This post may include affiliate links, meaning we’ll receive a commission if you choose to purchase through our links, at no extra cost to you. Please read disclosure here for more info.

Do you ever feel like your money just disappears into thin air? Yeah, me too. But staying broke isn’t fun, is it? The truth is, we all want to live life without constantly stressing over finances. And the good news? With some simple mindful spending tricks, you can start keeping more cash in your pocket!

Over the years, I’ve picked up 10 Things Not to but. From mastering credit cards to buying smart tech, to saving on books and gifts – these hacks have a huge impact. And you don’t have to be a financial expert! Just a few small changes can put you on the road to saving big time. awesome strategies for saving tons of money without giving up things I enjoy

Table of Contents

10 Things Not To Buy To Save Money

Strategy 1. Mastering Credit Card Use

Hey there! Let me tell you a story about my college buddy. He got a new credit card because of a cool signup bonus. You know, those perks they offer to get you to apply? Well, he used it to buy some furniture for his place. Smart move, right? Not quite.

Life threw him a curveball with a family emergency. In all the chaos, he forgot about his new credit card bill. Yikes! His $600 furniture suddenly turned into over $1,000 in expenses. That’s like buying the same sofa twice! This happens to a lot of people, and it’s why I want to share some tips to help you avoid this money trap.

A. The High Cost of Credit Card Debt

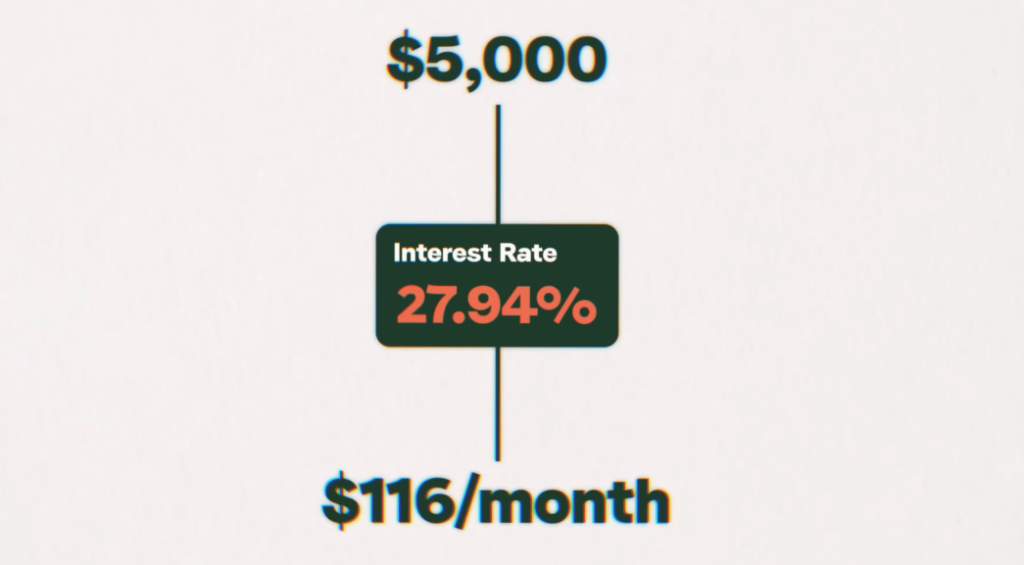

Did you know that the average American has about $5,700 in credit card debt? That’s a lot! But here’s the scary part: credit cards usually charge around 27% interest. Let’s say you have $5,000 on your card. In just one month, you’d be charged about $116 in interest. That’s more than a fancy dinner out!

Over time, you could end up paying more in interest than what you originally spent. It’s like buying something twice, just like my friend with his furniture. That’s why it’s super important to be smart with your credit cards.

B. Setting Up Automatic Payments

So, how do you avoid this? It’s simple: set up automatic payments. This is a game-changer! Your credit card bill gets paid in full each month without you having to remember. It’s like having a robot assistant who makes sure you never miss a payment.

I do this with all my cards. Why? Because it means I never pay a cent in interest. It’s like getting everything at its actual price, not the price plus extra fees. Pretty cool, right?

