This post may include affiliate links, meaning we’ll receive a commission if you choose to purchase through our links, at no extra cost to you. Please read disclosure here for more info.

Hey there! Ever feel like the more money you make, the more taxes you have to pay? Maybe you’ve even thought about turning down a raise because you’re worried it’ll bump you into a “higher tax bracket.” Well, guess what? That’s one of the biggest myths out there!

I used to think the same way. About two years ago, my friend was offered a pay raise but wanted to say no. He thought, “If I make more, I’ll be in a higher tax bracket and end up with less money.” But that’s not how it works at all!

But wait, there’s more! What if I told you that you could actually pay a lot less in taxes, or even none at all, without breaking any rules? Yep, you heard that right. Some of the wealthiest people in the world, like Warren Buffett, pay lower tax rates than their employees. How do they do it? Well, buckle up, because I’m about to share some of my favourite strategies that anyone can use to legally pay less in taxes.

Table of Contents

The Tax Process

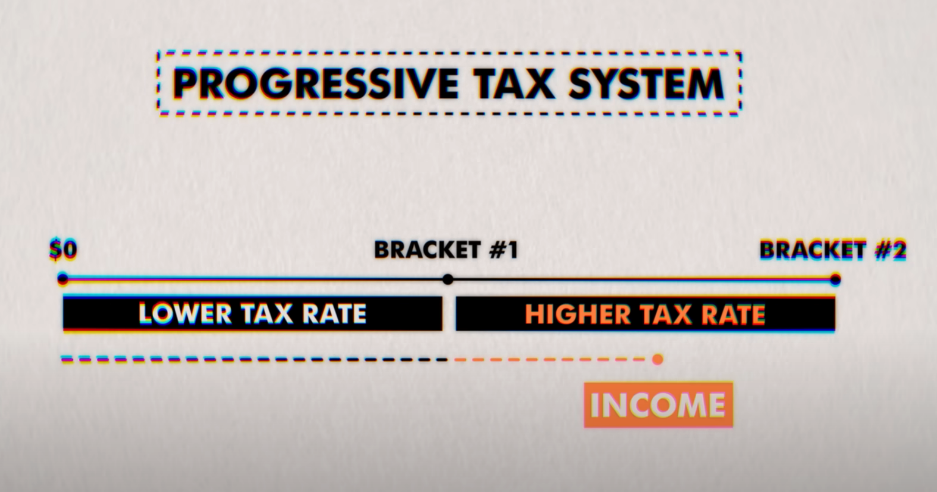

Many people mistakenly think that if they earn a higher income, they will pay higher tax rates on their entire income. However, this is a common misconception in the U.S., we use something called a progressive tax system with marginal tax brackets. The reality is that you only pay higher tax rates on the portion of your income that falls within the higher tax brackets – not on your total income.

It works like this: Imagine your total taxable income is divided into groups called tax brackets. The money you earn in the lowest bracket is taxed at 10%, the next bracket at 12%, and so on up to the highest bracket of 37%. But you only pay each higher rate on the income within that specific bracket, not your entire income.

For example, if you are a single filer in 2023 with $60,000 of taxable income, you would pay 10% on the first $11,000, 12% on the next $33,725 of income (from $11,001 to $44,725), and 22% only on the remaining $15,275 that falls into the next bracket. Your total federal income tax would be $8,508 – not 22% of the full $60,000.

So getting a raise does not necessarily mean all your income will be taxed at a much higher rate and you’ll take home less money. Pretty neat, right? The higher rates only apply to the portion of income above each successive bracket threshold.

But have you paid attention to that? I only said $60,000 of taxable income, not a $60,000 salary or $60,000 of income so the secret is you could technically have a salary of $100,000 but only have a taxable income of $60,000.

Now You Might be wondering how is that even possible, and how can you even lower your taxable income. Whereas in reality it’s a lot easier than you actually think, but all you have to do is to be very strategic about it. Basically, we need to do something with our money before we get paid.

