This post may include affiliate links, meaning we’ll receive a commission if you choose to purchase through our links, at no extra cost to you. Please read disclosure here for more info.

Hey there! Have you ever dreamed of being financially free and able to work from anywhere in the world? I know I did, especially back when I was a kid obsessed with video games. Little did I know that my love for gaming would eventually lead me to Wall Street and building this very YouTube channel.

You see, the path to making the most money in the least amount of time isn’t always obvious. It’s not about following a traditional route or having the highest grades. Instead, it’s about developing a few essential skills that can amplify your efforts and income. And that’s exactly what I’m going to share with you today – the five high income skills to learn that changed my life.

So, grab a pen and paper (or your favorite note-taking app), and get ready to learn the secrets that allowed me to escape the 9-to-5 grind and pursue my passions. Trust me, these high income skills are game-changers, and they can work for anyone, no matter where you’re starting from.

Table of Contents

5 High Income Skills to Make Money Online

Skill 1: Developing Specific Knowledge

Knowledge that can’t be learned in school or from books. Have you ever heard someone say, “You can’t learn that in school”? Well, that’s what specific knowledge is all about. It’s not something you can pick up from a textbook or learn in a classroom. It’s special, and it’s hiding in a surprising place—your hobbies and obsessions.

A. Finding your specific knowledge through obsessions

1. Personal example: Video game passion

Let me tell you a story. Back in high school, I was crazy about video games. I’m talking about Left 4 Dead, Team Fortress 2, Counter-Strike—you name it. I’d spend entire weekends at home, playing non-stop. I even skipped hanging out with friends just to get an extra hour of gaming. Not the healthiest habit, I know!

But here’s the twist: while gaming, I started making videos about these games. Montages, compilations, that sort of thing. On top of school and classes, it seemed like a ton of work. But weirdly, it never felt like work. I was just having a blast, even if I was a bit obsessed.

2. Transferring gaming skills to finance and content creation

Looking back, I see why I loved those games so much. I was always chasing the highest score, always trying to win. I’d practice the same moves over and over to get better. And you know what? That’s exactly what you do in finance and when you’re creating content.

With each work project or video I made, I learned something new. What worked in financial analysis? What didn’t work in my videos? More importantly, why didn’t it work? It became like another video game—always trying to improve, always aiming for that high score.

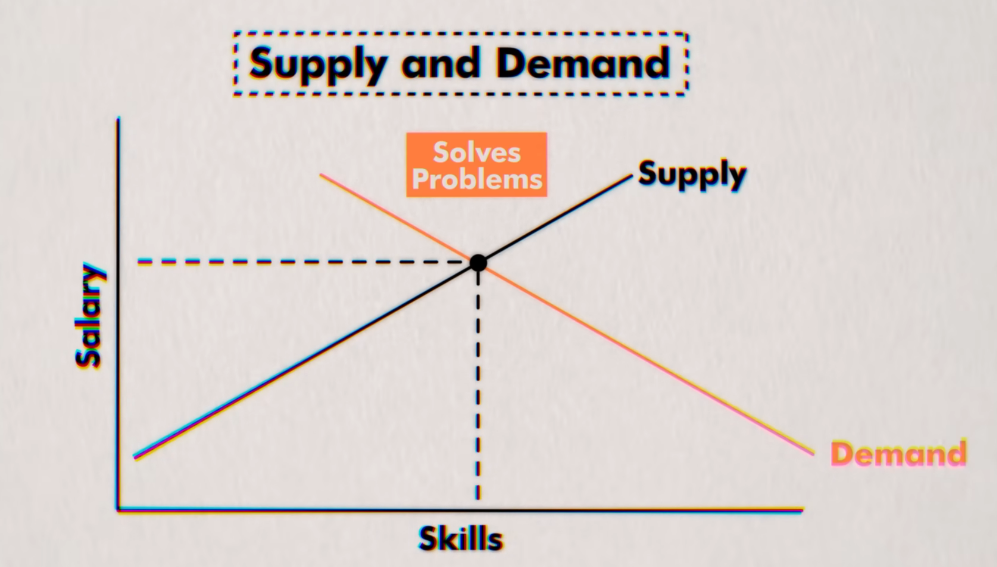

B. The economics of specific knowledge: Law of supply and demand

Now, let’s talk money. In economics, there’s something called the law of supply and demand. When lots of people can do something (high supply), it’s not worth much. But when something’s rare and people really want it (high demand, low supply), it’s worth a lot.