C. Only Charging What You Can Pay Off Monthly

Here’s another golden rule: only buy things with your credit card that you know you can pay back within a month. Think of your credit card like borrowing money from a friend. If you borrow $50 for a cool video game, you’d want to pay your friend back ASAP, right?

It’s the same with credit cards. If you charge $50, make sure you have $50 to pay off next month. This way, you’re using your card wisely, not building up debt. It’s a simple trick, but it keeps more money in your pocket.

Remember my friend’s $600 furniture that turned into $1,000? That won’t happen to you if you follow these tips. Use your credit card like a smart tool, not a money trap. Set up those auto-payments and only buy what you can pay off. Do this, and you’ll be a credit card master, saving tons of money along the way!

Strategy 2. Smart Investing: Low-Cost Index Funds

Hey there! Remember when you thought only smart people in suits could handle your money? I used to think that too! For years, I believed hiring a financial advisor or investing in actively managed mutual funds was the best move. You know, those funds where experts pick stocks they think will do well? But boy, was I wrong!

About 7 years ago, I had an “aha!” moment. I decided to switch from those fancy, actively managed funds to simple, low-cost index funds. Why? Because when I ran the numbers, I discovered something that blew my mind: expense ratios. It’s a fancy term, but it just means the fees you pay for someone to manage your investment. It’s like paying someone to water your plants, but in this case, they’re watering your money tree. These fees might seem small, but they can take a big bite out of your savings!

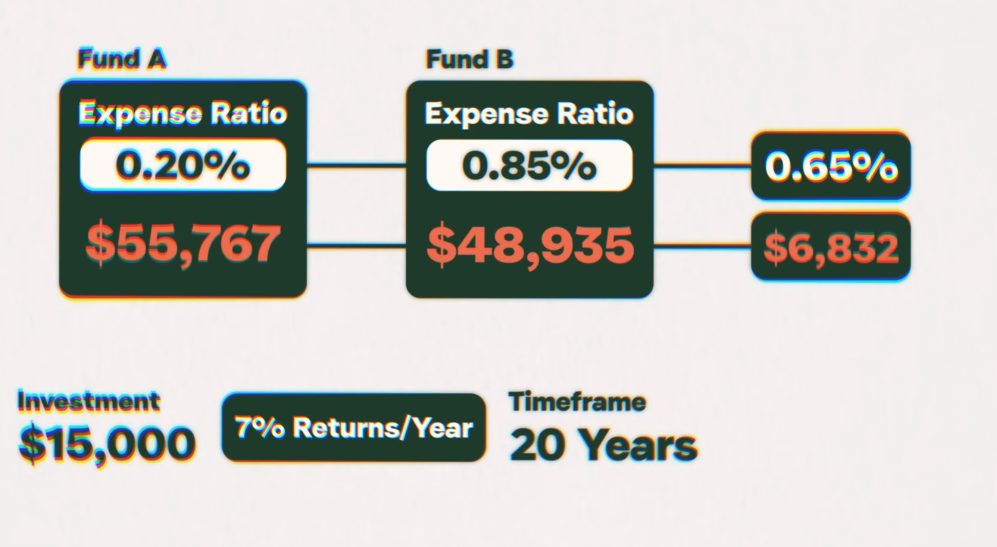

Let’s break it down with a fun example. Imagine you have two piggy banks: Piggy A and Piggy B. You put $15,000 in each, hoping they’ll grow over 20 years at about 7% per year. But here’s the twist:

- Piggy A (like a low-cost index fund) only takes 0.20% as a fee.

- Piggy B (like an actively managed fund) takes 0.85% as a fee.

Seems like a tiny difference, right? Just 0.65% between them. But fast forward 20 years:

- Piggy A grew to $55,767! 🎉

- Piggy B? Only $48,935. 😕

That tiny 0.65% fee difference turned into a whopping $6,832 gap! And that’s just with one $15,000 deposit. Imagine if you added more money or waited longer than 20 years. The difference could be huge! It’s like Bank B is secretly eating your cookies when you’re not looking!

Now, you might think, “But these experts must be super good at growing money, right?” Well, a study in 2021 found that 80% of these actively managed funds didn’t even beat the market. That means if you just invested in the entire market (like buying a tiny piece of every company), you’d do better than these “experts” most of the time.