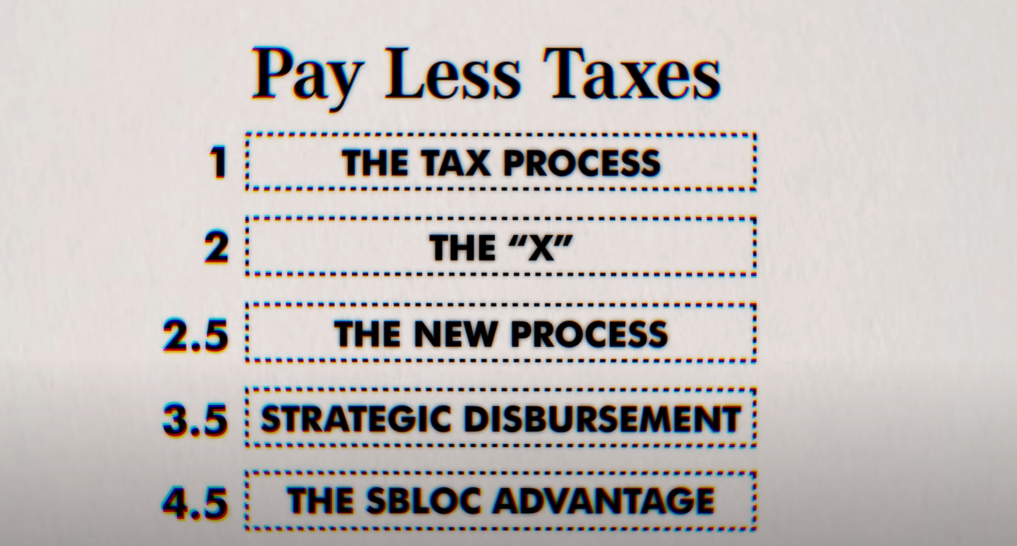

As you know the typical tax process is You get paid, You Pay your Taxes, and finally spend your money. But now I’m gonna tell you a secret, Which is gonna be our first strategy to avoid taxes legally. It goes like X, get paid, pay your taxes, spend your money. Thus it’s not

viewed as taxable income to the IRS. So what is X? Before I tell you that, There are two ways to do this but it’s a second strategy that helps me save the most in taxes which we’ll discuss later.

The First thing or X is a Qualified Retirement Plan that will shrink your taxable income to a considerable amount.

Strategy 1: Qualified Retirement Plans

One excellent strategy to legally reduce your taxable income is to contribute to qualified retirement plans. These allow you to set aside pre-tax dollars from your paycheck to invest and grow for retirement.

Out of these the most common plan is a 401k plan but your access to it depends on your employer and even if you don’t have access. I’ll show you some alternative options that you can use instead.

A. 401(k) plans are among the most popular. So, a 401k plan is typically a bucket that you can fill with pre-tax money which you can then use to invest. In 2024, you can contribute up to $23,000 to a 401(k) before taxes are withheld from your paycheck. This full contribution amount reduces your taxable income by $23,000 for the year which is your contribution to it.

B. Many employers also offer matching contributions on 401(k)s up to a certain percentage – essentially free money on top of your contributions. Thus the benefit is your taxable income is reduced by how much money you contribute to your 401k along with the matched contributions of your employer.

Common Issue:

Okay, Not many people know but there is a catch when it comes to qualified retirement plans. For most of the time you can’t access this money that you have contributed to, until you retire. Meaning it’s sort of locked away and growing over time for you.

However there are some major exceptions where you can take the money out before you even retire, some of these major events could be like when you need to buy your first house or you need to pay back certain bills. Although the 401k plan is fantastic it’s really the second strategy that helps me save a ton more money but first here are some other tax advantage accounts for you to know before it.

