This post may include affiliate links, meaning we’ll receive a commission if you choose to purchase through our links, at no extra cost to you. Please read disclosure here for more info.

Money, money, money. Whether you’re rich, poor, or somewhere in between, finances are just plain complicated, aren’t they? We all want to feel like we’re doing okay with our money. But what does “doing well financially” even really mean?

For a lot of people, big incomes automatically signal wealth and success. But as we’ll see, how much you earn doesn’t necessarily equate to how you’re actually doing financially. Someone making $250,000 a year could be tragically bad with money, swimming in debt and overspending. Meanwhile, a person bringing in $50,000 could be an absolute money master with their finances on point.

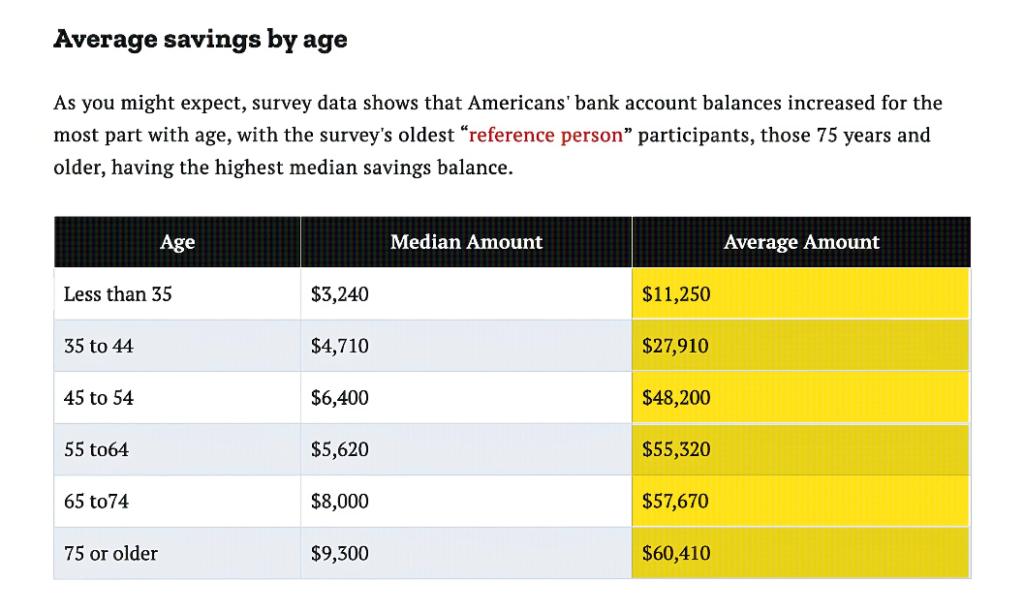

The reality is, in 2020 the median yearly earnings in the U.S. for men was around $60,000 and for women it was $49,800. Those seem like decent incomes at first glance. But the more important question is – how much of that money actually gets saved and put to good use?

It’s way too easy to assume your finances are a mess just because your salary isn’t crazy high or your net worth isn’t in the millions yet. But there are so many other indicators that you could actually be doing amazingly well with your money, even if it doesn’t feel like it. I’m talking about positive habits, smart management, and a healthy financial mindset.

So in this post, I’m going to cover 14 signs you are doing well financially than you might think, that you’re genuinely crushing it with your finances. Some might surprise you! Let’s dive in…

Table of Contents

14 Signs You’re Doing Well Financially

In 2020, the median annual earnings for men was around $60,000, and for women it was $49,800. While this may sound like a decent income, the real question is how much of it actually gets saved.

Sign 1: Automated Finances

Having your finances on auto-pilot is such a money game-changer! Trust me, I know how stressful it is to manually pay every single bill. But if you’ve got things automated, give yourself a high-five – you’re doing better than most!

A. The burden of late credit card fees

Did you know Americans paid a whopping $14 billion just in late credit card fees back in 2019? Yeah, letting due dates slip by is an expensive mistake way too many people make. I remember when I first started paying my own bills, it was such a headache. I’d have to set reminders, then inevitably end up frantically logging into my accounts the day everything was due. I’d forget passwords, have to reset them…it was all just so much hassle.

