long-term wealth through index funds.

Ok let’s get into it now,

The Simple 3-Fund Portfolio Strategy

Instead of trying to predict which individual stocks will perform well, a smarter approach is to invest in just three broad-based index funds that cover the entire stock and bond market. This strategy is known as the “3-Fund Portfolio.”

The 3-Fund Portfolio provides an easy way to build a well-diversified portfolio with good potential for returns over the long term. It has been popularized by the Bogleheads community of investors who follow the simple investing philosophy of John Bogle, the founder of Vanguard.

To implement the 3-Fund Portfolio, you just need:

- A total U.S. stock market index fund.

- A total international stock market index fund.

- A total bond market index fund.

How you allocate your investment % across these three funds depends on your individual risk tolerance, goals, and investment time horizon. As a general guideline from financial advisors:

- Higher risk tolerance = Higher allocation to stocks

- Lower risk tolerance = Higher allocation to bonds

- Longer time horizon = Can take more risk with stocks

- Shorter time horizon = Need to be more conservative

If you’re unsure about your own risk profile, there are online investor questionnaires that can suggest an appropriate asset allocation for your 3-fund portfolio.

The beauty of this strategy is its incredible simplicity yet comprehensive diversification across thousands of stocks and bonds. According to reports, 80% of active fund managers underperform the market indexes.

With the 3-fund approach, you avoid the downsides of stock picking and simply capture the returns of the overall markets through low-cost index funds.

2 Huge Benefits of the 3-Fund Portfolio

Benefit #1: Broad Market Tracking With the 3-fund strategy, you’re putting your money into most of the stocks and bonds that exist across global markets.

Numerous studies show that simply buying the entire market through index funds allows you to outperform most active fund managers over the long run. Just look at this chart tracking 2008-2016 – the index fund outperformed all the hedge funds shown.

Benefit #2: Ultra-Low Costs

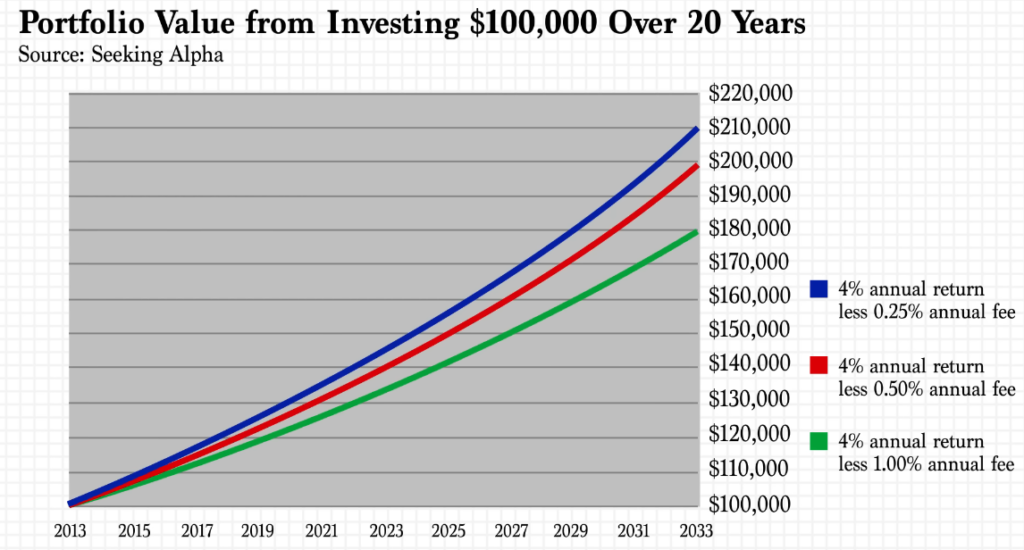

The 3-fund portfolio costs very little in fees and expenses. The average expense ratio for each of the 3 funds is around 0.05% to 0.1% annually. That means on a $10,000 investment, you’d pay just $5-$10 per year in fees.

Fees are critically important as we discussed above as well with the Vanguard quote. Although the SEC illustrates this well –

A 0.25% higher fee will cost you 10,000$ in 20 years- see below

and a 0.75% higher fee could reduce your portfolio value by over $30,000 over 20 years compared to a lower-cost option.