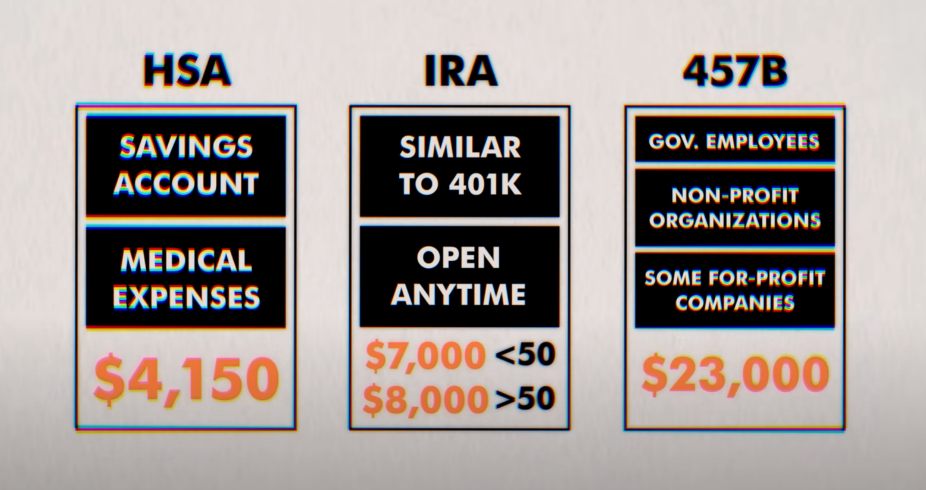

C. Other tax-advantaged account options are Health Savings Accounts (HSAs) which is a savings account that you can use to pay for current and future medical expenses like doctor visits or medicine in this particular account you can contribute up to and reduce your taxable income by $4,150 in 2024.

Next is Traditional IRAs which is similar to the 401K except you can open one up at any time and you can contribute up to and reduce your taxable income by $7,000 if you’re under 50 and $88,000 if you’re over 50. And last but not the least 457(b) plans for government/nonprofit workers under which you can contribute up to and reduce your taxable income by $23,000. You contribute pre-tax dollars, lowering your taxable income.

Strategy 2: Earning Income Outside a Traditional Job

For the Second Strategy, do you remember i told you what a typical tax process looks like:

- Get paid → pay taxes → then spend money.

But there’s a way to change this to:

- Get paid → spend money on business expenses → then pay less in taxes.

The U.S. tax code has this loophole where it favours people who earn money outside of a traditional full-time job, like through a side hustle, freelancing, or owning their own business. Which gives you more control over how much of your income gets taxed. Which Means there are some cool benefits of having a side hustle, freelancing, or owning a business.

When I first got into side hustles, I was managing it along with my regular job and was super overwhelmed with taxes in the beginning because it was my first time earning real hard cash outside of a traditional job setup. Naturally I had absolutely no idea what to do and where to go. I was really stressed out all the time, I was losing sleep and I didn’t want the IRS to start knocking on my door. But thankfully one of my CPA friends shared two major tax saving strategies to me double 401ks and business expense deductions:

A. Solo 401(k) option for self-employment income

If you have self-employment income from a side gig or business, you can open a solo 401(k) retirement account. So what it does is basically it allows you to contribute up to $23,000 of your self-employment income (in 2024) without paying taxes on it now to your regular 401k. On top of that, you can contribute up to $69,000 more to your solo 401k – significantly reducing your taxable income.