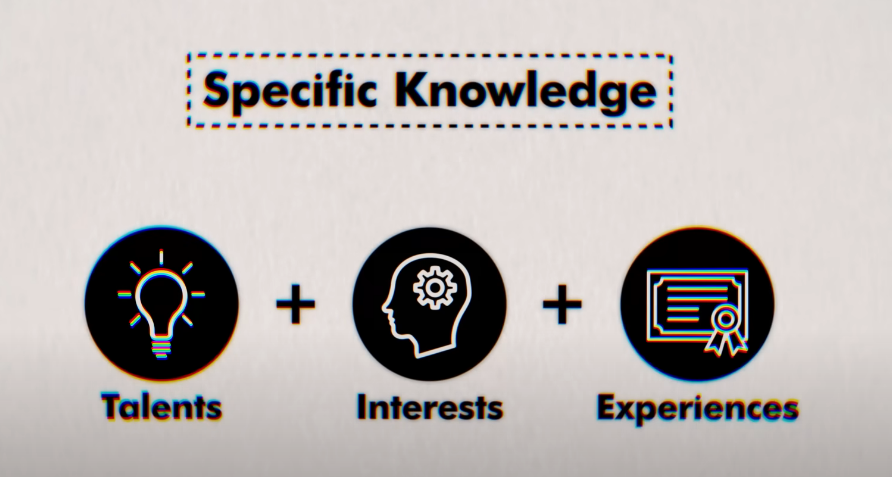

That’s what specific knowledge is. According to Naval Ravikant, it’s a mix of your talents, interests, and experiences. It’s what makes you, well, you! It’s rare, valuable, and hard to copy. Because it’s so unique, businesses and people will pay a premium for it. They need someone to solve problems that most others can’t.

C. Contrast with regular, easily replaceable knowledge

On the flip side, there’s regular knowledge. This is stuff you learn in school or from books. The problem? If you can master it just by reading, so can millions of others. And when millions can do the exact same thing, you’re easy to replace. It’s like having a toy that everyone else has—not very special, right?

But your specific knowledge? That’s like a one-of-a-kind, custom-made toy. No one else has it. For me, my odd obsession with video games led me to Wall Street and building this YouTube channel. Your obsession might seem weird or pointless now. Maybe it’s collecting rocks, or knowing everything about old cars, or being a wizard at solving puzzles. Whatever it is, don’t ignore it. That could be your golden ticket—your high income skill hiding in plain sight!

Understanding the Concept of Wealth

Before Moving on to the next skill, Let’s learn a bit about wealth. You know, when I was 21, I thought being rich meant having a big paycheck. Boy, was I wrong! The second high-income skill I wish I had known back then is understanding true wealth. It’s not just about making a lot of money—it’s about making your money work for you.

Rich vs. Wealthy: High income vs. owning income-generating assets

Here’s the thing: you can be rich without being wealthy. Sounds weird, right? But it’s true. Being rich means you have a high income. Maybe you’re a doctor or a lawyer, making $200,000 a year. That’s a lot of money!

But here’s the catch: the moment you stop working, your income stops too. Take a vacation? No paycheck. Get sick? No money coming in. You’re always trading your time for income. And let’s face it, you only have so many hours in a day. You can’t work 100-hour weeks forever!

Now, being wealthy? That’s a whole different ball game. When you’re wealthy, you own things that make money for you, even when you’re not working. Think of it like having a money tree in your backyard. You plant it once, and it keeps giving you apples (or in this case, dollars) year after year.