So, why pay them so much if they can’t even beat the average? It’s like paying for a maths tutor who gets worse grades than you!

After realising all this, I switched to something called “passive index funds like FXAIX or VOO. ” Don’t let the boring name fool you—these are money-saving superheroes! Instead of trying to pick winning stocks, they just buy a piece of every company in a big group, like the top 500 U.S. companies. They’re like buying a little piece of the whole stock market, not just a few stocks someone picked. They charge super low fees and, over time, they tend to grow steadily. I use an app called Mumu, which I’ve loved for years.

And, here’s a sweet deal: if you open a Mumu account with just $100, they’ll give you five free stocks. It’s like getting free money to start your investing journey. Plus, by using my link below, you’re helping support this blog. Win-win!

So, there you have it. Avoid those high-fee funds that eat your cookies. Go for low-cost index funds instead. They’re simple, they grow steadily, and they let you keep more of your hard-earned money. Start saving smart today, and watch your money tree grow big and strong

By choosing low-cost index funds, you’re keeping more of your hard-earned money. It’s like choosing a piggy bank that doesn’t eat your coins! 🐷💰

Strategy 3. Cost Per Use: A New Shopping Paradigm

When I got my first job, I thought I was being super smart. I’d buy the cheapest things I could find. T-shirts and jeans from H&M, shoes from lesser-known brands. I mean, why spend $100 on a coffee maker when you can get one for $20, right?

Wrong! Everything fell apart in just a few months. Those cheap jeans? Ripped. That $20 coffee maker? Broken. I didn’t think about how much it would cost to replace or fix these things. Oops!

A. Introducing the Cost-Per-Use Concept

Then I discovered something amazing: cost-per-use. It’s a fancy way of saying, “How much does it cost each time I use this thing?” This idea changed everything! Now, instead of just looking at the price tag, I think about how many times I’ll use something before it breaks.

B. Example: Cheap vs. Quality Jeans

Let’s talk jeans. I could buy a cheap pair for $20 or a nicer one for $50. The cheap ones might seem like a good deal, but what if they rip after just 20 wears? That’s like paying $1 every time I wear them!

Now, the $50 jeans might seem expensive, but if they last for 200 wears, that’s only 25 cents per wear. The cheap jeans end up costing four times more in the long run! It’s like magic, but it’s just smart math.

C. Making It a Game to Optimize Spending

I’ve even turned this into a fun game. I try to get the lowest possible cost-per-use for everything I buy. It’s like a challenge: “Can I get this shirt’s cost-per-wear lower than my last one?” It makes shopping way more fun and saves me tons of money!

D. Bonus: Maximizing Credit Card Rewards

But wait, there’s more! I also use my credit cards smartly. Different cards give different points for different stores. Like, one card might give extra points at supermarkets, another at gas stations. It’s great, but keeping track of all these deals? Super frustrating!

That’s when I found this awesome, free tool called Kudos. It’s a browser extension that does all the hard work for me. When I’m shopping online, Kudos automatically tells me which of my credit cards will give me the most points. It knows my spending habits and what rewards I like.

The best part? Kudos can even double my credit card rewards at over 15,000 stores like Walmart and StubHub. And it’s totally free! Last year, it helped over 150,000 people earn more than $100 million in rewards. That’s a lot of extra money!

So, there you have it. Stop just looking at price tags. Think about cost-per-use instead. Make it a game to spend smarter. And while you’re at it, let tools like Kudos help you earn more rewards. Together, these tricks will help you save tons of money without giving up the things you love. Cool, right? Now go out there and be a shopping superhero!

Strategy 4. Rethinking Daily Habits: Coffee vs. Green Tea

Hey there, productivity pals! Now, we’re going to talk about something you probably have every single day: your morning drink. For years, I thought I had the perfect morning buddy—a hot cup of black coffee. But boy, was I wrong! Let’s chat about how changing my morning sip changed my whole day.

A. The Coffee Energy Crash

For nearly a decade, I started every day the same way. A steaming cup of black coffee in my hands, the smell filling my nose. Mmm, it tasted great (even when it burned my tongue—ouch!). And whoa, that energy burst! I felt like I could conquer the world.