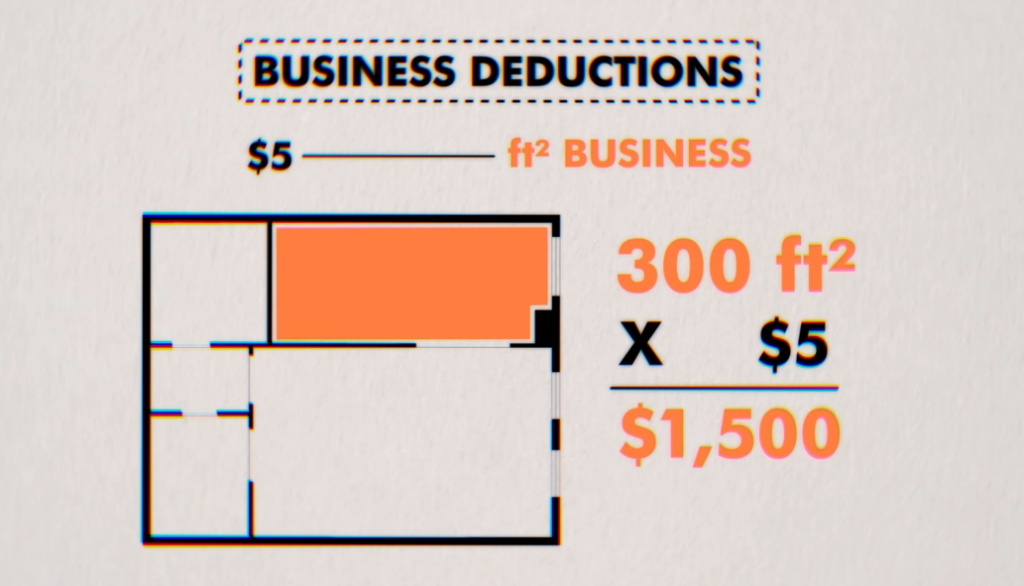

B. Business expense deductions

Any money that you spend on operating your side hustle business can potentially be deducted from your taxable income. If you have a home office, you can deduct $5 for every square foot you use for business. Other possible deductions include utilities, business meals, education costs, and equipment like laptops, iPads, and business vehicles. As long as it qualifies as a legitimate business expense, you can likely deduct it.

The tax code has many deductions business owners can take advantage of to lower their taxable income. Make sure to track all your qualified expenses.

Strategy 3: Long-Term Capital Gains Tax Rates

Hey, did you know Warren Buffett, one of the richest people in the world, pays a lower tax rate than his secretary? It’s true! Even though he’s worth over $120 billion. So, how does he do it? The secret is in something called long-term capital gains.

Let’s say you’re single and earned $40,000 of taxable income a year at your job depending on the state you’d pay around $6,000 in taxes and walk away with $35,420 post tax, not great but what if I told you you could end up with $40,000 a year and pay $0 in taxes.

A. Short-Term vs. Long-Term Capital Gains Taxes

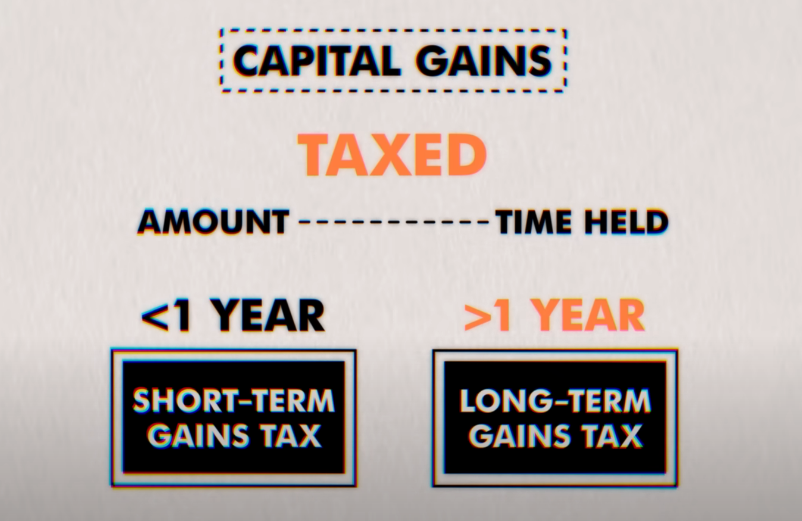

When you invest in stocks, real estate, or bonds and make a profit, you have to pay taxes on that profit. This is called a capital gains tax. But here’s the cool part: how much tax you pay depends on how long you hold your investment.

See when it comes to investing you generally want to sell your Investments at a higher price than what you purchased it for but when you make a profit you trigger this event called a capital gain. Unfortunately profits or capital gains are taxed, but the amount of tax you have to pay depends on how long you held the investment for before you sold, if you sell a stock after holding it for less than a year you’ll face a short-term capital gains tax.