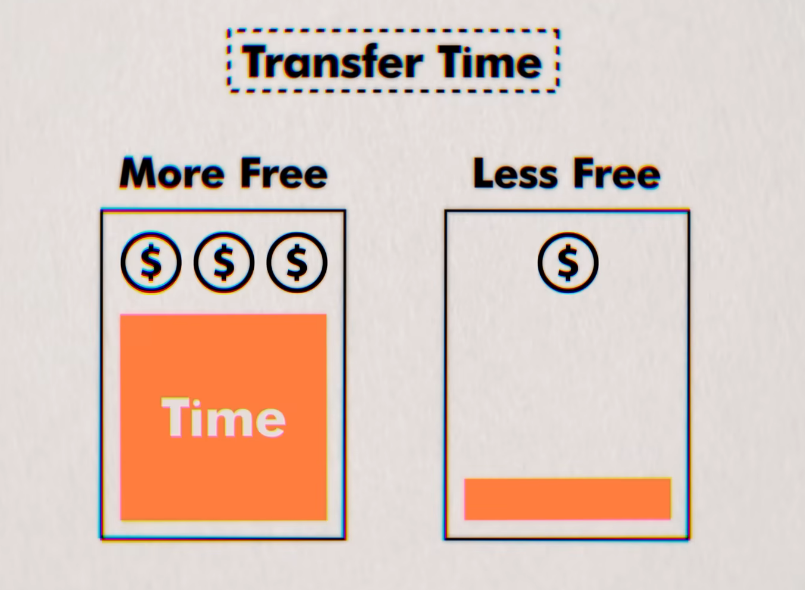

B. The time-money exchange: Buying freedom with wealth

When I figured this out, it changed everything. I realised that money isn’t just paper—it’s stored-up time. Every dollar you have is like a minute, an hour, or even a day that you’ve saved up.

When you’re wealthy, you have a big “time bank.” You can use this saved-up time to do what you love. Maybe that’s travelling, starting a charity, or just spending more time with your family. You’re not chained to your job because you need the next paycheck.

Someone who’s just rich? They’re usually super busy. They can’t take a day off work because they need that money coming in. Being wealthy gives you a kind of freedom that being merely rich can’t.

C. Strategies to build wealth-generating assets

So, how do you become wealthy? It’s all about owning things that make money while you sleep. Here are some ways to do that:

1. Real estate

In the old days (and still today), people would buy houses or apartments. They didn’t live in them—they rented them out. Every month, tenants would pay rent. That money went straight into the landlord’s pocket, even if they were off sipping coconut water on a beach!

2. Stock market investments

Another way is to buy stocks. When you buy a stock, you own a tiny piece of a company. If that company does well, your stock becomes more valuable. Some companies even share their profits with you every few months. This is called a dividend—it’s like getting a bonus check just for owning their stock.

3. Online businesses

But wait, there’s more! Thanks to the internet, there are new ways to build wealth that didn’t exist before. Think about this: In the past, if I wanted to tell people why pineapple pizza is amazing (it is, trust me!), I’d need a classroom. Maybe 30 people could fit. And I’d have to give the same talk every time new people wanted to hear it.

Now? I just need a camera and a computer. I recorded my pineapple pizza talk once, put it on YouTube, and bam! Millions of people can watch it. I do the work once, but it keeps earning money from ads or sponsorships for years. That’s what I call working smart!

Even before YouTube, I was doing this. I started a website where I wrote articles and created tools like a budget tracker. I made each thing once, but thousands of people read the articles or bought the tools. All from my website, which was like my own little money tree.

Here’s some great news: starting a website has never been easier or cheaper. There are services like Hostinger that give you everything you need. They even have AI tools to build your site or write articles for you. It’s like having a tech genius and a writing pro on your team, but without the big salaries!

The big lesson here? Being rich feels good now, but being wealthy sets you free forever. When you’re wealthy, your money works while you play. That’s the high income skill without degree I wish I knew at 21. Start planting those money trees early, and by the time you’re my age, you’ll have a whole forest working for you!

Skill 2: Gaining Leverage

Now that you know the true difference between being wealthy instead of just rich? Well, to get there faster, you need this next high income skill to learn: Gaining Leverage. It’s like having superpowers that make everything you do much bigger!