And you are already aware of the other benefits as well.

So By mentioning the advantages, I hope I somehow encourage you to do a 3 fund portfolio. and I want to give you an actual portfolio list to choose these 3 fund types, the most common allocation % split and most importantly a strategy called rebalancing portfolio.

Choosing the Right Index Funds

The core funds you’ll need are:

- A total U.S. stock market fund

- A total international stock market fund

- A total bond market fund

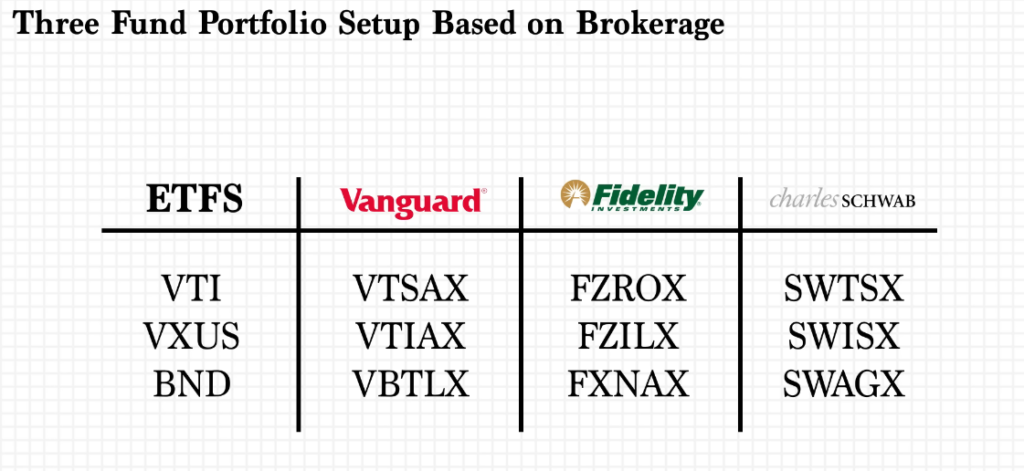

The specific ticker symbols will depend on which brokerage you use – Vanguard, Fidelity, Schwab, etc. For example, at Vanguard you’d invest in VTSAX (U.S. stocks), VTIAX (international stocks), and VBTLX (bonds). I’ll provide the fund names in the below image for major brokers.

Most funds have minimum investments, but you can buy the ETF versions without any minimum. The ETF tickers are VTI, VXUS, and BND. As you can see in the above image

Next, Deciding Your Asset Allocation

Once you’ve picked your three funds, you’ll need to decide your asset allocation – how much to put into stocks vs bonds. This depends on your risk tolerance and time horizon.

The most Common Asset Allocations

The three most common asset allocations for a three-fund portfolio are:

- Aggressive: 80% stocks / 20% bonds

- 64% U.S. stocks

- 16% International stocks

- 20% bonds

- Moderate:

- 33% U.S. stocks

- 33% International stocks

- 33% bonds

- Conservative:

- 20% U.S. stocks

- 6% International stocks

- 80% bonds

You may wonder why not split stocks 50/50 between U.S. and international. The reason is that including international stocks adds complexity like currency factors and less developed markets. You Should prefer overweighting U.S. stocks as they are considered less volatile.

The Long-Term Approach you need with any asset allocation %.

You have to understand that some years will give negative returns – that’s normal with stock investing. Even a balanced portfolio may lose 15-20% in a down market year like 2022.