And if you sell a stock after holding it for more than a year you’ll face a long-term capital gains tax. The problem with the short-term capital gains tax is that it’s tax like ordinary income meaning any short-term capital gains must be included in your total taxable income for the year.

If you sell a stock after owning it for less than a year, you pay short-term capital gains tax. This is not great because it’s taxed just like your regular job income. For example, if you make $35,000 at work and then make $10,000 selling Tesla stock you’ve owned for just six months, Your total taxable income is $45,000. This puts you in the 22% tax bracket in 2021 and you’ll end up paying Around $5648 in taxes. Ouch!. the $10,000 you made from the Tesla stock sale was taxed At $1,647 or 29% of the total federal income taxes you paid.

B. Taking Advantage of 0% Long-Term Capital Gains Tax

But what if I told you that you could pay $0 in taxes on your investment profits? Yes, zero! Here’s how How to avoid caital gains tax on stocks:

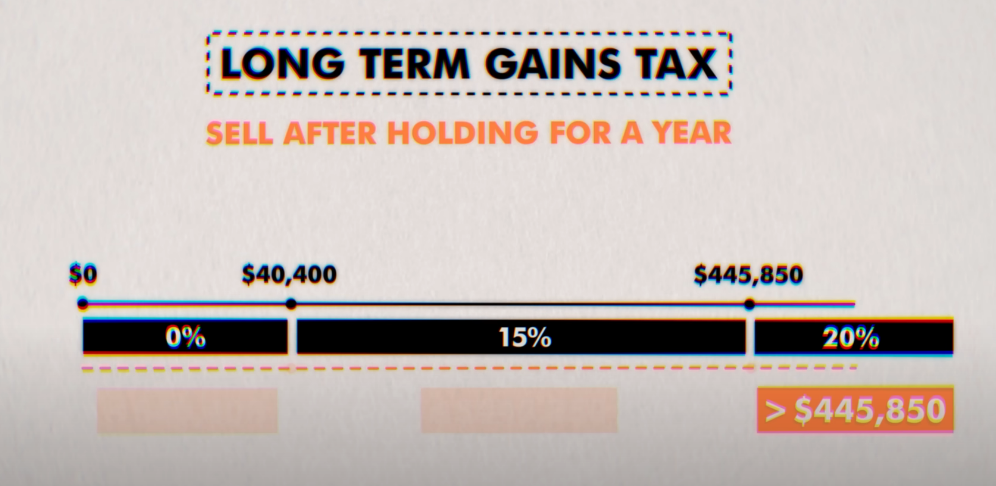

You’ll need to hold the stock for more than a year if you file a single. The long-term capital tax rates come in three flavours first. For single filers in 2021 if you sell your stock after holding it for a year and your taxable income (job + investment profits) is $40,400 or less, you pay 0% tax on those long-term gains. If your taxable income is more than $40,400 but it’s less than or equal to $445,850 then you’ll pay a 15% long-term capital gain tax and anything above $445,500 you’ll just pay a 20% long-term capital gain tax.

Let’s say you make $35,000 at your job and $10,000 from Tesla stock you’ve held for over a year. Since your total taxable income of $35,000 is below the first long-term capital gain tax threshold of $40,400 you will be in the 0% tax bracket for the first $5,400, The remaining $4,600 is taxed at just 15% which equals $690. This saves you $957 compared to the short-term gains scenario!