But here’s the bummer: that superpower didn’t last. By lunchtime, CRASH! It was like my energy battery went from 100% to 0% in a snap. I couldn’t focus. I couldn’t work. What did I do? Reached for another cup of coffee. Then another. It was a never-ending cycle!

B. Green Tea’s Sustained Energy Benefits

About five months ago, I decided to try something different: green tea. I know, it doesn’t sound as exciting as coffee, right? But trust me, this switch changed everything!

Now, every morning, I sip on a cup of green tea. Sometimes, when I’m feeling fancy, I go for matcha (it’s like green tea’s cool cousin). Here’s the amazing part: I stay productive ALL DAY LONG. No crashes, no slumps. How’s that possible?

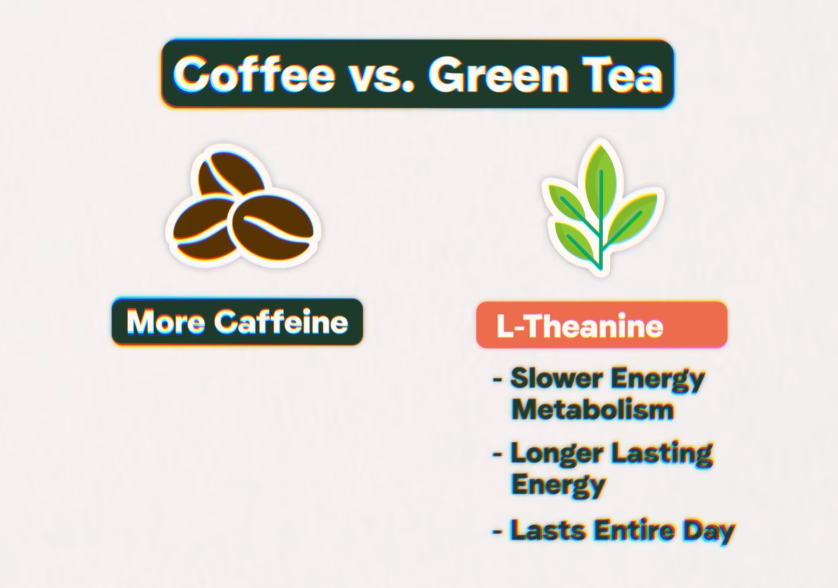

Well, it turns out green tea has a secret weapon. It’s called L-theanine (L-thee-a-neen). This super compound works with caffeine in a special way. Instead of giving you one big energy burst like coffee, it helps your body use the caffeine slowly. It’s like turning a sprint into a steady jog. You keep going, and going, and going!

C. Cost Comparison and Productivity Gains

Now, you might be thinking, “But green tea can’t have as much caffeine as coffee, right?” You’re correct! Coffee does have more. But here’s the thing: it’s not just about how much energy you get; it’s about how long it lasts.

Cost-wise, green tea and coffee are pretty similar. A box of good green tea bags or a bag of coffee beans—they won’t make a big difference in your wallet. But the real treasure? Time.

Because I have steady energy all day, I get way more work done. No more wasted hours feeling sluggish after my coffee crash. No more breaks to make another cup. Just steady, focused work. I’m finishing tasks faster, which means more free time for fun stuff!

So, here’s my advice: rethink your morning drink. Coffee might seem like your best friend, giving you that big hello in the morning. But green tea? It’s like a buddy who sticks with you all day, helping you get more done without the drama. Give it a try for a few weeks. You might just find your new morning hero!

Strategy 5. Resisting Sale Psychology

Moving on we’re going to talk about something that might surprise you. It’s all about sales. You know, those big “50% OFF!” signs that make you want to buy stuff right away? Well, they might not be saving you as much money as you think. Let’s chat about it!

A. Understanding Loss Aversion

Growing up, my family didn’t have a lot of money, so I witnessed firsthand the mistakes some make with money. Our house was always full of stuff—pots, pans, you name it. But here’s the funny part: most of it was still in boxes, never used! Why? Because my mom bought them all on sale.