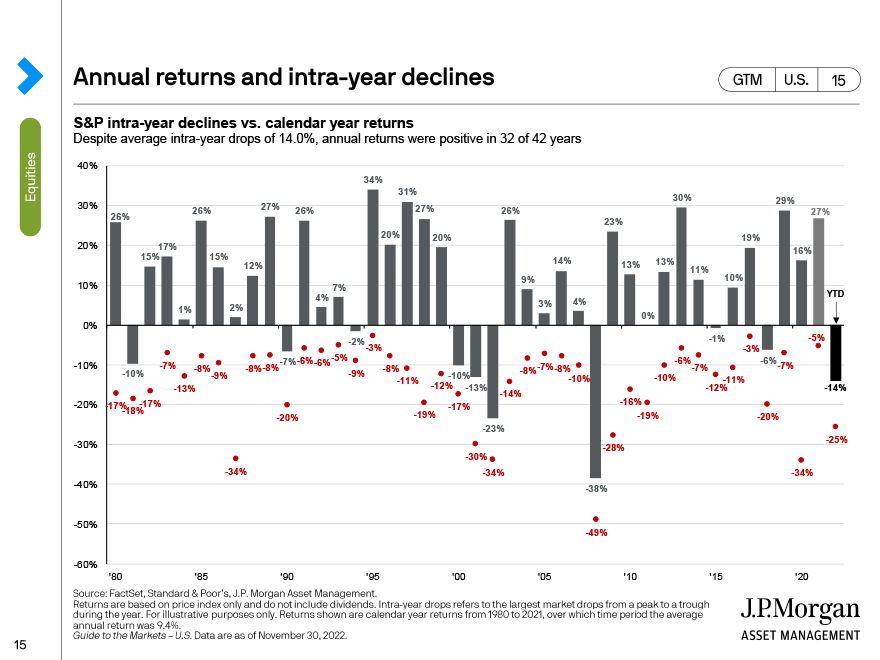

However, stocks have historically provided positive returns in most years and recovered from downturns over longer periods. From 1980-2021, the S&P 500 was positive in 32 out of 42 years.

So while annual losses are uncomfortable, the key is sticking with your strategy for decades, not months. That allows you to fully capitalize on the long-term wealth-building power of a simple, low-cost three-fund portfolio.

Rebalancing Your Portfolio

To the Final Chapter of Index fund. rebalancing portfolio- It’s important to rebalance your three-fund portfolio periodically, ideally once per year. This helps maintain your desired asset allocation as different investments will grow at different rates over time.

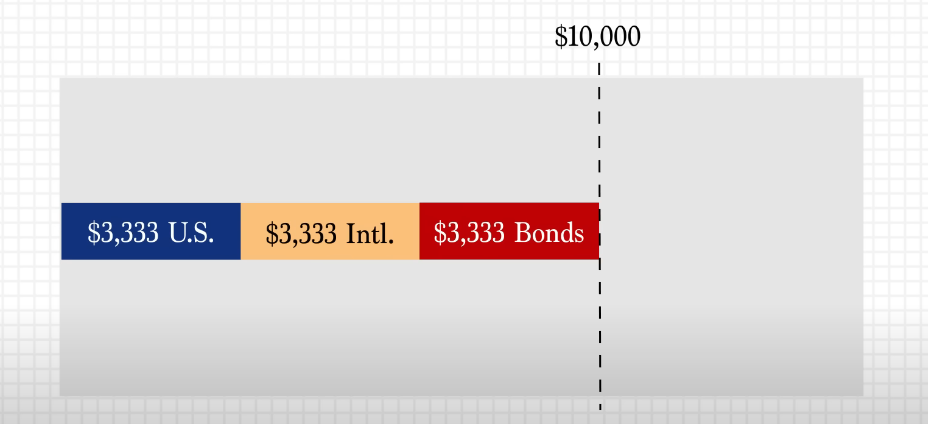

For example, let’s say you start with $10,000 split 33% in each of the three funds ($3,333 in each).

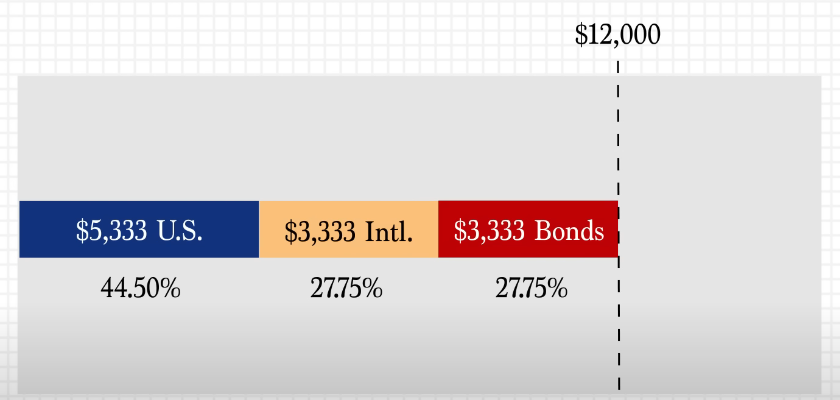

Over the next year, U.S. stocks perform well, growing your overall portfolio to $12,000. But now your U.S. stock allocation is 44.5% instead of the target 33%.