B. The convenience of automation

But having automatic payments or money transfers set up? Game changer! No more memory lapses, missed deadlines, or frenzied last-minute rushes. Your finances just seamlessly pay themselves. It’s like giving your money a task it can handle all on its own without you even thinking about it.

Automating your finances is one of the smartest money moves you can make. It avoids late fees, saves you time and stress, and ensures you stay on top of your payments and goals. If you’ve got that set up, you’re already miles ahead of the crowd. It’s such a simple step, but it makes a huge difference in how smoothly your financial life runs. So appreciate that accomplishment!

Sign 2: Consuming Financial Content

The fact that you’re reading this right now? That’s actually a really positive sign when it comes to your finances. For real! Taking the time to consume money-minded content shows you’re putting in an effort to get financially literate.

A. Indication of financial literacy efforts

Did you know that only 57% of Americans are considered financially literate? Yup, handling money wisely is a struggle for nearly half the population. So by actively seeking out financial education and advice, you’re already doing better than a huge chunk of people. Go you!

B. Developing financial awareness and questioning habits

The more you immerse yourself in this world of budgeting, investing, money management, etc., the more it’ll start shaping your everyday awareness too. You’ll catch yourself questioning purchases thinking “Did I really need to buy that?” Or re-evaluating some of your typical habits and decisions through a financial lens. That’s the power of consuming this kind of content – it makes you more conscious about your money.

C. Promotion for newsletter signup (optional)

By the way, if you want to keep leveling up your financial knowledge and building a wealthier, healthier life, be sure to sign up for my free weekly newsletter – link below. It’s packed with tips, insights and strategies to put you on the right money track.

The path to financial wellness isn’t always easy, but something as simple as reading blogs or watching videos on the topic shows you’re headed in the right direction. You’re actively trying to increase your financial literacy instead of staying in the dark. That self-awareness and eagerness to learn is such a valuable asset for long-term money success. Keep it up!

Sign 3: Comfortable Talking About Money

For some reason, money is still seen as a taboo topic. Money talk can be so awkward and uncomfortable for lots of people. A whopping 56% of Americans see discussing finances as straight-up taboo! But if you’ve gotten to the point where you can openly chat about money matters with your friends and family? That’s an awesome sign, financially speaking.

Of course, you probably don’t want to blab your salary to random spam callers or anything. But being open about income, budgets, etc. with your inner circle is so valuable. For starters, it allows you to get a real sense of what others in your field or with similar jobs are making. That transparency helps combat unfair pay gaps and inequality.

Talking dollars and cents might feel a little cringe at first, especially if you were raised to avoid those conversations. But pushing through that discomfort can pay off big time. Think how much easier it is to get advice, tips, and reality checks on financial decisions when money isn’t this huge taboo subject. Your friends and family can help keep you on track instead of being in the dark.

The bottom line is that losing your inhibitions around discussing finances sets you up for better understanding, smarter choices, and more success in the long run. It’s not easy, but managing to have open money convos puts you ahead of the pack. So kudos for breaking through that barrier! It’s a great financial habit.

Sign 4: Awareness of Financial Standing

Lots of people tend to bury their heads in the sand when it comes to their finances. It’s easy to just ignore or underestimate how much you truly earn, spend, and owe. But if you have a decent understanding of your overall financial standing? That’s a great sign you’re on the right track.

A. The tendency to ignore or underestimate finances

For many, willfully ignoring money matters feels easier than confronting the reality. It’s like trying to estimate calories – we often overestimate or way underestimate to avoid the truth. With finances, people do the same thing, underestimating expenses and overestimating income. That way you don’t have to face difficult numbers.

B. Understanding income, expenses, and debts

But having at least a general grasp on how much money you bring in, what you owe, and where it all goes? That level of awareness is so important. You don’t have to know precise figures down to the penny. But a decent handle on your overall earnings, expenses, debts, etc. is crucial.

C. The importance of regular check-ins

Maintaining that awareness can be as simple as glancing at your bank balance once a week or keeping a quick spreadsheet of what’s coming in and going out. Just some form of regular check-in. Because finances absolutely cannot be ignored for too long without seriously compounding negative effects down the road.