My mom thought she was being super smart. “Look, this pot was $50, but it’s on sale for $25. I saved $25!” But wait a second… did she really save money? Nope! She still spent $25 that she wouldn’t have spent otherwise. The sale made her think she was saving, but her wallet was still getting lighter. It’s called “loss aversion” in psychology.

Basically, we hate losing money more than we love saving it. So when we see a sale, our brain goes, “Oh no! If I don’t buy this now, I’m losing out on savings!” Companies know this trick, and they use it to get us to spend more.

Companies are sneaky. They put up big “Limited Time!” and “Sale!” signs to make you feel like you have to buy now. But if you buy something you didn’t plan for, even at half price, you’re not saving—you’re spending.

B. Creating Need vs. Want Lists

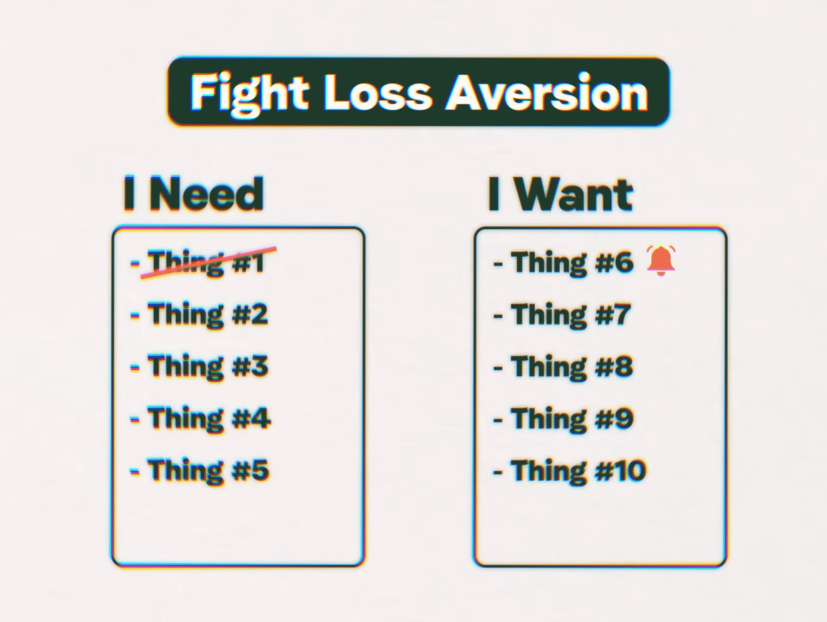

So, what’s my trick to avoid this trap? I have two special lists:

- Things I Need Now: This is stuff I really need, like a new pair of shoes because my old ones have holes.

- Things I Want: This is stuff that’d be nice to have, like a cool new video game.

If something is on my “Need Now” list, I buy it even if it’s not on sale. Why? Because I truly need it, and waiting might cost me more (like if my shoes get worse). But if it’s on my “Want” list, I wait for a sale. This way, I only buy what I really need and save money on the rest.

C. Using Price Alerts for Wanted Items

Here’s another cool trick: for things on my “Want” list, I set up price alerts. It’s like having a robot friend who watches the prices for you. When that video game I want goes on sale, my robot friend tells me right away. Then I can buy it at a lower price and—here’s the best part—I take the money I saved and invest it!

I even use this awesome tool called a “Saving Goal Tracker.” I tell it how much I want to save, like “$500 for summer vacation,” and it shows me how close I am to that goal. It’s like a savings game, and watching that bar fill up is super motivating! For a short time, I’m even giving away my special tracker for free. Just click the link below to get it.

So, there you have it! Sales aren’t always your friend. They trick your brain into thinking you’re saving when you’re really spending. Use my two-list trick and price alerts to outsmart those tricky sales. And with my Saving Goal Tracker, you’ll see your money grow faster than ever. Remember, a real deal is only a deal if you were going to buy it anyway. Stay smart, save big!

Strategy 6. Strategic Alcohol Consumption

Alcohol. Now, I know what you’re thinking, “What does drinking have to do with saving money?” Well, a lot more than you might think! Let’s dive into this in a fun way.

A. Social Pressure to Drink

I live in New York City, where drinking is a big deal. It’s part of hanging out with friends and even part of work life. People often think, “If everyone else is drinking, I should too.” But here’s the thing: you don’t have to! I’ve never loved drinking. For me, it was always just a fun, social thing I did once a week. You don’t need to follow the crowd to fit in.