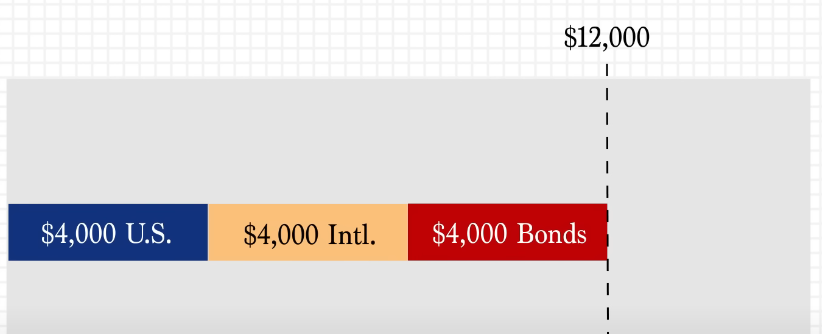

To rebalance, With the new total 12000$, you would have to sell $1,333 from the overweight U.S. stock fund and buy more of the underweight international stock and bond funds. This restores your original 33%/33%/33% target allocation.

So in real life, the percentages will be different so whatever overweight extra money you get either from stock, int stocks, or bonds, sell just that overweight Don’t withdraw from your wallet and now Buy Underweight with the additional money to reach the original target allocation % With the new total. (new total means the combined value of your 3 index fund portfolio)

The rebalancing process simply sells some appreciated assets and uses those profits to buy underweight assets – all within your portfolio. No money is withdrawn.

Regular rebalancing helps control risk by preventing any one asset from becoming too large a part of your portfolio. It’s a crucial part of maintaining a disciplined three-fund strategy over many market cycles.

—————————————————–END TO INDEX FUND GUIDE———————————————

Now it’s time we look at investment strategies you need to follow outside of index funds!!! Let’s say you want to buy a single stock or invest in an undervalued stock.

I know this article is getting long but hey you won’t need a second thought after this:

The Only Investment Strategy beginners should care about

Dollar Cost Averaging: The Effortless Way to Invest

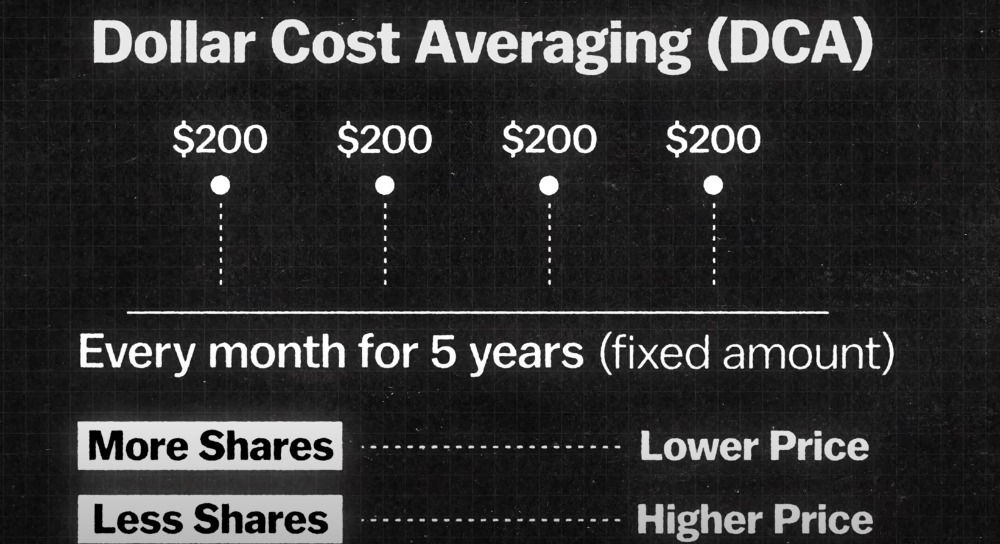

Dollar-cost averaging (DCA) is an investment strategy that makes building wealth simple and emotionless. It may sound technical, but DCA is really just consistently investing a fixed dollar amount at regular intervals.