A. Concept: Amplifying your efforts for greater output

Think about throwing pebbles into a calm pond. Each pebble is your effort—maybe an hour of work. When it hits the water, you see ripples. That’s your output, like making $50 from that hour. Now, imagine if you could turn those pebbles into boulders! Same effort, but the ripples are huge. That’s leverage—it takes your normal output and makes it 10 times bigger.

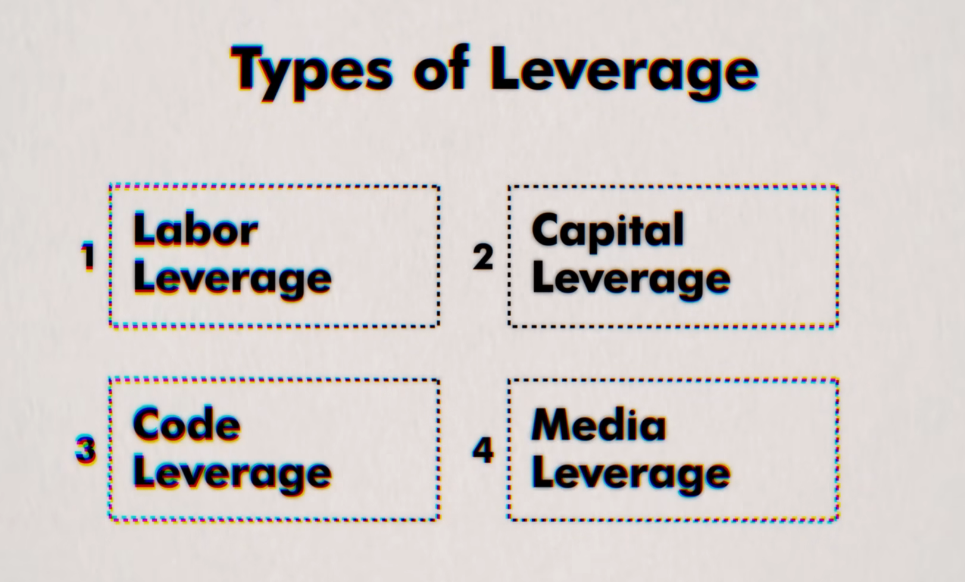

B. Four types of leverage

Naval Ravikant, a super-smart guy, says there are four types of leverage. For me, only one really worked, but let’s look at all of them:

1. Labour: Building a team

This is about hiring people. John Rockefeller (a very rich man) once said, “I’d rather earn 1% off 100 people’s effort than 100% off my own.” Having more people on your team lets you do more than you ever could alone.

2. Capital: Using money to make more money

This is about having access to money. You can use it to pay for ads, join fancy networking clubs, or just buy things that grow in value over time. But this one’s tricky—most people don’t have a lot of money lying around.

3. Code: Creating scalable software

This is about making computer programs. Once you make a program, lots of people can use it without you doing extra work. It’s like writing a book once and selling millions of copies.

4. Media: Producing content that compounds over time

This is about creating stuff like videos, articles, or podcasts. You make it once, and it can keep making money for years. This is the one that worked best for me!