Now, here’s something personal. Every single time I drink, without fail, I get what’s called the “Asian glow.” After just a few sips, I turn bright red like a lobster! At first, it was a bit embarrassing, but now I’ve gotten over that.

But here’s the not-so-fun part: which is how it makes me feel inside. My body gets really hot, I sometimes get headaches, and studies show that alcohol is extra, extra toxic for those who get this Asian glow. It’s like my body is saying, “Hey, this stuff isn’t good for me!” So, mainly for health reasons, I’ve mostly stopped drinking alcohol.

B. Financial Impact of Drinking Less

Now, here’s where saving money comes in. In New York, cocktails cost around $15 to $20 each. That’s like buying a new book or a cool board game every time you go out! By mostly stopping my alcohol intake, I’m now saving a ton more money. Think about it: if you go out twice a month and have two drinks each time, that’s $60 to $80 saved. In a year, that’s $720 to $960! That’s enough for a nice vacation or a big chunk of your savings goal.

C. Choosing Healthier Alternatives

But I still go out with friends in New York. Instead of alcohol, I’ll just order a Coke Zero. I hope it’s a healthier choice (fingers crossed!), and it definitely doesn’t hurt my wallet. A soda usually costs just a few bucks, way less than those fancy cocktails.

When I’m on vacation, I might still have a drink. But in my day-to-day life, I’ve found that sticking to alternatives saves me money and keeps me healthier. It’s a win-win!

So, here’s my advice: Don’t feel pressured to drink just because others are. It’s okay to choose something else. Maybe you have health reasons like me, or maybe you just want to save money. Whatever your reason, choosing not to drink can keep more cash in your pocket. And who knows? You might even start a trend of cool, non-alcoholic drinks among your friends. Now that would be something to toast to—with your Coke Zero, of course!

Strategy 7. Buying Smart: New vs. Refurbished

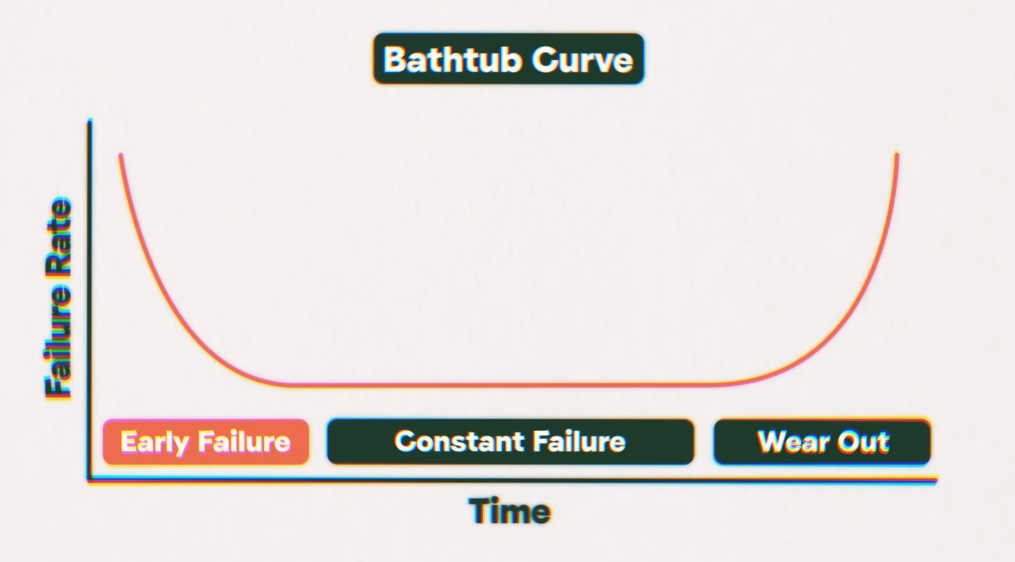

Next is buying things brand new and fresh, for the longest time I would only buy brand-new tech gadgets like iPhones, Macs, airpods. I didn’t love the idea of using something that someone else had previously owned. Later on, I found out about this thing called the Bathtub curve.