For example, you could invest $200 into a stock or fund like Microsoft every single month for five years. By investing the same amount each period, you’ll naturally buy more shares when prices are lower and fewer shares when prices are higher. Over time, this minimizes the average cost per share for that investment.

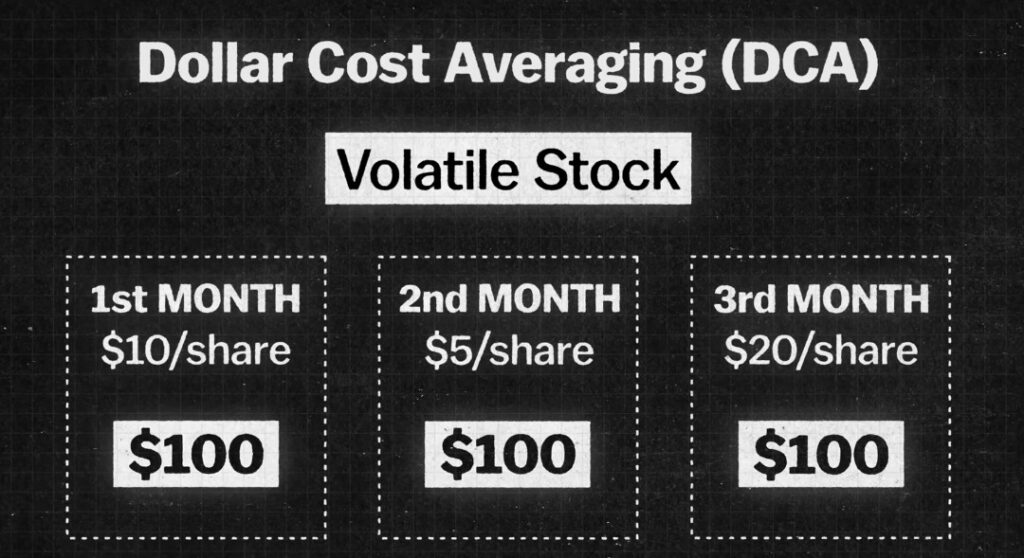

Let’s look at a volatile stock example with a $300 monthly investment:

Month 1: Stock is $10, you buy 30 shares

Month 2: Stock drops to $5, you buy 60 shares

Month 3: Stock rises to $20, you buy 15 shares

At the end of 3 months, you own 105 shares that cost you $300 per month or $900 total at the end of the third month. Your average cost per share is now just $8.57 – lower than the $10 and $20 price points.

If you could perfectly time the market, you’d buy everything at $5 in month 2. But since no one can predict future prices,

DCA ensures you don’t dump all your money at an inopportunely high price point. It automatically builds your position over multiple price cycles.

DCA is especially powerful during volatile times, as it prevents the psychological fear that makes you want to stop investing when prices are falling. Instead of panic-selling, you’re automating new cheap share purchases every month or quarter.

By removing all the guesswork, emotion, and market timing from investing, dollar cost averaging allows you to build wealth gradually yet consistently over many years through regular, fixed contributions. It’s the ultimate hands-off, disciplined approach for beginners.