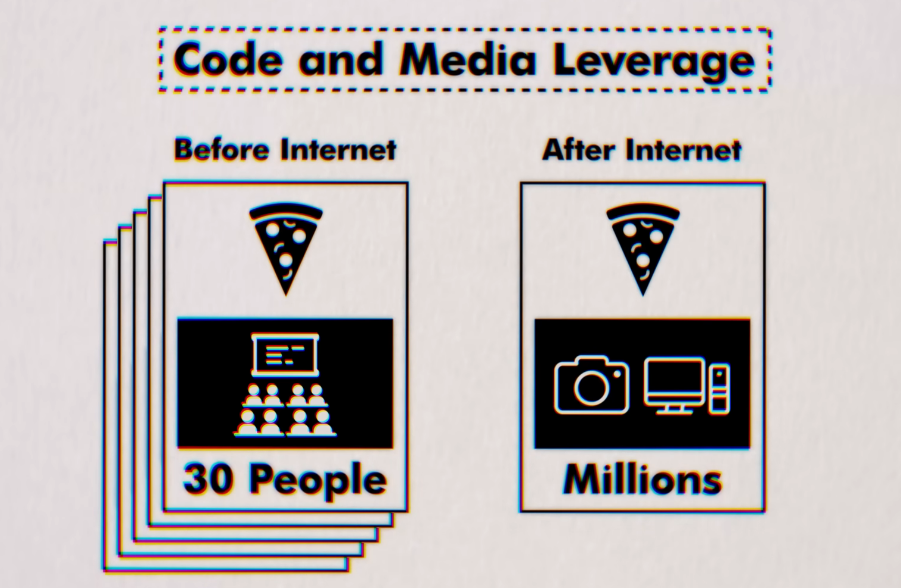

C. Personal experience: From classroom to worldwide reach

Let’s say I wanted to tell people why pineapple pizza is amazing (it is, trust me!). In the old days, I’d need a classroom that fit maybe 30 people. And every time a new group wanted to hear it, I’d have to give the same talk again. Tiring, right?

But now, with media leverage, all I need is a camera and a computer. I recorded my pineapple pizza talk once, put it on YouTube, and bam! Millions of people can watch it. I do the work once, but it keeps earning money from ads or sponsorships for years. That’s working smart!

Even before YouTube, I was doing this. I started a website. I only had to write an article once, but thousands of people read it. I only had to make a budget tracker once, but thousands bought it. All from my website—it was like my own little machine that worked while I slept.

D. Using tools like Hostinger to start an online business

Here’s some great news: starting a website has never been easier or cheaper. There are services like Hostinger that give you everything you need. They even have AI tools to build your site or write articles for you. It’s like having a tech genius and a writing pro on your team but without the big salaries!

You just enter your brand name, pick what kind of site you want, describe your business, and bam! You have a working website. Or you can choose from 150 beautiful templates. They even have an AI writer to help you make SEO-friendly articles. That means your articles can show up higher in Google searches!

For a limited time, you can get all these AI tools, a free domain (that’s your website’s name), 24/7 help, and more for only $22.99 a month, with 2 months free. They even offer a 30-day money-back promise. Plus, they’re giving my viewers an extra 10% off! Just go to hostinger.com/nykcbusiness and use code NYKCBUSINESS at checkout.

So, gaining leverage is all about making your work grow bigger without you working harder. Whether it’s through people, money, code, or media, it’s about setting up systems that work for you. For me, media leverage was the game-changer. It lets me share my thoughts with millions, not just in a classroom. And now, with tools like Hostinger, anyone can start building their own leverage machine. Pretty cool, right?

Skill 3: Building Credibility Through Accountability

Okay so moving on we even know what is leverage—making your work grow bigger without working harder? And how it works. Well, there’s a catch. No matter which type of leverage you choose (people, money, code, or media), it won’t work if people don’t trust you. That’s where our fourth high income skill without a degree comes in: Building Credibility Through Accountability.

A. The power of a credible name or brand

Think about this: if you hear that Jeff Bezos, Bill Gates, or Oprah are starting a new business, what’s your first thought? “That’s going to be huge!” Right? But why? You don’t even know what the business is yet! It’s because these names carry power. People trust them. That’s credibility.

B. Taking responsibility for successes and failures

1. Personal failures: Clothing companies and tech startups

Building credibility means taking responsibility for everything you do—the good and the bad. It’s like a two-sided coin. You take credit when things go well, but you also own up when they don’t.

I’ll be the first to admit, I’ve had my share of flops. I’ve started several businesses, from clothing companies to tech startups, that never hit the success I was aiming for. That stings, right? You pour your heart into something, and it doesn’t work out.

2. Learning from each failure

But here’s the cool part: each time that happened, I learned something new. Maybe I needed to find a better match between my product and what people wanted (that’s product-market fit). Or I realized I needed to focus more on how I was reaching customers. Sometimes, I had to admit that my product just wasn’t good enough.