A. The bathtub curve in product reliability

Have you ever heard of the “bathtub curve”? It’s a weird name, but it describes how brand-new products can actually be more likely to break down than slightly older ones. When companies first make and sell a new gadget, they only do basic checks before shipping it out. This means some unlucky people end up with a “dud” that stops working pretty quickly. Bummer!

B. Why refurbished products are often better

But here’s the cool part – when people return those duds, the companies have to fix them up and test them really thoroughly before reselling them as “refurbished.” They can’t risk having to deal with returns again, so they make extra sure the refurbs are working perfectly. That extra testing makes refurbished items more reliable than brand-new ones!

C. Cost savings without sacrificing quality

And the best part? Refurbished products cost way less than new ones, even though they’re just as good (or better!) under the hood. These days, I always try to buy refurbished tech when I can. I get amazing quality for a super low price. It’s a total win!

So don’t always assume brand new is best. Those refurbs have been put through the wringer to make sure they’ll last. Plus, you save a ton of money! It’s a smart way to buy.

Strategy 8. Rethinking Luxury and Brand Names

When I was in college, I struggled with wanting all the cool brand-name stuff that everyone else had. It felt like I was the odd one out for not having fancy labeled clothes, bags, and gadgets. I was lowkey jealous of those who could afford it all. But then I realised I was falling into the “keeping up with the Joneses” trap – buying things just to look wealthy and fit in.

A. Focusing on functional value over brand

These days, I’ve grown out of that mindset. I don’t need to show off by buying a $10,000 watch, even though I could afford one now. My favourite watch is this $30 Casio! I’m okay with choosing quality over big brand names.

B. Example: High-quality vacuum cleaner

There’s one exception though – I will pay more for brand names if the product is really well-made and does its job way better than cheaper options. Like my vacuum – it was pricier but it’s so powerful, lightweight, and easy to use. I don’t mind paying extra for that great functional value over just buying the lowest-priced vacuum.

So don’t get sucked into buying luxury brands just for the name. If the item truly works better and makes your life easier, then it may be worth the investment. But most of the time, the off-brand or generic version works just as well for a fraction of the cost!

Strategy 9. The Art of Thoughtful Gift-Giving

Okay, so I have a pretty big family which means that every year I would have to spend a healthy chunk of money on gifts but in the past 2 years I’ve decided to stop buying expensive gifts and instead only get a very specific type of gift. initially I didn’t think people were going to like this but apparently my friends and family appreciated these gifts a lot more than the ones before.

A. The disappointment of expensive gifts

You know that sinking feeling when you open a gift and think “Why did they even get me this?” A survey found that over 72% of people have felt that way before! The problem is, that people often spend a ton of money ($975 on average!) thinking an expensive gift will be appreciated more.

B. The myth of cost-equalling thoughtfulness

But here’s the truth – the dollar amount doesn’t make a gift more thoughtful or meaningful. Gift-givers mistakenly believe that spending more equals more thoughtfulness. But studies show that’s just not true!

C. The secret to meaningful gifts

What people want is for you to show you listen and put some real thought into their gift. I’ve mastered giving awesome, inexpensive gifts by paying close attention when friends or family casually mention things they like throughout the year.

D. Cost-effective, personalised gifting

If we’re out shopping and they admire a cool mug or blanket, I discreetly make a note on my phone. Then for their birthday or holiday, I get them that exact item they pointed out months ago! Most of these gifts only cost $10-20, but are so personalised. My loved ones appreciate these small, thoughtful gifts way more than a random expensive gadget.

So forget splurging tons of cash – focus on being an awesome listener and gifting based on what your friends and family have genuinely shown interest in. A little creativity and observation goes a long way!

Strategy 10. Saving on Books and Media

I used to waste so much money buying textbooks for school that I hardly even read. It was such a waste that it kind of scarred me! For a long time after, I avoided reading physical books altogether. If I had to read something, I’d just buy the cheaper digital version instead.

Nowadays though, I’ve found an awesome way to read any book I want for completely free – the Libby app! It’s like having a Kindle and Audible rolled into one, but you can “rent” regular books, ebooks, and audiobooks from your local library using just your library card. No more overpaying for books that collect dust on my shelf.