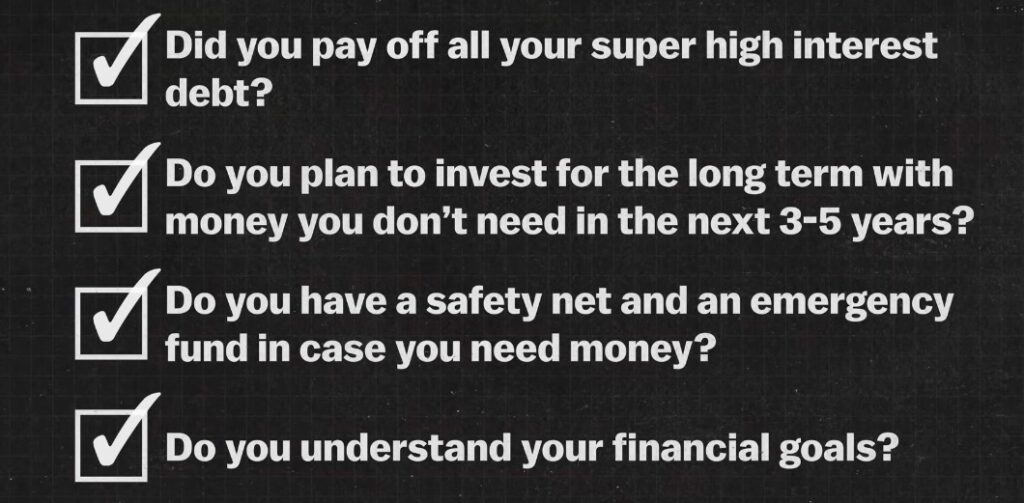

When Is The Best Time To Start Investing?

The secret is – the absolute best time was yesterday. The next best time is today, but that applies to only those who meet these four conditions:

This is not the first time you have been recommended to go for long term and to justify it let’s not rely on my word just look at this study

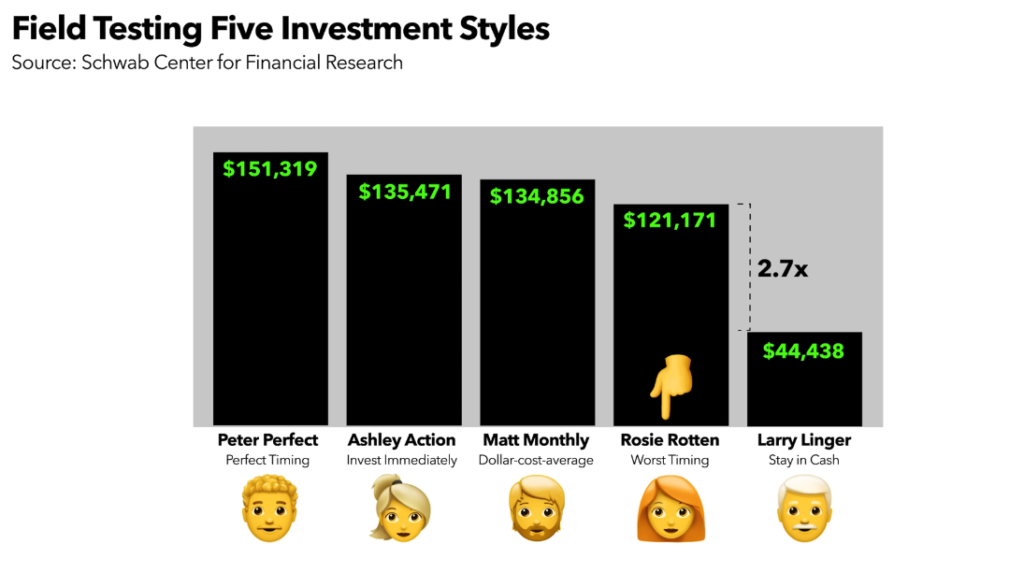

Schwab Study: Charles Schwab did a study with 5 hypothetical investors, each receiving $2,000 per year for 20 years to invest:

- Peter Perfect timed perfectly and invested at the lowest point each year.

- Ashley Action invested the $2,000 lump sum on the first trading day annually.

- Matthew Monthly invested $166.67 every month (dollar cost averaging).

- Rosie Rotten had the worst timing, investing at the market’s peak each year.

- Larry Linger never invested, leaving the money in cash.

Even Rosie Rotten, with the absolute worst timing, still tripled her money compared to Larry who never invested at all.

The study showed that investing immediately (like Ashley) performed slightly better than dollar cost averaging over 20 years. But the key was being invested, as both strategies far outperformed terrible timing or keeping cash.

So long term investing is the only solution where your money works for you!