Taking the blinders off and getting educated about your full financial picture is such a key step. Even if the reality is tough at first, acknowledging it head-on is way better than letting it fester. With a clear understanding of your income, expenses, debts and overall standing, you can start making much smarter and more informed money decisions. It’s an essential foundation for real financial progress.

Sign 5: Having a Long-Term Financial Plan

Having a long-term money plan in place is such a game-changer! It doesn’t matter if that plan is just some quick notes scribbled on a napkin or a massive Excel spreadsheet projecting out 69 years. The important thing is that you have one at all.

A. The value of a plan, formal or informal

Look, we all know it’s way easier to make progress on something when you have an actual plan guiding you. It doesn’t have to be complex or super formal. But having even just a basic roadmap for your finances over the long haul keeps you focused and purposeful with your money moves. An informal, back-of-the-napkin plan is still 100 times better than just winging it.

B. Shifting from short-term to long-term thinking

The big benefit of having that long-term financial plan is that it shifts your whole mindset. Instead of only thinking about money week-to-week or month-to-month, you start considering the decades ahead too. That long-term lens is so valuable for avoiding short-sighted decisions and sticking to habits that actually build lasting wealth over time.

Maybe your long-term plan is to be debt-free by 40 and have $2 million invested for retirement by 65. Or perhaps it’s to save enough to take a world cruise at 80. Whatever your personal goals, just having that formalized long-view keeps you laser-focused on your destination instead of getting derailed by temporary detours.

So even if your “plan” is just a rough sketch for now, that’s still lightyears ahead of most people. You’re actively thinking about your money’s bigger purpose beyond just the immediate bills and budgets. With that long-term financial vision driving you, all the micro steps and strategies have way more context and meaning.

Sign 6: Knowing Spending Triggers

We all have those spending weaknesses or vices that can really throw our budgets out of whack. But being self-aware enough to recognize your personal triggers? That’s such a valuable money skill!

A. Acknowledging personal vices and weaknesses

For me, my kryptonite is new tech stuff – computers, gadgets, you name it. I used to see those shiny new toys and my willpower just flew out the window. Maybe for you it’s shoes, video games, fancy pens – we all have our vices that can lead to impulsive overspending.

But the first step is simply acknowledging those weaknesses and triggers. Admitting “Yep, anytime I see [X item] on sale, I have zero self-control” is huge. Once you shine a light on those habits, you can start reining them in.

B. The 72-hour rule for non-essential purchases

One fantastic tip is implementing a 72-hour rule for non-essential buys. Whenever you come across something you want but don’t truly need, force yourself to wait 72 hours before purchasing. During that time, the craving to spend will often pass.

You can go for a walk, drink some water, or do anything to distract yourself for those three days. More often than not, when you circle back to it, the intense desire will have faded and you’ll realise you don’t actually need that thing after all.

So if you’ve gotten to the point of knowing what prompts your impulsive or emotional spending, you’re way ahead of the game. That self-awareness empowers you to pause and override those habits before mindlessly overspending. Recognizing your spending triggers is such a valuable tool for financial discipline.

Sign 7: Paying Bills on Time

Keeping up with all those monthly bills and expenses is no easy feat. A staggering 40% of Americans struggle to pay their bills on time each month. But if you’re able to consistently cover rent, utilities, food, and other necessities without racking up more debt? Major props – that’s a fantastic sign, financially speaking!

A. The struggle many face with bill payments

For so many households, it’s an endless juggling act every month. With limited funds coming in, tough decisions have to be made about which bills get paid and which ones have to be skipped or partially paid. It’s an incredibly stressful situation to constantly be in.

B. Avoiding late fees, debt, and credit score impacts

And the consequences of falling behind are no joke – late fees start piling up, debt escalates even further, and credit scores take a beating. I don’t know about you, but I’d rather not have Siri sarcastically judging me every month about missing payments!

If you’ve managed to create a system where all your crucial monthly expenses get covered without fail, that’s such an accomplishment. No more looming late fees, no more dodging debt collectors, no more credit score drops. You’re building up fantastic financial habits and avoiding so many unnecessary pitfalls.