With Libby, I can easily borrow the latest novel I want to read, or finally check out that classic I’ve been meaning to. And if I’m going on a road trip or just don’t feel like reading, I can grab the audiobook version instead. Best of all, it’s totally free as long as you have an active library card!

The key is taking advantage of free resources like Libby to feed your book habit without going broke. Why pay $20+ for a book you’ll likely only read once when you can just rent it? Save that cash for something else!

Additional Money-Saving Strategies

A. Budgeting and tracking expenses

Having a budget is like a money map that shows where your cash is going. By writing down what you spend each month on things like rent, groceries and fun stuff, you can clearly see where you might be overspending. Apps like Mint make budgeting super easy – it automatically categorizes your expenses so you can spot any money leaks!

B. Negotiating bills and subscriptions

You’d be surprised how many companies will cut you a deal just for asking! Call up providers for things like cable, internet and streaming services and politely ask if there are any promotions. Don’t be afraid to negotiate – the worst they can say is no. And don’t forget to cancel subscriptions you don’t use anymore, like that pricey cable package if you mostly just stream shows.

C. Meal planning to reduce food costs

Eating out or ordering every meal adds up fast. Try planning out your meals for the week and making a grocery list from that. You’ll save a bunch just by cooking at home more often. And bringing your lunch to school or work instead of buying it can save over $1,000 a year! No more wasting money on expensive takeout.

D. Using public transportation or biking

Car costs like gas, maintenance, and insurance are no joke. Whenever possible, take public transit or ride your bike instead. It’s much cheaper and better for the environment too! Even carpooling with friends or family can make a big dent in those driving expenses.

E. DIY home and car maintenance

You don’t have to pay a professional for every little repair or maintenance task. YouTube has tons of great tutorial videos for doing simple home fixes and basic car upkeep yourself. Changing your air filters, cleaning gutters, and changing windshield wipers can save you major money over time, just like doing your vacuum maintenance.

Psychological Aspects of Saving

A. Dealing with savings dissatisfaction

Even when you’re doing your absolute best to save, it can still feel like you’re not making enough progress. Don’t get discouraged! Remind yourself that slow and steady wins the race. Every little bit adds up over time, like using cost-per-use to maximize your money.

B. Setting realistic financial goals

Having big dreams is great, but it’s also important to set achievable, step-by-step money goals along the way. That way you can celebrate small victories and stay motivated. Trying to save up $10,000 overnight for a luxury watch will just leave you feeling overwhelmed.

C. Celebrating small wins

Speaking of small victories – make sure you actually take time to celebrate them! Whether it’s going on a cheap weekend hiking trip or just treating yourself to a nice dinner out, little rewards for hitting savings milestones can rejuvenate you. Maybe splurge on a thoughtful but inexpensive gift for yourself!

D. Building a supportive community

Talking about the financial aspect of your life with friends and family doesn’t have to be awkward. See if you can build a fun, supportive squad to keep each other accountable and motivated. Friendly competitions around saving challenges or swapping money-saving tips like getting free books from the library can make a huge difference.

The most important thing is to make saving an enjoyable journey, not a restrictive chore. With smart strategies and the right mindset, you’ve got this!

Conclusion on Things not to buy to save money

So there you have it – 10 proven ways to keep more money in your pocket. We covered things like using credit cards the right way, investing smartly, and thinking about cost-per-use when shopping. Then there were the daily life upgrades like switching to green tea and avoiding pricey alcohol. And who could forget the gifting and shopping secrets that save you hundreds?

Now, I’m not saying you need to overhaul your whole lifestyle overnight. That’s too overwhelming! Just try out a couple of these tips that feel doable. Swap your morning coffee for green tea. Set up auto-pay on a credit card. Start looking for refurbished tech. Tiny steps build up over time.

And here’s the big prize – all those small saving wins will snowball into something huge before you know it. Imagine keeping thousands extra in your pocket each year. That’s a dream vacation, paying off debt, or building up your emergency fund. Pretty cool, right?

So don’t wait – pick one or two money-saving strategies that excite you and give them a try. Your future wealthy self will thank you! Who’s ready to start keeping more cash?