Have you ever looked at your bank account and thought, “How did I end up here?” Or stare at your to-do list, wondering where all your time goes?

You’re not alone. In a world Where everyone is focused on taking drastic measures for success, it’s easy to feel overwhelmed.

But here’s a little secret: sometimes, the smallest changes pack the biggest punch.

To understand it better, I Welcome You to our guide on 9 Simple micro-adjustments that can majorly impact your wallet and your daily life.

In this post, we’ll look at small changes in two areas: money and everyday life. Exploring how the power of small changes in life can really improve how we think and live. you’ll learn:

- Why “timing the market” is a fool’s Habit, and what Change to do instead.

- The three magic numbers you need to track to change your financial Complexity.

- How simplifying your investment portfolio could be your ticket to better returns.

- The secret to absorbing more books without finding extra reading time.

- Why asking better questions can make you the most interesting person in the room.

And much more let’s get into it-

Personal Finance Lessons I Learned Through Time

We’ve shared numerous financial insights on our NYKC Business blog, But today I’m just focusing on small, easily implementable changes that can significantly impact your financial Wellness Especially the mindset.

Below are 4 tips or you can say changes that will surely improve your Views on Managing finance.

Tip:1 Long-Term Gains Beat “Timing the Market”

Investors should stay invested in stocks over a long period. The stock market is a long-term game. Don’t take my word for believing it. An infamous blog post ”just keep Buying” on the DollarsAndData website explains it well.

In that blog, The author looked at the P/E ratio to see if stocks are expensive or not. The P/E ratio compares how much a stock costs to how much profit it makes. As the P/E ratio goes up, future stock returns tend to go down. It makes sense. An overpriced stock won’t grow as fast as an undervalued one.

A quote from the same blog:

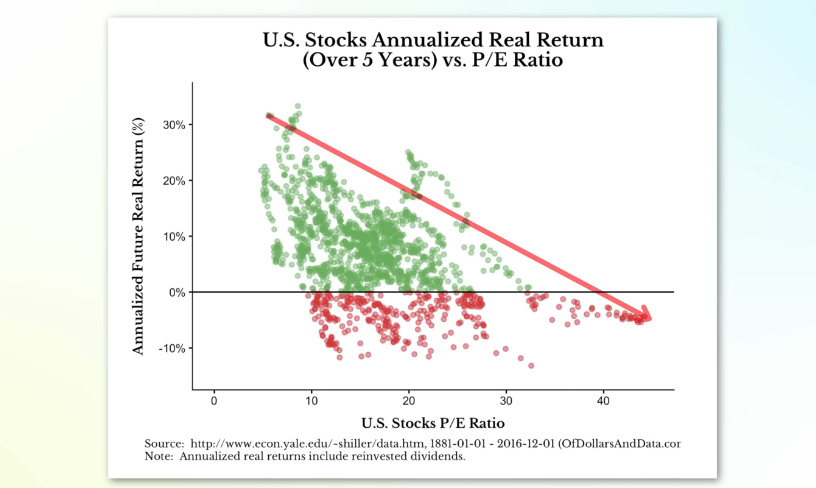

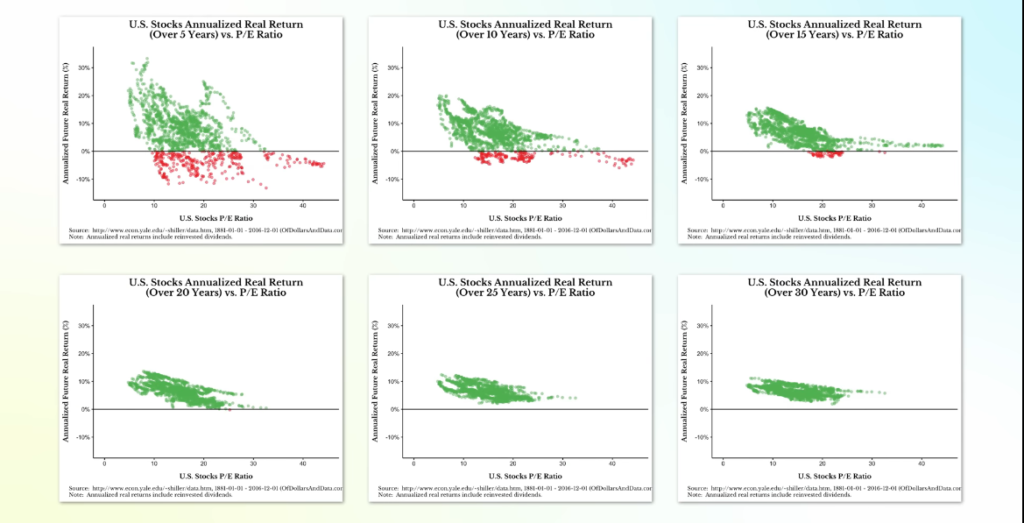

The image below showed as P/E ratios increase, there are more negative 5-year returns. The red dots represent losses over 5 years. There are way more red dots than green ones when P/Es are high at 30-40.

But Now look below at what happens over longer periods – 10, 15, 20 years. The red dots disappear! The author states “Over any 20-year period, U.S. stocks have had no real negative returns when including dividends.”

So even if stocks seem pricey, investing for decades pays off. Just keep buying regularly and HOLD….

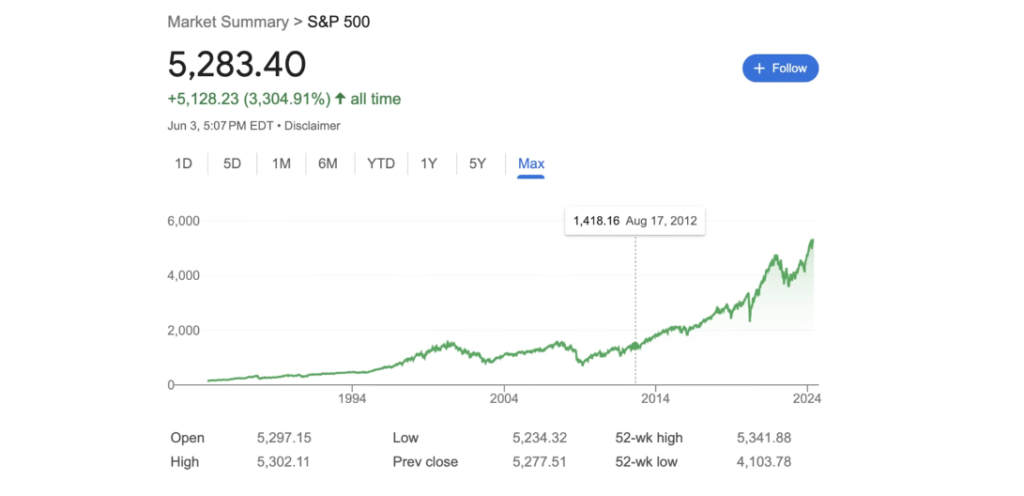

Taking an example of 2012 Overvalued hype People thought the market was 50% overvalued in 2012. But the S&P 500 tripled from 1400 to over 4000 in 10 years after that and in 2024 it’s over 5k.

The takeaway? Don’t try to time highs and lows. Just accumulate stocks month after month. Using the dollar cost averaging method (investing a certain amount each month regardless of highs and lows) With over 20 years invested, you’ll make money regardless of the market’s volatility.

TIP:2 Track these 3 Personal Finance Essentials

There are three key numbers to monitor if you want to build wealth and become financially free. Let’s call them the “Big Three” essentials of your money:

- Expenses

- Savings Rate

- Net Worth

Keeping close tabs on these numbers – and making improvements over time – will supercharge your finances.