C. The Edison approach: 10,000 ways that don’t work

Thomas Edison, the guy who invented the light bulb, once said, “I have not failed. I have found 10,000 ways that don’t work.” I love that! He’s saying that each try that didn’t work wasn’t a failure—it was a lesson. It was one more way crossed off the list, getting him closer to success.

D. Overcoming the fear of public failure

We’re wired to avoid failing in public. No one wants to be judged or criticized. But I think that’s a missed chance. Failure is part of life. For me, people who can admit their mistakes are way more credible than those who hide behind a fake image.

E. Credibility as a factor in partnerships and opportunities

Any time someone is deciding whether to work with you, they’re really asking, “Can I trust this person?” That’s your credibility on the line. The more credible you are, the less replaceable you seem. This gives you more leverage and lets you offer more value.

I remember when I was just starting out. A potential partner was considering working with me. They looked at my history—not just my successes but also how I handled my failures. They saw that I openly admitted when things didn’t work out, like my clothing company that didn’t take off. I explained what went wrong and what I learned.

You know what? They chose to work with me. Not because I had a perfect track record, but because they saw I was honest. They knew that if something went wrong in our project, I wouldn’t hide it or blame others. I’d own it, learn from it, and work to fix it.

Building credibility through accountability isn’t easy. It’s like walking a tightrope—you have to balance taking credit for wins and owning up to losses. But in the long run, it makes people trust you more. And in business, trust is like gold. It opens doors, brings opportunities, and yes, it helps you earn more.

So, don’t be afraid to talk about your failures. They’re not just mistakes; they’re lessons. They show people that you’re real, that you learn, and that you don’t give up. That’s what building credibility is all about. It’s a high income skill that pays off in ways you can’t even imagine!

Skill 4: Taking Action

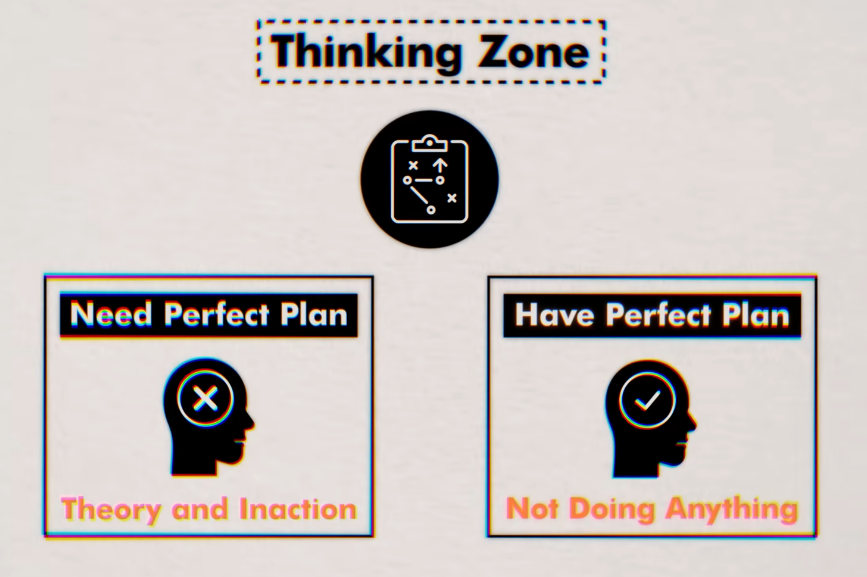

A. Escaping the “Thinking Zone” Trap

Ever had a friend who’s always talking about their big plans? “I’m gonna write a book!” or “I’m starting a business!” But years pass, and… nothing happens. They’re stuck in what I call the “Thinking Zone.” It’s a tricky place:

- The Perfectionist’s Paralysis: You convince yourself that you need to craft a flawless plan before you start, so you don’t risk failure. But while you’re busy perfecting that plan, your idea remains just a theory, and you never actually do anything about it.

- The Imaginary Victory: You come up with what seems like the perfect plan, and you feel so good about it that you trick yourself into thinking you’ve already accomplished your goal. After all, you’ve got it all figured out in your head, right? Wrong! You end up not lifting a finger to make it happen.