Staying on top of bills might sound like a bare minimum expectation. But as we can see, millions upon millions of Americans struggle with this basic task every single month. If you’ve risen above that crowd and can reliably pay what you owe on time? You’re killing it! That’s absolutely a sign of someone handling their finances responsibly.

Sign 8: Having an Emergency Fund

For a lot of households, money just flows in one month and straight back out the next with nothing left over. But that scenario is just one unexpected event away from total financial chaos if you don’t have an emergency fund to fall back on. An emergency fund can be an absolute lifesaver when something goes wrong.

Think about it – your car could break down and need expensive repairs. You might lose your job out of nowhere. Or a medical emergency could leave you with tons of out-of-pocket costs. Any of those situations would be hard enough to deal with emotionally and practically. But not having a cash cushion set aside? That makes a difficult situation so much worse.

Personal example: Car accident expenses

About 10 years ago, I got into a pretty bad car accident that ended up costing me $5,000 out of pocket for repairs and other expenses. If I didn’t have any savings built up, I would have been forced to take out a loan to cover those costs. And then I’d be paying even more in the long run once you factor in interest charges. It was a stressful enough situation as it was!

Having a cushion of cash set aside for a rainy day is so important. It protects you from going into expensive debt or making other difficult money decisions when an emergency inevitably pops up. If you’ve managed to put away an emergency fund, kudos! You’re way ahead of the game. That savings could literally be the difference between a bad situation and a total financial catastrophe.

Sign 9: Investing in Yourself

You’ve probably heard the saying “you have to spend money to make money.” While that’s sometimes a line used by pyramid schemes (avoid those!), investing in yourself is actually crucial. Even if you’re not putting money into stocks, bonds, or other assets, investing to develop your own skills and abilities is just as important, if not more so.

A. Personal example: Video editing course

One of the first substantial investments I made in myself was taking an online video editing course. At the time, I had just started making a couple hundred dollars as a content creator. I knew that to take it further, I needed to uplevel my editing abilities. So I spent a chunk of that initial income on a reputable course.

B. Potential returns on skill development

Thanks to the internet, there’s essentially a limitless number of courses, videos, books, and other resources to help you build virtually any skill – whether that’s graphic design, data analysis, you name it. And when you invest some of your money into the right education and tools to improve your talents, it can pay you back in dividends down the road through higher income potential.

Putting your funds towards developing valuable skills is one of the smartest investments you can make in your financial future. If you’re spending on self-improvement, it’s a fantastic sign you’re managing your money wisely.

Sign 10: Knowing and Improving Credit Score

Your credit score is such an important number when it comes to your finances. A whopping 1 in 10 Americans don’t even know their score at all! But if you’re clued into yours and actively trying to improve it, that’s an excellent sign you’re on the right money track.

A. The impact of credit scores on borrowing costs

See, your credit score determines how much it will cost you to borrow money for major things like a mortgage for a house or a car loan. The higher your score, the better interest rates you’ll qualify for. But the lower your score, the more expensive that borrowing becomes.