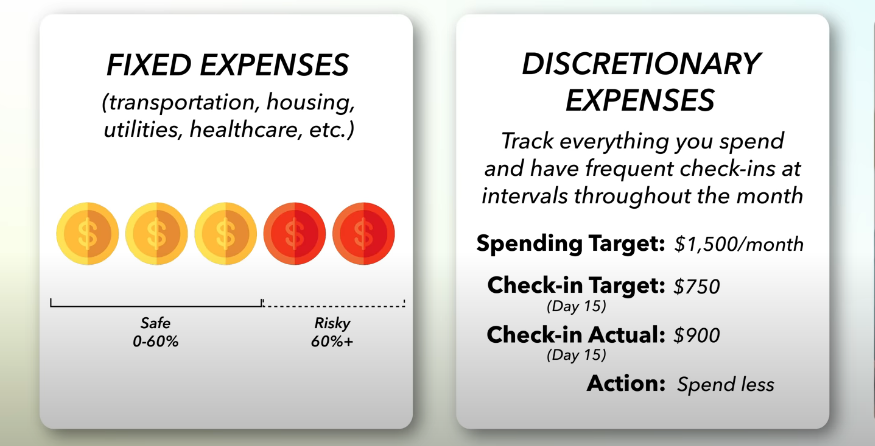

1. Expenses Start by tracking your essential fixed costs like housing, transportation, utilities, and insurance. These should stay below 50-60% of your income. If they creep higher, it gets tough to save and spend on extras.

For variable discretionary costs(avoidable costs), check in at the halfway mark each month. If you’ve blown past halfway through your $1,500 monthly limit by the 15th, you know to cut back.

2. Savings Rate Aim to save at least 10% of your income, but keep increasing this percentage over time. The higher your savings rate climbs, the more money gets Invested into wealth-building investments.

3. Net Worth This number reflects the total value of your assets minus debts. Tracking net worth at the end of the year provides a reassuring perspective on your overall financial standing. Watching it rise brings great peace of mind that you’re on the right path.

By consistently monitoring these three vital signs, you’ll make consistent forward progress toward financial freedom. Stay focused on optimizing the Big Three numbers, and brighter money days lie ahead.

Tip:3 Simplify Your Portfolio for Success

One key lesson for achieving long-term investment success? Don’t overcomplicate your portfolio by holding too many funds and stocks. Keeping it simple with just a handful of broadly diversified, low-cost index funds is often the smartest approach.

It’s an easy trap to fall into – thinking you need to own 10, 12, or more different ETFs and individual stocks to be properly diversified. But oftentimes, these holdings just end up overlapping each other unnecessarily.

For example, the Vanguard S&P 500 ETF (VOO) and the Vanguard Mid-Cap Value ETF (VOE) hold a 92.1% overlap in their stocks. You think you’re diversifying by holding both, but you’re really just duplicating a huge portion of your portfolio.

The reality is, that most broad-based index ETFs are already extremely well-diversified on their own. For the average investor, you likely only need to own 1-3 total funds to properly cover your portfolio bases.

Going overboard with more funds just creates redundancy, increased fees, and added complexity to manage. “Keep it simple instead”.

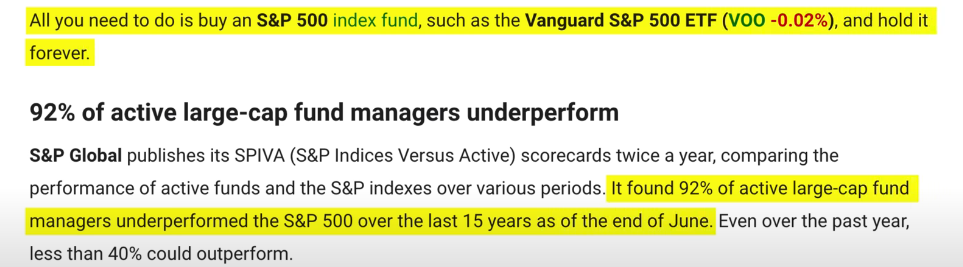

To Give you more data-backed support to this thought of Simplify investment according to Mootly Fool blog data Just buying 1 S&P 500 index And holding it for Over 15 years, The S&P 500 index investors outperformed 92% of active fund managers that are trying to beat the market.

Here is a quote from the same blog-

By avoiding over-diversification into too many funds, you’ll sidestep unnecessary overlap while reducing costs and headaches. Stick to just a handful of total market index funds,

Note: linkkkkkkkkkkk The simple 3-fund strategy is all you need and

let that powerful simplicity compound your wealth over decades.

Tip:4 Don’t Fall for the Millionaire Mirage

You know the type – those pretending to be baller millionaires while actually making $30,000 a year. Driving fancy cars, popping bottles in the club, acting like money is no object. According to Urban Dictionary, these are the dreaded “30k millionaires.”