Both lead to the same place: nowhere. My buddy wanted to be a writer for years. He kept waiting for the perfect guide, the perfect moment. I pushed him to start, but he just couldn’t. He was trapped in the Thinking Zone.

B. Big Dreams, Small Steps

So how do you escape this trap? So, the next high income skill is all about shifting your focus from the “how” to simply getting started. When I made my first article, if I had focused on the finished product, I probably would have been too overwhelmed to even begin. Instead, I broke it down into smaller, manageable steps.

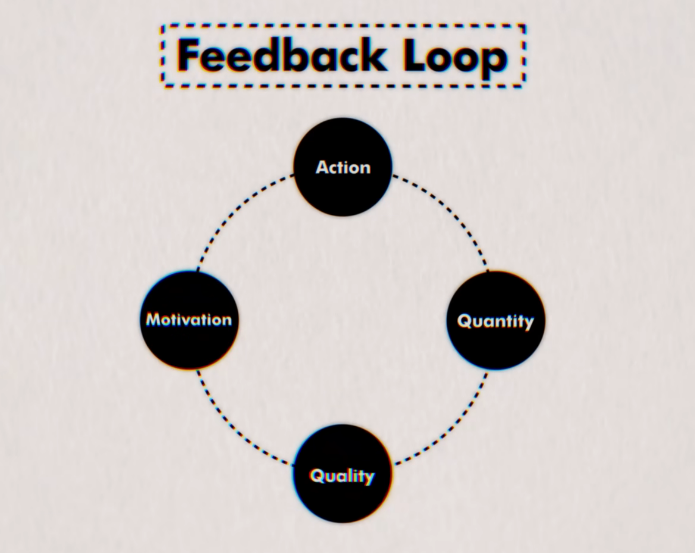

My first step was simply outlining the Blog idea. Then I planned out each heading. After that, I write the section. And so on. By taking these small steps, I created a feedback loop that forced me to keep going. Action generates quantity, which generates quality, which generates motivation, which in turn creates more action. Small steps, no pressure. Before I knew it, I had a whole Article!

C. The Magic Loop: Action → Quality → Motivation

Here’s a cool trick: just start doing. Action creates a magical loop:

- Action makes you produce stuff (even if it’s not great at first)

- The more you produce, the better you get (quality improves)

- As you get better, you get excited (motivation grows)

- More excitement? More action!

It’s like a snowball that keeps growing. Each part feeds the next. It’s a self-perpetuating cycle that keeps you moving forward, one small step at a time. So, don’t get caught up in trying to figure out every little detail before you start. Just take that first step, no matter how small it may seem, and let the momentum carry you forward.

Skill 5: Cultivating Grit

Hey, did you know that being super smart isn’t the most important thing for success? I was shocked too! A 2007 study found that there’s another skill that matters even more. It’s called grit, and it’s our fifth high income skill.

A. Grit Superstars

You know, it’s easy to look at successful people like Mark Zuckerberg or Steve Jobs and think, “Wow, they must be geniuses!” After all, they came up with revolutionary ideas like Facebook and the iPad, right? Well, here’s the thing: they weren’t the first ones to have those ideas.

Before Facebook, there was Friendster, Myspace, and even something called Second Life. And before the iPad, there were devices like the Creative Nomad and iAudio that tried to let people carry thousands of songs in their pockets. So, what made Zuckerberg and Jobs so special? One word: Grit.

B. When You Fail (And You Will)

Let’s say you spend weeks working on a project, pouring your heart and soul into it, only for it to fail. What do you do? Chances are, most people would just throw in the towel. They don’t want to experience that feeling of failure again, so they quit.

But if you have grit, you know that you have two real options: improve or pivot. Maybe your original idea wasn’t quite right, but with some tweaks and improvements, you can make it work. Or, maybe it’s time to take what you’ve learned and try something new, something even better.

Think about it: Instagram was originally an app that let people make hangout plans. YouTube started as a dating site. And Nintendo? They used to sell playing cards! Some of the most successful individuals and companies in the world had to pivot their ideas several times before they hit the jackpot.