B. The cost difference between high and low scores

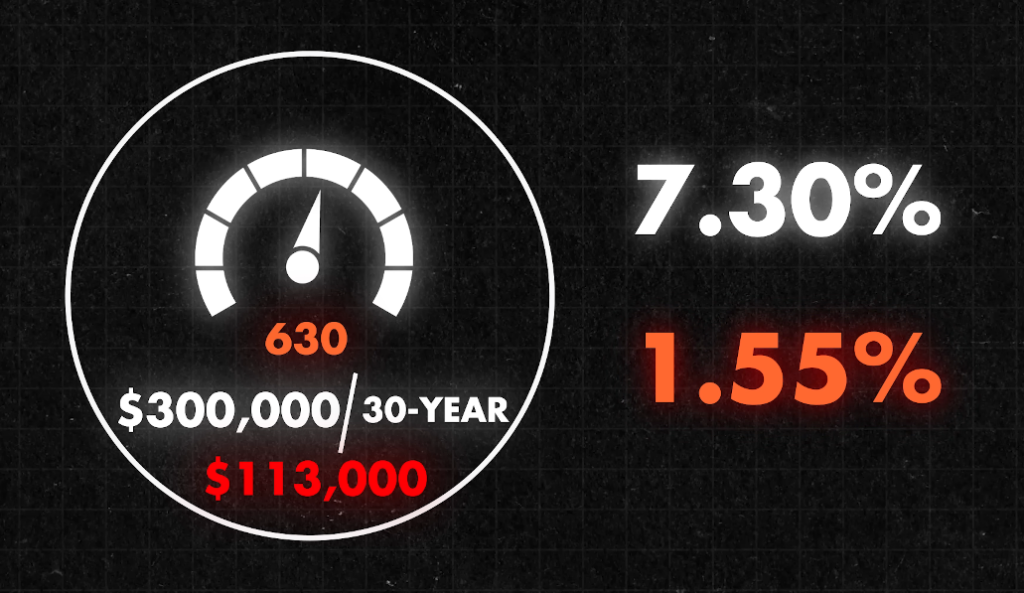

Let’s look at an example: Say you want to take out a $300,000 30-year fixed mortgage to buy a home. With an excellent credit score of 760, you might snag an interest rate around 5.75%. Not too shabby!

But if your credit score is on the lower end at 630, that same $300,000 mortgage could have a rate of 7.3%. That 1.55% difference may not sound like much, but get this – it means you’ll pay an extra $113,000 in interest over the entire 30 years! Just because of your credit score.

C. Working to improve credit score

So knowing what your current credit score is and actively taking steps to improve it? That’s huge! You’re avoiding paying way more than necessary on loans and debt. Fixing mistakes, paying on time, decreasing balances – all those things boost your score.

The higher you can get your credit score, the less you’ll shell out in interest to banks and lenders. That’s more money staying in your pocket where it belongs. Monitoring and optimizing your score puts you in a great position financially.

Sign 11: Increasing Net Worth

A. The prevalence of zero or negative net worth

It’s an unfortunate reality that about a third of Americans have a net worth of zero dollars or even in the negative. Between lifestyle inflation, taking on too much debt, and other financial missteps, most people actually see their net worth decreasing over time rather than growing.

B. The importance of an upward trend

Now, your net worth doesn’t have to skyrocket every single year. That’s not realistic for most people. But if you look at the overall direction it’s trending, you want to see that number moving upwards during most periods, even if it’s slow and steady progress. As long as your net worth is increasing more often than not, that’s a really positive sign financially.

Building lasting wealth is a marathon, not a sprint. If you can avoid the typical money pitfalls and keep steadily growing your net worth year over year, you’re in great shape. An increasing net worth shows you’re making smart money moves and that you’re on track for long-term financial success.

Sign 12: Viewing Mistakes as Learning Opportunities

We all mess up with money sometimes, don’t we? Maybe you took on too much debt or didn’t ask for that raise early enough. But here’s the thing – viewing your financial mistakes as learning opportunities instead of failures is a great sign you’re on the right track.

A. Acknowledging and learning from financial mistakes

Nobody is perfect when it comes to money. We all slip up now and then. The important part is recognizing your mistakes and taking a lesson from them. Instead of beating yourself up, look at what went wrong and how you can do better next time.

B. Mistakes as the cost of learning

Think of your financial missteps not as failures, but as the cost of learning something new. Every mistake provides a valuable experience that can shape your future money decisions in a positive way. The key is having that mindset of turning mistakes into lessons instead of just feeling bad about what happened.

Let me give you an example from my own life. A few years back, I got into a car accident that ended up costing me $5,000 out of pocket. Now if I didn’t have any savings built up, I might have needed to take out a loan. And paying that back with interest would have cost way more than the $5,000. From that mistake, I learned just how important it is to have an emergency fund. It was an expensive lesson, but one that stuck with me.

The reality is, you might not be exactly where you want financially right now. But as long as you’re viewing your mistakes as opportunities to improve and get smarter about money, you’re heading in the right direction. Dwelling on missteps and beating yourself up won’t help. But taking those lessons to heart? That’s how you make real financial progress.