But here’s the truth: The real wealthy millionaires typically live quite modestly and avoid loud displays of cash.

There is a quote from the book As The Millionaire Next Door Study that i love to read anytime:

“If your goal is to become financially secure, you’ll likely attain it. But if your motive is to make money to spend money on the ‘good life’, you’re never going to make it.“

Flashing cash and living that “millionaire lifestyle” is often just a front for those struggling to keep up appearances.

So ignore the 30k millionaire posers Instead, live well within your means, avoiding debts and indulgences beyond your current income level. (of course, some loose strings are ok but living around your mean and not losing the core essence of finance is what you need to take away from this)

Let the others play “fake rich” while you diligently save, invest, and build true wealth over decades. Sustained, reasonable living coupled with disciplined saving! That’s how you become the next actual millionaire on the block.

Small Changes I made to improve my daily life productivity

Finance is What we breathe I can talk about that all day, but when it Comes to life the most important thing is your time and utilization of that time ie, productivity. I Picked some of my habits that actually improved my productivity,

And as you know there is always room for improvement, So Now we will look at tips or again you can call them changes that will help us be more productive even outside of the finance world.

Tip: 5 Biggest Power is Delayed Gratification

We live in an age of instant gratification. With the constant use of social media, and streaming services our attention spans are Down drastically tell me the last time you watched the whole YouTube video.

and our self-control is being challenged.

This is where the ability to delay gratification is the key to Success

Delayed gratification is the practice of resisting the temptation for an immediate reward in favor of a more significant, long-term gain.

The Marshmallow Experiment, a famous study conducted by psychologist Walter Mischel

In this experiment, children were offered a choice: they could either eat one marshmallow immediately or wait for the researcher to return and receive two marshmallows. The findings were remarkable.

Children who were able to resist the temptation and wait for the larger reward not only demonstrated better self-control but also experienced better academic performance and overall health later in life.

And this study become even more true to itself in this digital age!

How to perform delayed gratification-

It’s a skill that can be developed and strengthened over time. I have experienced it, and implementing this in life is not that complex:

- Start Small: Begin with manageable goals, such as taking regular breaks from social media and using phone usage restriction apps Nowadays, there are plenty like the minimalist app. As you build momentum, gradually increase the level of difficulty.

- Design Your Environment: Reduce temptations by creating an environment that supports your goals. Remove distractions, unhealthy snacks, or other triggers that may undermine your self-control. I removed a poster of a video game from my room And it really helped to some extent for now.

- Journal Productivity: It could be a diary (a whiteboard is more effective), the prime objective is to record what you are going to do today like a to-do list, and at the end of the day you need to check what were you able to accomplish from the list. believe me, it acts like a mirror, it forces you to be more productive. leaving the distraction behind becomes easier with these practices!

And keep following it you will become more productive towards the thing that really matters within a month.

Tip: 6 Whiteboard Your Way to Achievement

Motivational experts agree – writing down your goals dramatically increases the likelihood of accomplishing them. As Peter Drucker, the father of modern management, famously said: “What gets measured, gets managed.”

Visually tracking progress toward your aims provides powerful motivation to keep pushing forward. There’s something deeply satisfying about physically crossing an objective off your list.

To harness this technique, Use a whiteboard to prominently display your priorities and goals, no matter how small.

List out tasks like

“Take out the trash,”

“Spend time with family,”

“Write an email to Jeff.”

Then relish checking each one off as you power through.

With your aims laid out, your progress gets measured. Measurements enable management of your time and efforts toward steady achievement.

Use that whiteboard to update your accomplishments daily. Watch in delight as more and more items get crossed off, propelling you ahead of the game.

Tip: 7 Absorb More Books Through Audio

Successful people read extensively, there is no hiding that fact but sitting down with physical books requires focused effort. And focus in today’s world is the most shiny thing a person can have.

YOu should do reading but more often than that listen to Audiobooks it offers an easier solution to “read” more by multitasking.

Turn daily commutes, chores, or workouts into learning opportunities by pressing play instead of zoning out to music or podcasts.

With audio editions, you can feed your mind with motivating life lessons, insights, and stories throughout the day during otherwise wasted pockets of time. Let those voices pour nuggets of wisdom and knowledge into your ears.