Grit isn’t about never failing; it’s about seeing failure as a lesson, not a stop sign. It’s about having the determination to keep going, to keep trying, until you find something that works.

So, whether you’re dreaming of creating the next big thing or just want to boost your income, cultivating grit is essential. It’s the skill that separates those who succeed from those who give up at the first hurdle. With grit, you’ll have the power to turn “I can’t do this” into “Watch me try again!”

Beyond Skills: Smart Money Management

Hey, we’ve been on quite a journey together, haven’t we? We’ve talked about five high income skills that can seriously boost your earnings: specific knowledge, understanding true wealth, gaining leverage, building credibility, and cultivating grit. But here’s the thing—these skills are like ingredients. You need all of them to bake a cake, but without the right oven temperature, your cake won’t rise.

In this world of money, that “right temperature” is Smart Money Management. You can earn all the money in the world, but if you don’t know how to handle it, you’ll never truly be free.

A. The importance of correct investment

Listen, I can’t stress this enough: it’s not just about making money; it’s about what you do with that money. In the transcript, I mentioned, “if you don’t invest your money correctly, you will never achieve real freedom.” That’s huge!

Think of your money like seeds. You can have a handful of the best seeds in the world, but if you don’t plant them in good soil and take care of them, they won’t grow into a big, beautiful tree. Same with money. You need to “plant” it in the right places so it can grow and give you more freedom.

B. Common financial questions

I totally get it—money stuff can be super confusing. In the video, I said, “I get it, it’s confusing.” Because it is! You’re probably asking yourself:

1. Debt payoff vs. 401(k) contributions

Should you focus on paying off your debts first? Or should you put money into your 401(k) retirement account? It’s like wondering, “Should I fix the leaky roof, or should I start saving for a bigger house?” Both are important, but which comes first?

2. Investment strategies for 2024

Then there’s the big question: Where should you invest your money? With so many options—stocks, bonds, real estate, crypto—it’s like being a kid in a huge candy store. Everything looks good, but what’s the best choice, especially for 2024?

C. Teaser: Optimal order for investing money in 2024

Now, don’t you worry. I didn’t just point out these questions to leave you hanging! In the next blog, I promised, “check out this article to learn the optimal order to invest your money in 2024.” It’s like having a treasure map—I’m showing you the best path to take.

But wait, there’s more! I also said, “I’ll even share what I’m personally investing.” That’s right! I’m not just giving advice; I’m showing you exactly where I’m putting my own hard-earned cash. It’s like when your friend recommends a restaurant—it means a lot more if they say, “I eat there all the time!”

So, here’s the deal: All these high income skills we’ve talked about? They’re your superpowers. Specific knowledge is your unique talent. Understanding wealth helps you play the right game. Leverage makes your efforts bigger. Credibility opens doors. And grit keeps you going when things get tough.

Conclusion on High Income Skills

Phew, that was quite a journey, wasn’t it? We covered five powerful high income skills for side hustle that can truly transform your financial situation:

- Developing specific knowledge from your unique obsessions and experiences.

- Understanding the difference between being rich and being truly wealthy.

- Gaining leverage through labor, capital, code, or media.

- Building credibility by taking accountability for your successes and failures.

- Cultivating grit to keep pushing forward, even when faced with obstacles.

But here’s the thing: these skills are just the beginning. They’re the ingredients that can help you earn more money, but it’s up to you to combine them with smart investing strategies to achieve true financial freedom.

And you know what? It’s never too late to start. Whether you’re fresh out of school or well into your career, these skills can be developed and applied at any age. The key is to take action now, one step at a time.

So, what are you waiting for? Sign up for my free weekly newsletter (link below) to stay motivated and learn more about optimal investing strategies for 2024. And be sure to check out the next video, where I’ll share exactly where I’m personally investing my hard-earned money.

Remember, the path to financial freedom isn’t about following a traditional route or having the highest grades. It’s about developing the right skills and having the grit to keep pushing forward, no matter what obstacles come your way. So, let’s get started and make your dreams of financial freedom a reality!