C. Warren Buffett’s Tax-Saving Strategy

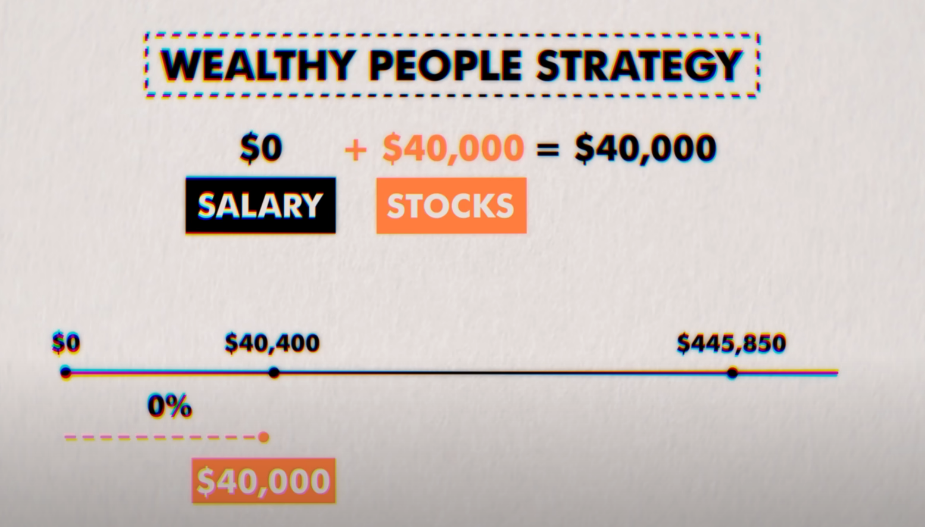

Now, here’s what wealthy people like Warren Buffett do: Most of his income comes from dividends (money companies pay to shareholders) and long-term capital gains.

Imagine if you had $0 job income throughout the year but sold $40,000 worth of stocks you’ve held for over a year. Since your total income is under $40,400, you’d pay $0 in federal taxes. You’d have $40,000 in your pocket, tax-free!

This is basically what Buffett does. He doesn’t take a big salary. Instead, his money comes from dividends and selling long-held investments. This way, he pays much lower tax rates than people who earn their money from regular jobs.

Remember, investing isn’t just for the rich. Start small, hold for the long term, and you too can take advantage of these lower tax rates. It’s a smart way to keep more of your hard-earned money!

Strategy 4: Using Debt Strategically (Securities Backed Line of Credit)

Most people think debt is a bad thing, and when not handled right, it definitely can be. But did you know that some of the wealthiest people actually use debt to their advantage? It’s one of their sneaky tricks to access millions of dollars without paying much (or any) taxes. Let’s talk about how they do it.

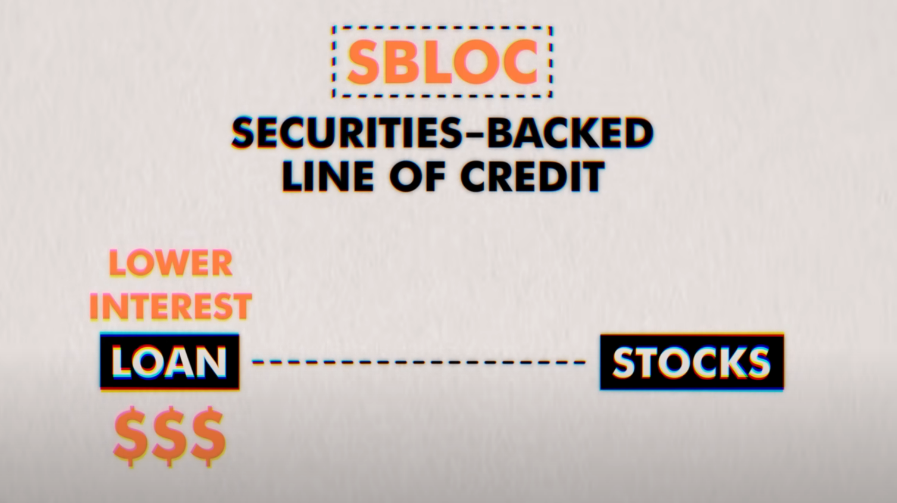

A. What is a Securities Backed Line of Credit (SBLOC)?

First, let’s talk about something called an SBLOC, or Securities Backed Line of Credit. Don’t worry, it’s not as complicated as it sounds! Basically, if you have a bunch of stocks in your portfolio, you can use them as collateral to borrow money. It’s like using your car to get a loan, but instead, you’re using your stocks.

The cool part? The interest rates on these loans are usually much lower than what you’d get from a bank or credit card. So, you can borrow money cheaply.