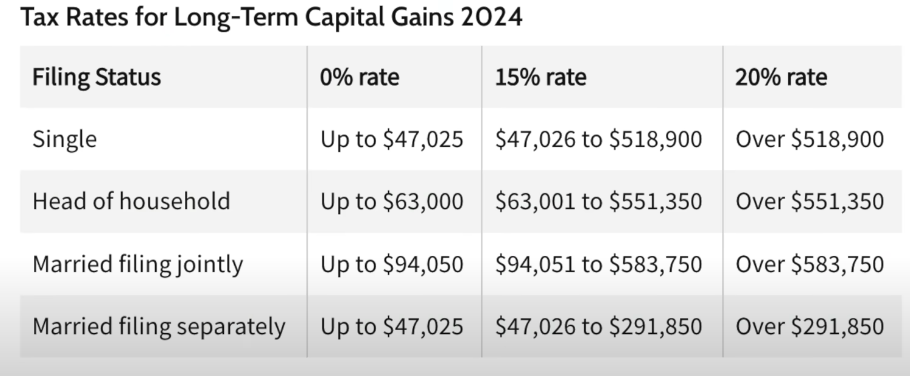

And you know you save taxes on long term as well?

How Taxes Work With Investing

There’s one more fee you need to be aware of – since your investments are a form of earning money, the US government will want a slice of the pie. The size of that slice is determined by how much you gained or lost after selling a stock.

Let’s say you bought A stock for $1,000 a year ago and sold it today for $1,500. That $500 gain counts as a capital gain, which means you’ll be taxed on the $500.

If the reverse happened and you sold the same stock that you bought for 1000 for only $500, that $500 loss counts as a capital loss, allowing you to deduct $500 from your Whatever Total Capital gain tax amount is. And really who wants loss? It is just to inform you.

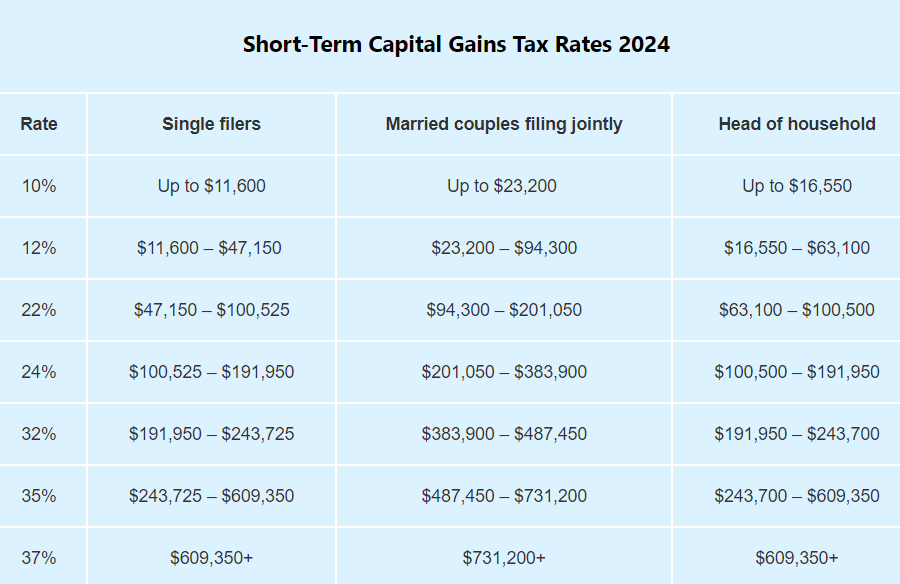

Now in Taxation the twist is – that you’ll be taxed higher if you invest short-term (less than a year) versus long-term. The government makes this distinction at the one-year mark.

And below I have attached taxation rates of short-term vs long-term capital gain and the differences are pretty significant!!

FAQ-

Why Invest and Not Just Save?

Saving money in a typical bank account with 0.06% interest will take an extremely long time to grow your wealth. For example, if you save $15,000 and contribute $500 monthly, it would take 157 years to reach $1 million.

Investing on the other hand, can significantly speed up this process. With an average 10% annual return (historical S&P 500 average), it would only take 26 years to reach $1 million with the same savings.