Audiobooks make productive use of driving, housework, exercise, and more. It’s an easy way to constantly expand your knowledge.

Tip: 8 Spark Better Conversations by Asking Open-ended Questions

People skills from an introvert like me, 😅

We all want to be fascinating conversationalists, especially when meeting new people. But opposite to what you might think, the path to being interesting isn’t constantly talking about yourself and telling stories.

The truth is, Others don’t care about you nearly as much as you assume. Until you first show you care about them.

How do you do this? By asking good, open-ended questions.

Skip the yes/no questions that lead to dead ends. Instead, ask questions that inspire the other person to share more details and insights.

For example:

Rather than “Do you like pasta?”, ask “What’s your favorite pasta dish and what do you like about it?”

Instead of “Did you like that movie?”, go with “What was your favorite scene from that movie?”

Open-ended questions require more thoughtful responses. They invite the other person to elaborate and provide you with much more meaningful information to work with to continue the conversation.

For more, I recommend this book that you should read: “The Art of asking open-ended Questions by Robert Cesar”.

By getting the other person to open up first, you’ll unlock far richer dialogue. You’ll learn about their unique perspectives, experiences, and interests. Once they feel you’re genuinely interested in them, they’ll be more engaged and eager to learn about you as well.

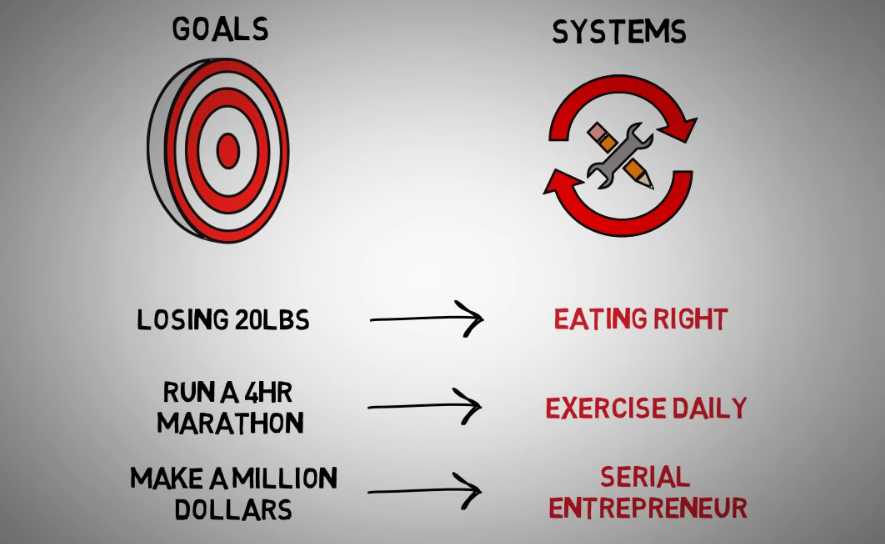

Tip: 9 Systems Over Goals for Lasting Progress

Well here are the Statistics Collected by “Discover Happy Habits” that provided the statistics figure of only 9-12% people are able to keep up with their new year resolutions,

As the saying goes, anyone can have goals – but very few people actually reach them. So there must be something that you and I lack right?

Simply stating “I want to be a millionaire by 30” means little if you don’t map out the daily actions to make it happen.

Rather than fixating on a big, shift your mindset to developing systems – routines, and practices you follow each day to chip away at your objective continually.

For example, instead of “Write a bestselling novel,” implement a system where you commit to writing one page per day. After a year, you’ll have a full book draft. After a decade at that pace, you could have 10 books under your belt.

Or if your goal is to build a successful business, your system could be “give 1 hour of night time” daily to work on it for the next two years. Small but consistent daily efforts create momentum.

So ditch the traditional approach of setting yearlong goals in January that you’ll inevitably view as overwhelming a few months later.

Lasting progress stems from micro-systems, not macro-goals. Identify your goal, then construct the micro-habits to make it happen on autopilot.

Final Thoughts

We hope these tiny tweaks inspire big changes in your finances and daily life. Got your own micro-hack or need advice? Drop a comment below – your small insight could be someone else’s game-changer! and i will see you in the next one…