B. How the Wealthy Use SBLOCs to Access Money Tax-Free

Now, here’s how rich folks use this trick. Let’s say you have $200,000 in your stock portfolio, and you want to access $100,000 of it. But you don’t want to sell your stocks because then you’d have to pay taxes on any profits.

So, you do an SBLOC. The bank looks at your $200,000 portfolio and says, “Sure, we’ll lend you $100,000.” Now you have $100,000 in cash to spend however you like. Want to buy a fancy car or take a luxury vacation? Go for it!

But here’s the best part: You don’t pay any taxes on that $100,000. Why? Because it’s a loan that you have to pay back with interest. The IRS doesn’t tax loans. Smart, right?

C. Interest Rate Arbitrage and Investing Borrowed Money

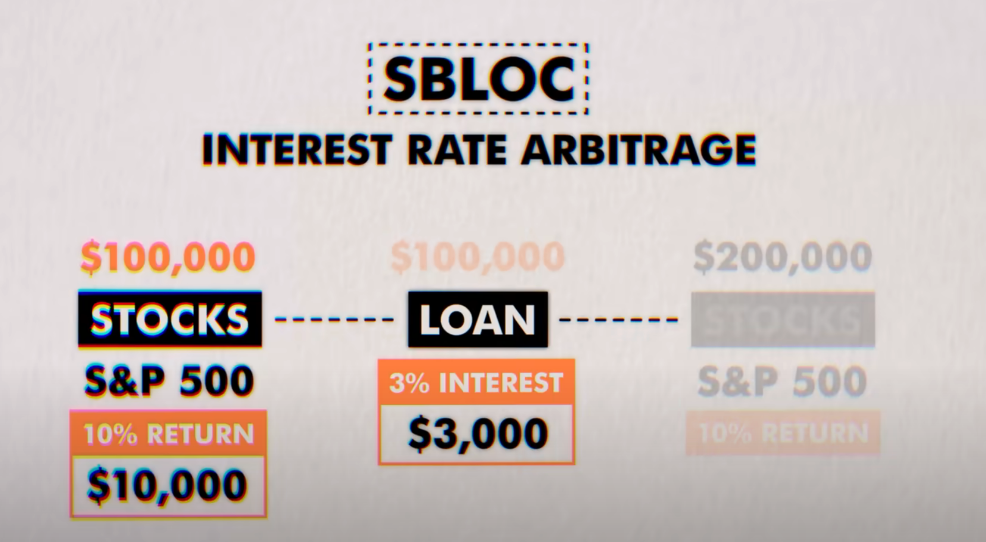

“But wait,” you might say, “I still have to pay interest on that loan!” True, but wealthy people have another trick up their sleeves: interest rate arbitrage. It’s a fancy term that just means borrowing at a low rate and investing at a higher rate.

Here’s how it works: Let’s say your $200,000 is invested in an S&P 500 index fund that historically returns about 10% a year. You take out a $100,000 SBLOC loan at just 3% interest. Then, you invest that borrowed $100,000 into another S&P 500 fund.

Now, you owe $3,000 in interest on your loan (3% of $100,000). But your borrowed $100,000, invested at 10%, earns you $10,000. You pay $3,000 in interest but make $10,000, leaving you with an extra $7,000 in your pocket. Not bad, huh?

Some rich people even get fancier. They might use part of the loan for fun stuff (like buying pineapple pizza, if that’s their thing) and invest the rest in something that grows faster than their loan’s interest rate. Then they use the investment profits to pay back the loan. It’s like getting free money without paying taxes!

Now, there are some details to be careful about, and this strategy isn’t without risks. But it shows how the wealthy look at debt differently. They see it as a tool to access money tax-free and even make more money. Pretty clever, right?

Risks and Nuances

Hey, we’ve talked about some pretty cool tax-saving strategies, right? Using retirement plans, taking advantage of long-term capital gains, even using debt in smart ways. But here’s the thing: every strategy, no matter how clever, comes with some risks. It’s super important to understand these before diving in.