Sign 13: Tracking Major Financial Items

You don’t have to track every single penny, but keeping tabs on the big money matters is so important. If you’re making an effort to stay on top of major expenses, debts, and financial goals, that’s a great sign!

A. The value of tracking significant expenses and debts

Let’s be real – trying to monitor every little purchase is way too much work. But the major stuff? That’s where carefully tracking can really pay off. We’re talking about things like your total debts, monthly payments, interest rates, and progress towards goals like saving for a house or retirement. Having a good handle on these bigger financial items helps you stay in control.

B. Personal example: Debt payoff tracking spreadsheet

When I was paying off a bunch of debt, one of the first things I did was list out the total amount I owed, monthly payments, and interest rates in a spreadsheet. Every time I made a payment, I’d open it up and adjust the remaining balance. Seeing those numbers go down kept me motivated to keep chipping away until I didn’t owe a single penny!

C. Teaser for upcoming budgeting dashboard

I know handling spreadsheets isn’t everyone’s idea of fun. But don’t worry, I’m actually working on releasing a simple budgeting dashboard tool very soon. It’ll make tracking your major money matters a total breeze. So stay tuned for that!

The most important thing is understanding what’s happening with the heavy hitters in your financial life. As long as you have a decent grasp on those big numbers and situations, you’re in a good spot. You don’t need to go overboard scrutinizing every last dollar. Just stay on top of the significant financial items, and you’ll be set.

Sign 14: Diversifying Income

Having extra income streams beyond just your main job? That’s a fantastic way to beef up your finances! Especially with the economy being so unpredictable lately, diversifying where your money comes from is super important.

A. The importance of side hustles in uncertain times

Let’s face it – relying only on employment income these days is pretty risky. Companies are cutting jobs left and right, and even if you keep your position, a single income source makes you very vulnerable. That’s why starting a side hustle to bring in additional cash is such a smart move right now. With multiple income streams, you become way less dependent on any one employer or client.

B. Personal example: Content creation income

A few years ago, I started making videos just for fun. I had no idea it could actually turn into a decent income source! But within months, I was making enough money from it to quit my finance job on Wall Street. If someone had told me videos would replace my full-time position, I wouldn’t have believed it. But diversifying my income completely changed my financial situation for the better.

C. Identifying marketable skills

The cool thing is, you probably already have skills that others will pay for. Think about it – if you can find at least 7 examples of people making a living from something you’re interested in or talented at, that’s a sign you can make it work too! Maybe you’re a great writer, designer, teacher, or just really know your way around plants. Don’t sell yourself short – you have marketable expertise that can earn you extra income.

The economy ebbs and flows, and employment comes and goes. But building up multiple income sources through side gigs and hustles? That’s a fantastic way to recession-proof your finances and get ahead. Even if your main job situation is solid, diversifying your income gives you so much more security and opportunity.

Conclusion on Signs you are doing well financially

There you have it – 14 signs you are doing well financially that you’re truly doing well with your money, even if your income and net worth numbers don’t necessarily reflect that yet. From automated finances to consuming financial content, having an emergency fund to diversifying your income, all of these habits and behaviours are incredibly positive indicators.

The key is to stop hyperfocusing on your current salary or how much you have saved so far. Those singular numbers can be pretty discouraging if they aren’t where you want them to be yet. Instead, look at the bigger picture – are you taking the right steps and developing the proper habits to set yourself up for lasting financial success?

If you can relate to most or all of the signs we covered, congratulations! You’re making smart, mindful moves to build a strong financial foundation. It’s an awesome position to be in. Just stay consistent with those habits and your income and net worth will inevitably reflect your efforts in time.

And if there are some areas where you’re falling short, that’s okay too! Now you know what to focus on developing. Every financial journey is different and looks unique based on your circumstances. The most important thing is making constant progress, no matter how small.

I really hope this list opened your eyes to signs of financial wellness that you might have overlooked before. If you want to keep levelling up, be sure to subscribe for newsletter updates and new videos. There’s always more to learn when it comes to taking control of your money!