A. Potential Risks of Using Strategies Like SBLOCs

Remember that Securities Backed Line of Credit (SBLOC) we talked about? It sounded pretty awesome—borrow money against your stocks, pay low interest, maybe even make extra money. But there’s a catch, and it’s a big one.

The reason banks offer such low interest rates on SBLOCs is that they use your stocks as collateral. It’s like when you get a car loan, and the bank can take your car if you don’t pay. With an SBLOC, your stocks are like that car.

So, what happens if something goes wrong and you can’t repay the loan? Maybe you lose your job, or there’s a big emergency expense. The lender doesn’t just say, “Oh, no problem, take your time.” Nope. They have the right to sell your stocks to get their money back.

Imagine you borrowed $100,000 against your $200,000 stock portfolio. Then, a financial crisis hits, you lose your job, and can’t make payments. The lender sells your stocks to recover their money. But here’s the scary part: if the market is down, your stocks might be worth much less. They might have to sell most or all of your portfolio just to cover the loan. You could lose a huge chunk of your investments!

B. Importance of Understanding Tax Laws and Consulting Professionals

Each tax-saving strategy we’ve discussed—from 401(k)s to business deductions to using debt—has its own set of rules and potential pitfalls. Tax laws are really complicated, and they change often. What worked great last year might not work the same way this year. So be wary to Check them Out Before, in the meanwhile You can also find out more about how to avoid taxes on 401k later.

For example, with business deductions, you can’t just say any expense is for business. There are strict rules about what counts. Claim the wrong thing, and you could end up in trouble with the IRS. Or with long-term capital gains, the tax rates and income thresholds can change year to year. What got you 0% tax one year might not the next.

That’s why it’s super important to talk to professionals—people whose job is to understand all these tricky rules. A good CPA (Certified Public Accountant) or tax attorney can help you navigate this complex world. They can spot risks you might miss and help you stay on the right side of the law.

Here’s another thing to remember: Even when you’re doing everything you can with your money—maxing out retirement accounts, investing wisely, maybe even using some advanced strategies—you might still feel like you could be doing more. That’s normal! There’s always another tip, another trick out there.

But chasing every strategy isn’t always smart. Some might be too risky for your situation. Others might save you taxes but cost you in other ways. The key is to find the right balance—strategies that save you money without putting you at too much risk.

So, while it’s great to learn about these tax-saving techniques, always, always do your homework. Understand the risks, stay updated on tax laws, and get advice from experts. Your goal is to keep more of your hard-earned money, not to lose it chasing risky schemes. Smart and safe—that’s the way to go!

Conclusion on How To Avoid Taxes Legally

So there you have it – my favorite strategies for legally paying less in taxes:

- Using retirement plans like 401(k)s and solo 401(k)s to shrink your taxable income.

- Running a side hustle or business to take advantage of tax deductions.

- Using Warren Buffett’s trick of long-term capital gains tax rates.

- Borrowing against your investments with SBLOCs to access money tax-free.

Each of these strategies can help you keep more of your hard-earned cash. But remember, while it’s exciting to learn about these techniques, they do come with risks. Always do your homework, understand the potential downsides, and when in doubt, talk to a tax pro. The goal is to save money safely, not to chase risky schemes.

You know, even after learning all this, you might feel like there’s always more you could be doing with your money. That’s totally normal! There’s always another tip or trick out there. But here’s the thing – not every strategy is right for everyone. Some might be too risky, or they might save you taxes but cost you in other ways.

The key is finding the right balance – strategies that save you money without putting you at too much risk. It’s about being smart, not just about paying the least tax possible.

And here’s something else to think about: Even if you’re doing everything you can with your money, you might still feel like you could do more. But that’s okay! You’re already way ahead of most people just by learning these strategies. Remember, it’s a journey, not a race.

So, what’s your next move? Maybe it’s maxing out your 401(k), starting a side hustle, or learning more about investing for long-term gains. Whatever it is, keep learning, keep growing, and keep more of your money in your own pocket. You’ve got this!